3 High Insider Ownership Growth Companies With Earnings Expanding By At Least 18%

As the United Kingdom's financial markets brace for the Bank of England's rate decision and eagerly await GDP growth figures, investor sentiment remains cautiously optimistic. In such a context, companies with high insider ownership can be particularly compelling, as they often reflect a management team deeply invested in the company’s success, aligning well with broader market growth expectations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 43.9% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 30.9% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

LSL Property Services (LSE:LSL) | 10.6% | 33.7% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

We'll examine a selection from our screener results.

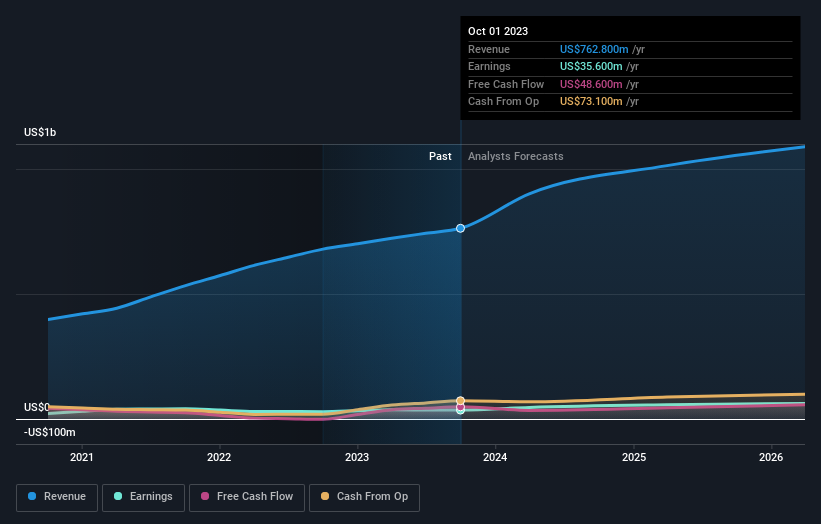

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc is a company that develops, licenses, and supports software for the healthcare industry in the United States, with a market capitalization of approximately £803.97 million.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Earnings Growth Forecast: 28.5% p.a.

Craneware, a notable player in the UK market, demonstrates robust growth prospects with earnings expected to surge by 28.5% annually, outpacing the UK market's average of 12.6%. Despite a modest return on equity forecast at 11.2%, the company's revenue growth is also set to exceed the market, increasing by 7.3% per year against a market rate of 3.5%. Recent developments include an extended buyback plan and consistent dividend increases, reflecting strong financial health and commitment to shareholder returns.

Navigate through the intricacies of Craneware with our comprehensive analyst estimates report here.

Upon reviewing our latest valuation report, Craneware's share price might be too optimistic.

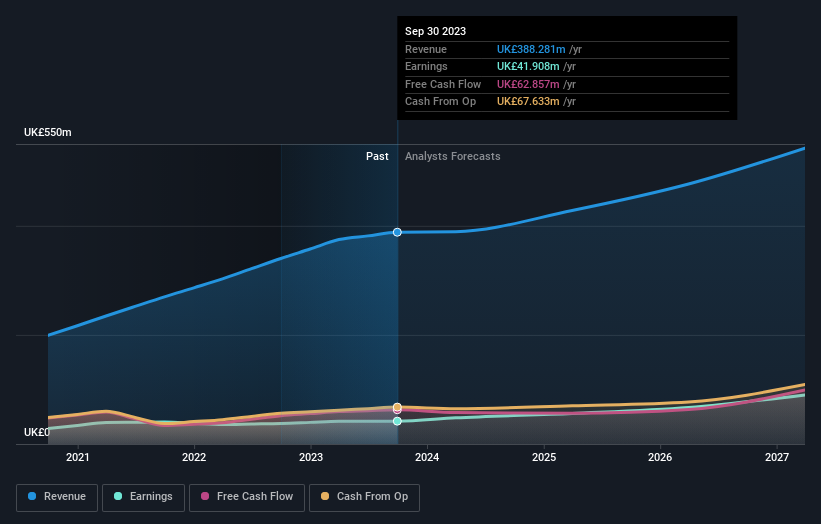

Volex

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Volex plc is a manufacturer and supplier of power products and cable assemblies, operating across North America, Europe, and Asia, with a market capitalization of approximately £603.50 million.

Operations: The firm operates primarily in the regions of North America, Europe, and Asia, focusing on the production and distribution of power products and cable assemblies.

Insider Ownership: 26.9%

Earnings Growth Forecast: 21.1% p.a.

Volex, a key growth company in the UK with significant insider ownership, has recently upgraded its revenue forecast to at least £900 million for FY 2024, marking a substantial increase. This revision includes contributions from its latest acquisition and suggests earnings above analyst expectations. Despite high debt levels and recent share dilution, Volex's revenue and earnings are projected to grow faster than the market average. Insider activities show more buying than selling over the past three months, reinforcing confidence in the company’s trajectory.

Click to explore a detailed breakdown of our findings in Volex's earnings growth report.

Our valuation report unveils the possibility Volex's shares may be trading at a premium.

Kainos Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc is a provider of digital technology services operating across the United Kingdom, Ireland, North America, Central Europe, and other international markets, with a market capitalization of approximately £1.25 billion.

Operations: The company generates revenue through three primary segments: Digital Services (£223.12 million), Workday Products (£50.49 million), and Workday Services (£114.67 million).

Insider Ownership: 24.5%

Earnings Growth Forecast: 18% p.a.

Kainos Group, a notable player in the UK tech sector, is trading at 45.8% below its estimated fair value, presenting an attractive entry point. The company's earnings have grown by 11.3% over the past year and are expected to increase annually by 18%, outpacing the UK market average of 12.6%. Despite a slower revenue growth rate of 9% compared to other high-growth firms and an unstable dividend record, Kainos boasts a very high forecasted return on equity of 40.8%.

Where To Now?

Embark on your investment journey to our 56 Fast Growing Companies With High Insider Ownership selection here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRWAIM:VLX and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance