3 High Potential German Growth Stocks With Up To 39% Insider Ownership

As global markets exhibit resilience with Germany's DAX index notably advancing by 4.28%, investors are keenly watching the European economic landscape for robust investment opportunities. In this context, growth companies with high insider ownership in Germany present a compelling case, as such structures often signal strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 73% |

Deutsche Beteiligungs (XTRA:DBAN) | 35.3% | 30.2% |

init innovation in traffic systems (XTRA:IXX) | 39.7% | 23% |

YOC (XTRA:YOC) | 24.8% | 21.8% |

Exasol (XTRA:EXL) | 25.3% | 107.4% |

Beyond Frames Entertainment (DB:8WP) | 10.9% | 81.9% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stemmer Imaging (XTRA:S9I) | 26.4% | 18.2% |

HomeToGo (XTRA:HTG) | 11.4% | 60.8% |

elumeo (XTRA:ELB) | 25.8% | 78.8% |

Here's a peek at a few of the choices from the screener.

Brockhaus Technologies

Simply Wall St Growth Rating: ★★★★☆☆

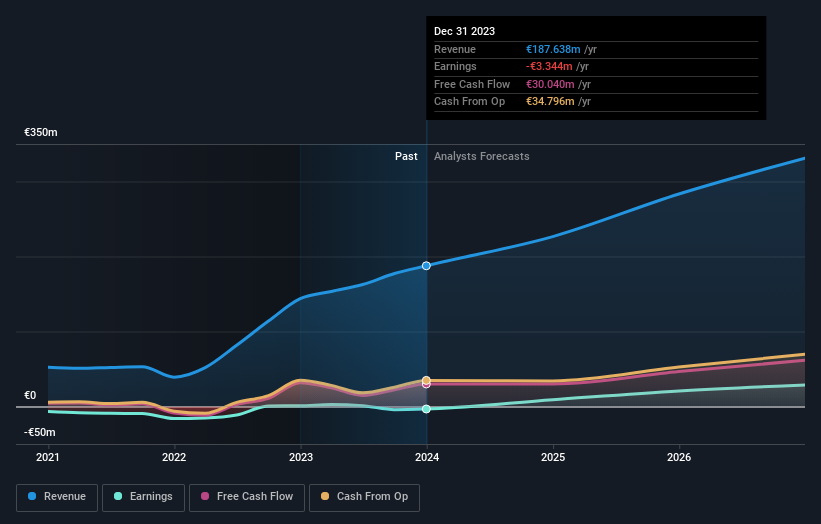

Overview: Brockhaus Technologies AG operates as a private equity firm and has a market capitalization of approximately €240.30 million.

Operations: The revenue segments for the firm are primarily comprised of Security Technologies and Financial Technologies, generating €40.47 million and €146.21 million respectively.

Insider Ownership: 26.6%

Brockhaus Technologies, a German growth company with high insider ownership, reported a significant shift in financial performance for 2023, transitioning from a net income of €49.02 million to a net loss of €3.34 million. Despite this setback, the company anticipates robust revenue growth between €220 million and €240 million in 2024, marking an increase of up to 29% year-over-year. Additionally, Brockhaus plans to initiate dividend payments at €0.22 per share this June, reflecting confidence in its financial recovery and future profitability projections.

init innovation in traffic systems

Simply Wall St Growth Rating: ★★★★★☆

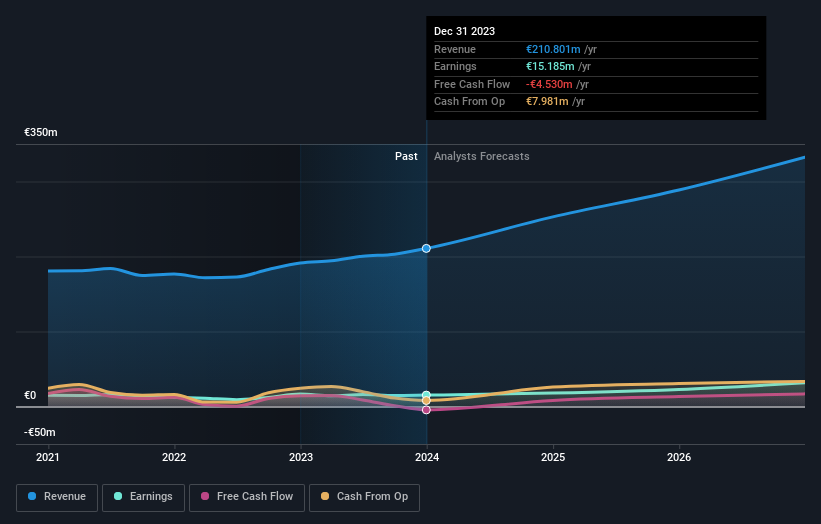

Overview: init innovation in traffic systems SE operates globally, offering intelligent transportation systems solutions for public transport, with a market capitalization of approximately €381.80 million.

Operations: The company generates its revenue primarily from the wireless communications equipment segment, amounting to €210.80 million.

Insider Ownership: 39.7%

Init innovation in traffic systems SE, a German growth company with substantial insider ownership, reported a slight decline in net income from EUR 16.52 million in 2022 to EUR 15.19 million in 2023 despite an increase in sales to EUR 210.8 million. The company's earnings are expected to grow by approximately 23% annually over the next three years, outpacing the German market's forecasted growth of 16.9%. Additionally, init is trading at about 14.5% below its estimated fair value, suggesting potential undervaluation relative to its financial outlook and market performance expectations.

Zalando

Simply Wall St Growth Rating: ★★★★☆☆

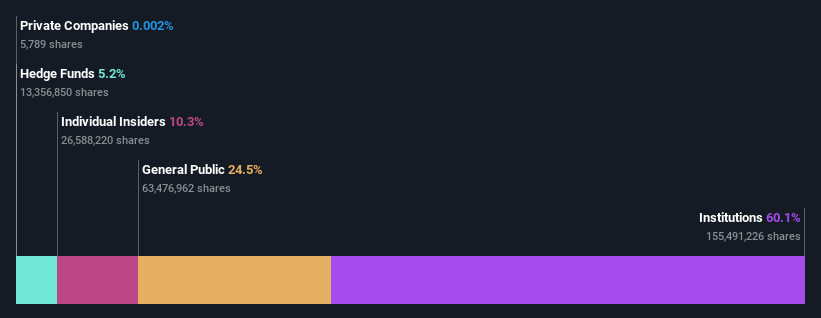

Overview: Zalando SE is an online retailer specializing in fashion and lifestyle products, with a market capitalization of approximately €6.54 billion.

Operations: The company generates €10.35 billion from its online fashion and lifestyle platform.

Insider Ownership: 10.3%

Zalando SE, a German growth company with high insider ownership, experienced substantial earnings growth of 184.3% last year. Despite a highly volatile share price recently, ZAL's earnings are expected to grow by 27.1% annually, outpacing the German market forecast of 16.9%. However, its revenue growth is projected at only 5.5% per year, slightly above the market average but underwhelming compared to its earnings surge. The firm also trades at 46.9% below estimated fair value and posted a net loss of €8.9 million in Q1 2024 amidst sales of €2,241.4 million.

Make It Happen

Click through to start exploring the rest of the 19 Fast Growing German Companies With High Insider Ownership now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:BKHT XTRA:ZAL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance