3 High Yield Dividend Stocks On SGX With Returns Up To 6.3%

Amidst the dynamic landscape of the Singapore stock market, investors continue to seek stable and potentially lucrative opportunities, particularly in high-yield dividend stocks. In this context, understanding what constitutes a robust dividend stock can be crucial, especially when navigating through varying economic conditions that influence market performance.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.35% | ★★★★★★ |

Singapore Exchange (SGX:S68) | 3.65% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.71% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.66% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.54% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 7.06% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Oversea-Chinese Banking (SGX:O39) | 5.88% | ★★★★☆☆ |

Sing Investments & Finance (SGX:S35) | 6.25% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

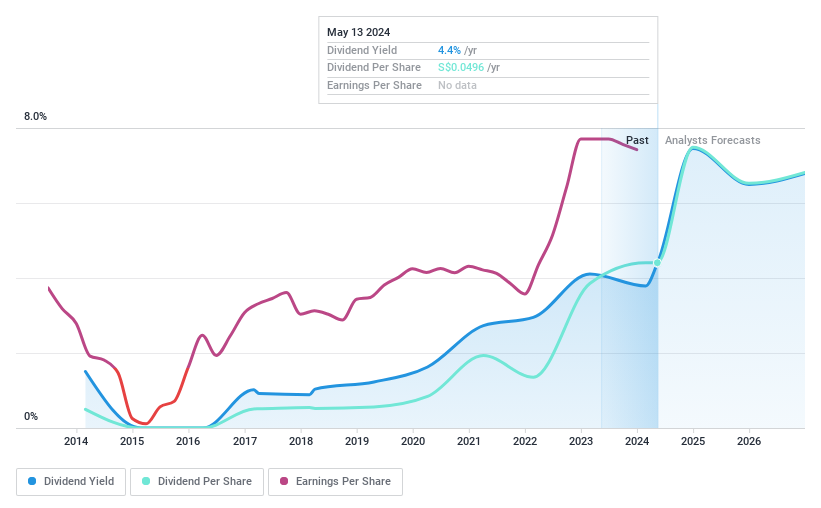

Food Empire Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Food Empire Holdings Limited is a Singapore-based investment holding company specializing in the manufacturing and distribution of food and beverage products across Russia, Ukraine, Kazakhstan, other CIS markets, Southeast Asia, South Asia, and globally, with a market capitalization of approximately SGD 597.91 million.

Operations: Food Empire Holdings generates its revenue primarily from South-East Asia (SGD 239.74 million), Russia (SGD 152.42 million), South Asia (SGD 68.36 million), and Ukraine, Kazakhstan, and other CIS markets (SGD 110.74 million).

Dividend Yield: 4.4%

Food Empire Holdings, while trading at 66.3% below its estimated fair value, presents a mixed outlook for dividend investors due to its unstable dividend history over the past decade and a relatively low yield of 4.39% compared to the top quartile in Singapore's market at 6.29%. However, dividends are well-supported with a payout ratio of 35.2% and cash payout ratio of 50.9%. Recent shareholder approvals for share buybacks and an increased dividend suggest potential commitment to returning value to shareholders.

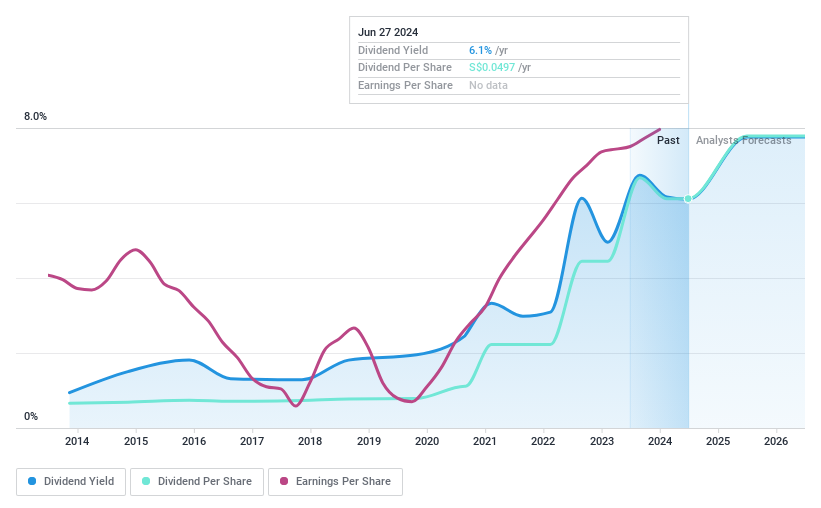

Civmec

Simply Wall St Dividend Rating: ★★★★★★

Overview: Civmec Limited is an investment holding company specializing in construction and engineering services across the energy, resources, infrastructure, and marine and defense sectors primarily in Australia, with a market capitalization of approximately SGD 393.38 million.

Operations: Civmec Limited generates revenues from three main segments: Energy (A$46.02 million), Resources (A$752.82 million), and Infrastructure, Marine & Defence (A$105.52 million).

Dividend Yield: 6.3%

Civmec Limited, with a dividend increase to A$0.025 per share, signals a positive trend in shareholder returns, supported by a 25% rise in interim dividends year-over-year. The company's robust sales growth to A$492.35 million and net income increase to A$31.89 million for the half-year ending December 2023 underline its financial health. Civmec's dividends are sustainably covered by earnings and cash flows with payout ratios of 45.4% and 27%, respectively, ensuring reliability in its dividend payments amidst a competitive yield of 6.35%.

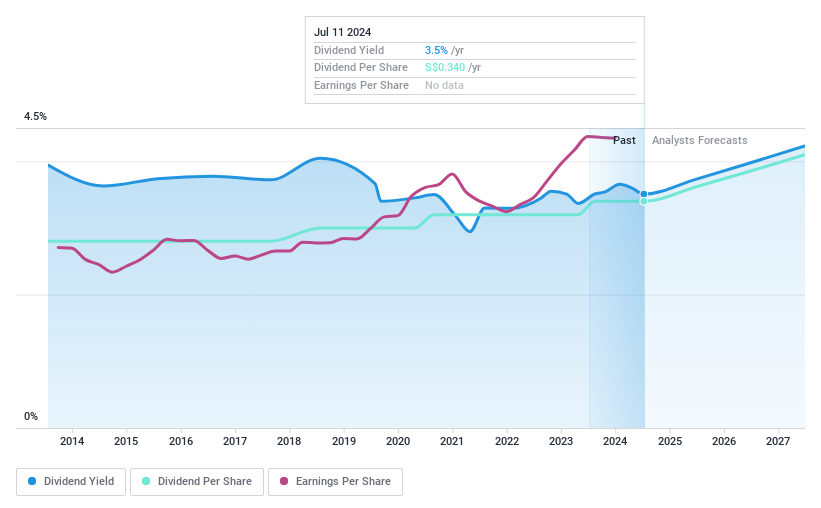

Singapore Exchange

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited (SGX: S68) operates as an integrated securities and derivatives exchange with related clearing houses in Singapore, boasting a market capitalization of approximately SGD 9.96 billion.

Operations: Singapore Exchange Limited generates its revenue primarily from two segments: Segment Adjustment and Fixed Income, Currencies, and Commodities, with earnings of SGD 843.68 million and SGD 371.53 million respectively.

Dividend Yield: 3.7%

Singapore Exchange's dividend yield of 3.65% is modest compared to the top quartile in the Singapore market, which averages 6.29%. Despite this, its dividends have shown stability and reliability over the past decade, with a recent payout of SGD 0.085 per share. The company maintains a healthy coverage with earnings supporting 63% and cash flows covering nearly 79.1% of dividend payments, reflecting prudent financial management amid consistent earnings growth at an annual rate of 7.2% over the past five years.

Unlock comprehensive insights into our analysis of Singapore Exchange stock in this dividend report.

Summing It All Up

Navigate through the entire inventory of 20 Top SGX Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:F03 SGX:P9D and SGX:S68.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance