5 Stocks to Watch on Dividend Hikes to Reward Investors

Amid high volatility, major U.S. indexes like the Dow, the S&P 500 and the Nasdaq have managed to stay positive with 4.5%, 9.3% and 8.9% gains, respectively, year to date.

However, key concerns of investors are increasing domestic inflation, which continued to rise for thethird straight month in March, the slowest economic growth in nearly two years, a strong labor marketand a lack of any direction on how long the central bank intends to keep the higher interest rate intact

The Consumer Price Index (CPI), which is the most accepted gauge for inflationfor the month of March rose 3.5% year on year against 3.2% in February, mostly due to a rise in the cost of gasoline and shelter. The growth of the U.S. economy was recorded at 1.6% in Q1, the slowest in nearly two years and below Wall Street’s expectation of 2.4%. The Department of Labor reported that labor costs increased 1.2% in the last quarter compared with a 0.9% rise in Q4 of 2023, indicating an increase in wage pressures and a resilient labor market.

With expectations to bring inflation within the accepted range of 2%, the Federal Reserve after the Federal Open Market Committee meeting between Apr 30 and May 1, has kept the key interest rates unchanged at its existing range of 5.25-5.5%. Fed Chairman Jerome Powell has denied the possibility of a rate cut until there is further evidence of declining inflation.

The manufacturing index for the month of April came in at 49.2%, below the consensus estimate of 49.8%, according to the report published by Institute of Supply Management. It is important to note that any reading below 50% indicates a contraction in manufacturing activities. Also, the Consumer Confidence Index of 97%, which came in below the consensus estimate of 103.5%, hit the lowest level in more than one and a half years, indicating deteriorating consumer confidence.

In the current situation, the challenge remains for the Fed to create a soft landing for the economy by striking the right balance between inflation and growth by keeping the interest rate higher for longer to counter rising inflation.

Prudent investors who wish to invest their money for regular income and capital preservation can buy dividend stocks. These companies, due to their well-established businesses, pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks in a highly volatile market.

On that note, let us look at companies like Ardmore Shipping ASC, TEGNA TGNA, HysterYale Materials Handling HY, Chesapeake Utilities CPK and Expeditors International of Washington EXPD that have lately hiked their dividend payouts.

Ardmore Shipping provides seaborne transportation of petroleum products and chemicals worldwide to oil majors, national oil companies, oil and chemical traders, and chemical companies. The Mahon, Ireland-based company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

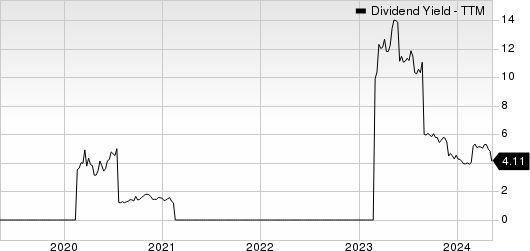

On May 8, ASC declared that its shareholders would receive a dividend of 31 cents a share on Jun 14, 2024. ASC has a dividend yield of 4.1%.

Over the past five years, ASC has increased its dividend four times, and its payout ratio presently sits at 23% of earnings. Check Ardmore Shipping’s dividend history here.

Ardmore Shipping Corporation Dividend Yield (TTM)

Ardmore Shipping Corporation dividend-yield-ttm | Ardmore Shipping Corporation Quote

TEGNA is headquartered in Tysons, VA. This Zacks Rank #3 (Hold) company has evolved as one of the largest U.S. broadcasting groups and a leading local news and media content provider.

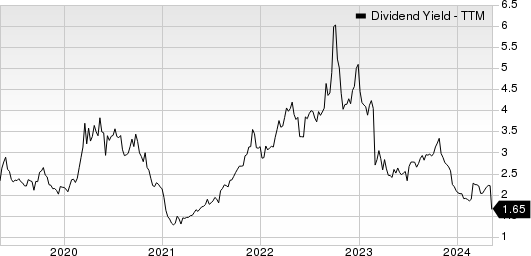

On May 8, TGNA declared that its shareholders would receive a dividend of 13 cents a share on Jul 1, 2024. TGNA has a dividend yield of 3.1%.

In the past five years, TGNA has increased its dividend three times. Its payout ratio at present sits at 26% of earnings. Check TEGNA’ dividend history here.

TEGNA Inc. Dividend Yield (TTM)

TEGNA Inc. dividend-yield-ttm | TEGNA Inc. Quote

HysterYale Materials Handling designs, engineers, manufactures, sells and services a comprehensive line of lift trucks, warehouse trucks, counterbalanced trucks, cargo, container handling trucks and aftermarket parts. The Zacks Rank #3 company is headquartered in Cleveland, OH.

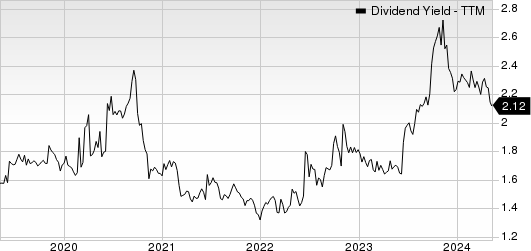

On May 8, HY announced that its shareholders would receive a dividend of 35 cents a share on Jun 14, 2024. HY has a dividend yield of 1.8%.

Over the past five years, HY has increased its dividend four times. Its payout ratio now sits at 18% of earnings. Check HY's dividend history here.

Hyster-Yale Materials Handling, Inc. Dividend Yield (TTM)

Hyster-Yale Materials Handling, Inc. dividend-yield-ttm | Hyster-Yale Materials Handling, Inc. Quote

Chesapeake Utilities is engaged in natural gas distribution and transmission, propane distribution and marketing, advanced information services and other related businesses. The Dover, DE-based company currently carries a Zacks Rank #3.

On May 8, CPK declared that its shareholders would receive a dividend of 64 cents a share on Jul 5, 2024. CPK has a dividend yield of 2.1%.

Over the past five years, CPK has increased its dividend six times, and its payout ratio presently sits at 45% of earnings. Check Chesapeake Utilities’ dividend history here.

Chesapeake Utilities Corporation Dividend Yield (TTM)

Chesapeake Utilities Corporation dividend-yield-ttm | Chesapeake Utilities Corporation Quote

Expeditors International of Washington is headquartered in Seattle, WA. This Zacks Rank #3 company is engaged in the business of global logistics management, including international freight forwarding and consolidation, for both air and ocean freight.

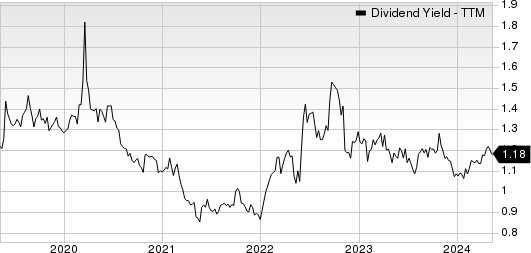

On May 6, EXPD declared that its shareholders would receive a dividend of 73 cents a share on Jun 17, 2024. EXPD has a dividend yield of 1.2%.

In the past five years, EXPD has increased its dividend six times. Its payout ratio at present sits at 28% of earnings. Check Expeditors International of Washington’s dividend history here.

Expeditors International of Washington, Inc. Dividend Yield (TTM)

Expeditors International of Washington, Inc. dividend-yield-ttm | Expeditors International of Washington, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

Hyster-Yale Materials Handling, Inc. (HY) : Free Stock Analysis Report

Ardmore Shipping Corporation (ASC) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance