AllianceBernstein's (AB) April AUM Falls on Market Depreciation

AllianceBernstein Holding L.P. AB has announced assets under management (AUM) for April 2024. The company’s preliminary month-end AUM of $737 billion reflects a 2.9% decline from the end of March 2024.

The decrease was primarily due to market depreciation. This was partly offset by net inflows in the Retail channel. AB recorded net outflows in Institutions and Private Wealth channels.

At the end of April, AllianceBernstein’s Equity AUM decreased 4.9% on a sequential basis to $313 billion. Alternatives/Multi-Asset Solutions AUM (including certain multi-asset services and solutions) was down 2.1% to $140 billion. Fixed Income AUM of $284 billion declined 1% from the end of March 2024.

In terms of channel, April month-end Institutions AUM of $313 billion decreased 3.1% from the previous month. Retail AUM was $299 billion, down 2.9% from the prior month’s end. Private Wealth AUM of $125 billion decreased 2.3% from the March 2024 level.

AllianceBernstein’s global reach and solid AUM balance are likely to boost top-line growth. However, rising operating costs and a challenging operating backdrop are major near-term concerns.

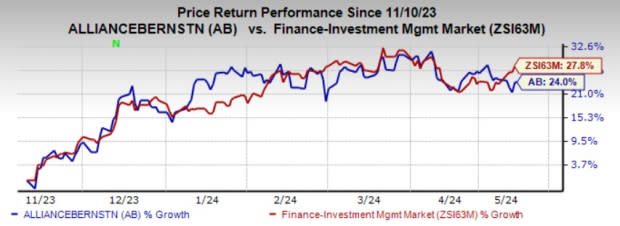

Over the past six months, shares of AB have gained 24% compared with the industry's growth of 27.8%.

Image Source: Zacks Investment Research

Currently, AB carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AllianceBernstein’s global reach and solid AUM balance are likely to boost top-line growth. However, rising operating costs and a challenging operating backdrop are major near-term concerns.

Performance of Other Asset Managers

Cohen & Steers, Inc. CNS reported a preliminary AUM of $77.2 billion as of Apr 30, 2024. This reflected a decline of 4.9% from the prior month's level.

Cohen & Steers’ AUM declined due to market depreciation of $3.9 billion, net outflows of $74 million and distributions of $151 million.

Invesco IVZ announced a preliminary AUM of $1,625.2 billion for April 2024, reflecting a 2.3% decline from the previous month-end.

Invesco’s AUM was adversely impacted by unfavorable market returns, which decreased AUM by $37.5 billion. Also, FX lowered the AUM balance by $3.7 billion. Further, money market net outflows were $1 billion. On the other hand, IVZ delivered net long-term inflows of $5 billion in the month. Non-management fee-earning net inflows were $0.7 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance