Is AMD Stealing the Spotlight in Server and Client Markets? Here's What You Need to Know

Advanced Micro Devices Inc (NASDAQ:AMD) increased its market share for client and server categories in the x86 processor market. Despite intense competition in the market, particularly between AMD and Intel Corp (NASDAQ:INTC), AMD continued to grow. Intel, however, made gains in the Internet of Things (IoT) sector.

Excluding IoT and semi-custom products such as game console chips that AMD manufactures, Venture Beat cites Mercury Research.

The company again recorded gains in both client and server segments quarterly and yearly.

Dean McCarron of Mercury Research noted that x86 processor shipments aligned with typical seasonal trends in the first quarter, ending March 31, with all segments seeing moderate declines, which is typical for this time of year.

This past quarter marked the first normal market results across desktop, mobile, and server segments since early 2020 when the COVID pandemic began. However, IoT/SoC processor shipments fell significantly due to decreased console demand, impacting AMD’s SoC shipments. AMD reported a 48% drop in gaming revenue in the first quarter compared to the previous year and anticipated further declines throughout 2024.

McCarron explained that the statistics and share movements from the past few quarters better reflect how suppliers managed their inventory corrections. Most comparisons should be valid by the third quarter of 2024, although the year-on-year results are not.

For the all-inclusive share, which includes PC client CPUs, servers, IoT, and semi-custom products like gaming consoles, Intel gained 2.4 percentage points over the quarter, driven by AMD’s reduced SoC business.

Analysts flagged AMD’s significant gains in the server CPU market and its successful market share capture in the merchant accelerator sector with the Mi300 series, making it a formidable competitor to Nvidia Corp (NASDAQ:NVDA) in the merchant accelerators market. They also flagged the untapped potential of revenue synergies from the acquisition of Xilinx, suggesting a long-term upside of over $10 billion.

Meanwhile, after Arm Holdings Plc’s (NASDAQ:ARM) recent quarterly print, analysts flagged the British chipmaker’s ability to displace Intel and AMD as a critical beneficiary of AI adoption at the edge (phones, PCs) and traditional x86 in data center server CPU infrastructure.

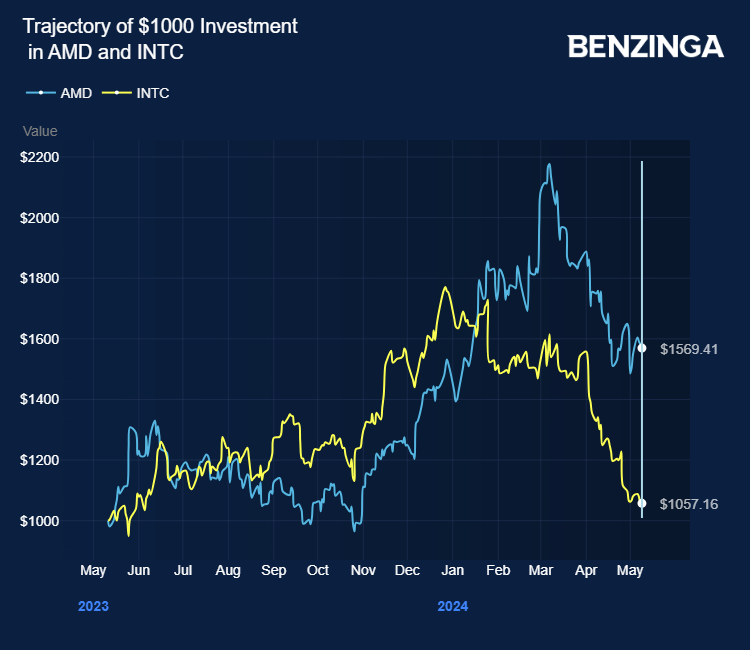

AMD stock gained over 57% in the last 12 months. Investors can gain exposure to the stock via AOT Growth And Innovation ETF (NASDAQ:AOTG) and Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ).

Price Actions: AMD shares traded higher by 0.79% at $153.58 premarket at the last check Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy of AMD

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Is AMD Stealing the Spotlight in Server and Client Markets? Here's What You Need to Know originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance