Amur Minerals (LON:AMC) shareholders have earned a 21% CAGR over the last five years

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more -- or less -- than that. The Amur Minerals Corporation (LON:AMC) stock price is down 94% over five years, but the total shareholder return is 162% once you include the dividend. And that total return actually beats the market decline of 13%. The falls have accelerated recently, with the share price down 87% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Amur Minerals

Amur Minerals hasn't yet reported any revenue, so it's as much a business idea as an actual business. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Amur Minerals finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Amur Minerals investors have already had a taste of the bitterness stocks like this can leave in the mouth.

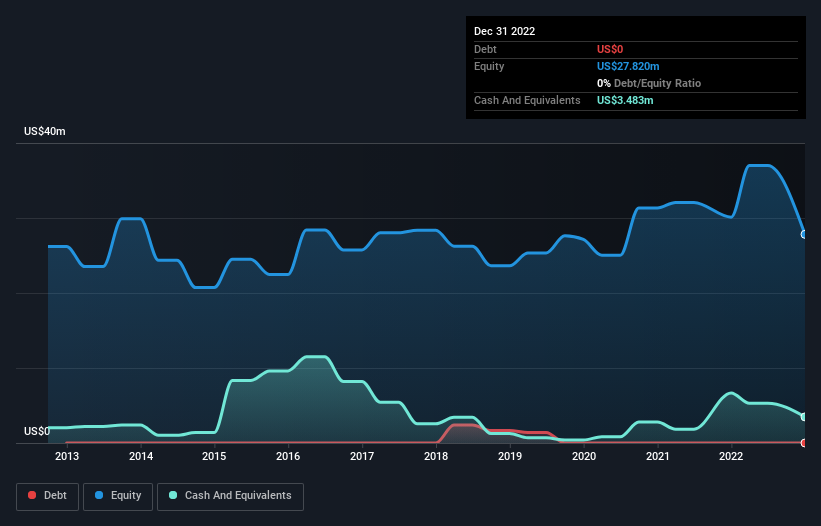

Amur Minerals had cash in excess of all liabilities of just US$2.6m when it last reported (December 2022). So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. With that in mind, you can understand why the share price dropped 14% per year, over 5 years. You can see in the image below, how Amur Minerals' cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

What About The Total Shareholder Return (TSR)?

We've already covered Amur Minerals' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Amur Minerals' TSR, at 162% is higher than its share price return of -94%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Amur Minerals shareholders have received a total shareholder return of 1,348% over one year. That's better than the annualised return of 21% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 4 warning signs we've spotted with Amur Minerals .

But note: Amur Minerals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance