Another post-Brexit economic survey shows a collapse in activity — this time in retail

Peter Byrne / PA Archive/Press Association Images

Britain's retail sector has taken a huge hit in the aftermath of the vote to leave the European Union, a new survey from business lobby the Confederation of British Industry (CBI) showed on Wednesday.

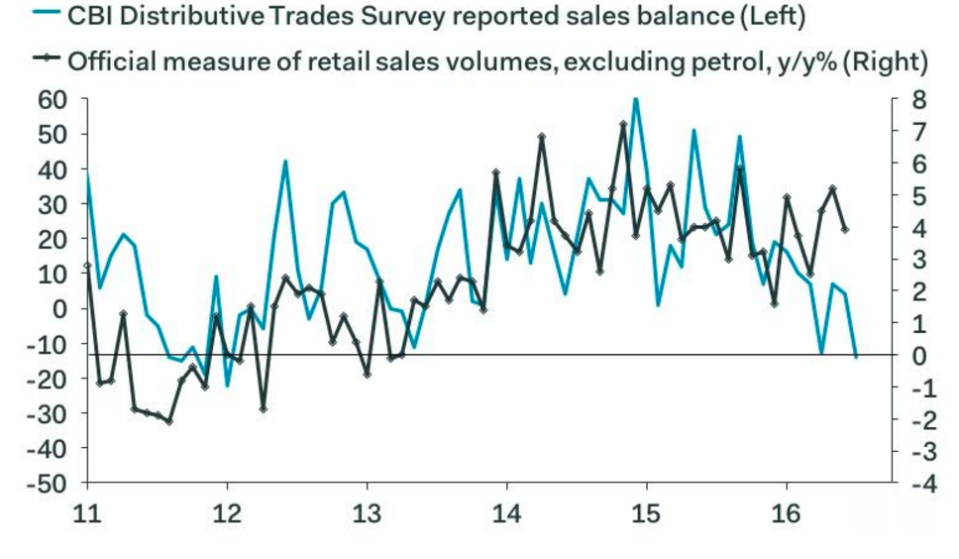

The CBI's latest Distributive Trades Survey, which is an indicator of short-term trends in the UK retail and wholesale distribution sector, showed activity cooling massively in July, with sales volumes collapsing more quickly than at any point in the last four and a half years. The CBI's overall reading came in at -14, against an expected score of 1, and a previous score of 4.

The survey isn't a major economic datapoint by any means, as it only takes in the opinions of 132 firms across Britain, but it does provide a handy indicator of sentiment and that sentiment appears to be dropping rapidly.

The CBI notes that the retail areas to suffer most in the immediate aftermath were grocers and furniture stores, both of which saw big falls in sales. Furniture and carpet retailers in particular tanked, with sales falling 90% from the CBI's last survey.

Some sectors did gain substantially, including non-specialised goods (up 52%) and footwear/leather goods (up 44%), leading CBI Chief Economist Rain Newton-Smith to urge caution in reading too much into the numbers:

"While conditions in the retail sector have weakened, we should be careful about reading too much too soon, as consumers were likely to err on the side of caution in the immediate period following a vote to leave the EU.

"Current low levels of inflation and high overall employment should support consumer spending in the near term, although the impact of lower sterling is likely to feed through to higher inflation over time."

Commenting on the survey, Samuel Tombs of Pantheon Macroeconomics noted:

"The plunge in the reported sales balance in July to its lowest level since January 2012 indicates that consumers as well as businesses are immediately tightening their belts following the referendum. The survey was undertaken in the first half of July and it is the first major retail report solely to cover the post-referendum period. Retailers’ expectations for sales over the next month also fell to a four-and-a-half year low and they cut orders with suppliers at the fastest rate since March 2009."

Here's Pantheon's chart showing just how big that collapse:

Peter Byrne / PA Archive/Press Association ImagesThe CBI's survey is the latest to show that economic activity and sentiment have started to slow substantially since the referendum. Last Friday, Markit's UK PMI data showed a collapse in sentiment, while a separate CBI survey earlier this week suggested that Britain's manufacturers have not felt so depressed about their industry since the financial crisis.

Earlier on Wednesday, the latest UK GDP data from the Office for National Statistics showed economic growth accelerating in the run up to the referendum.

NOW WATCH: Why this deadly threat could cost the world $100 trillion by 2050

See Also:

SEE ALSO: One of Britain’s biggest house builders says the property market is 'encouraging' after Brexit

DON'T MISS: The Bank of England thinks we're falling into recession and 'there is very little that the bank can do'

Yahoo Finance

Yahoo Finance