Bear of the Day: Ashtead Group (ASHTY)

On the surface, Ashtead Group’s ASHTY robust bottom line as a premier construction and industrial equipment provider in the United States and United Kingdom may be very enticing.

However, the market tends to sniff out companies that may not be able to deliver on their lofty expectations which can send a stock faltering if this materializes. Unfortunately, Ashtead Group fits this scenario with its stock now landing a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Time to Take Profits

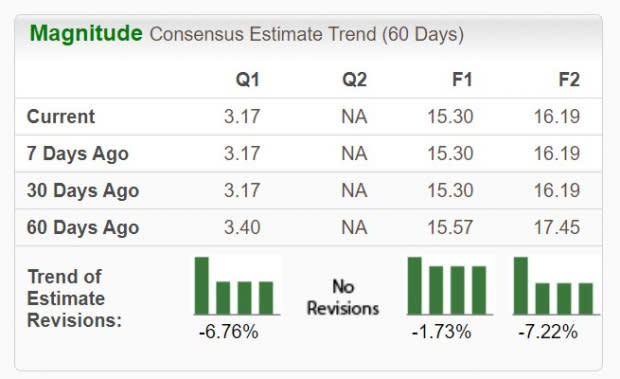

It appears to be time to take profits in Ashtead’s stock which is near $300 a share after rising +29% over the last year and up +4% in 2024. To that point, earnings estimate revisions have remained lower in the last 60 days with FY24 EPS projections falling roughly -2% and FY25 EPS projections down -7%.

It’s also noteworthy that Ashtead’s Zacks Industrial Services Industry is in the bottom 24% of over 250 Zacks industries with Global Industrial Company GIC, Hudson Technologies HDSN, and Kion Group KIGRY being other peers with sell ratings in correlation with declining earnings estimates.

Image Source: Zacks Investment Research

Valuation Cracks

Unlike Global Industrial, Hudson Technologies, and Kion Group, investors are paying a very pretty penny for Ashtead’s stock. This makes taking a closer look at the company’s valuation more necessary and when doing so, there are some concerns.

Specifically, Ashtead’s PEG ratio points to the company's earnings growth not supporting what appears to be a reasonable P/E valuation. In this case, Ashtead’s stock trades at 19.9X forward earnings which is below the S&P 500’s 21.5X and near its industry average of 19X. Still, Ashtead’s PEG is currently pegged at 3.6 which is noticeably above the optimum level of less than 1 and the industry average of 1.3 with the S&P 500 at 1.7.

Image Source: Zacks Investment Research

Bottom Line

Simply put, when investors are paying a lofty price for a stock they want to be aware of when it may depreciate or if it's time to take profits and this appears to be the case for Ashtead Group. This is not to say that Ashtead Group won’t be a viable investment in the future but on the contrary, its stock may not be worth the risk at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashtead Group PLC (ASHTY) : Free Stock Analysis Report

Hudson Technologies, Inc. (HDSN) : Free Stock Analysis Report

Global Industrial Company (GIC) : Free Stock Analysis Report

Kion Group (KIGRY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance