Berkshire Hathaway Q1 Earnings: A Detailed Analysis

Net Earnings: Reported at $12,702 million, significantly below the previous year's $35,504 million, and exceeded the current quarterly estimate of $7,302 million.

Earnings Per Share (Class A): Achieved $8,825, exceeding the estimated $6,155.28.

Operating Earnings: Increased to $11,222 million from $8,065 million in the previous year.

Insurance Underwriting: Grew to $2,598 million from $911 million year-over-year.

Investment Gains/Losses: Reported a net gain of $1,480 million, influenced by $11.2 billion in realized gains on sales of investments.

Share Repurchases: Approximately $2.6 billion was used to purchase shares of Class A and Class B common stock during the quarter.

Insurance Float: Reported at approximately $168 billion as of March 31, 2024.

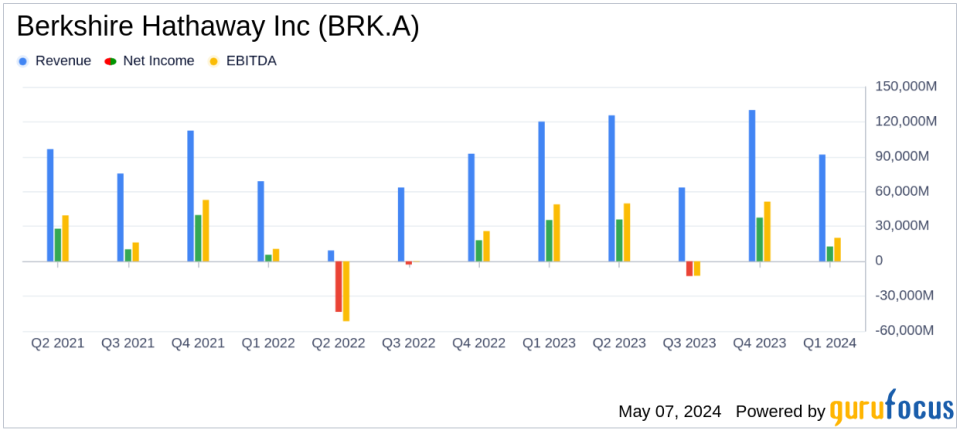

Berkshire Hathaway Inc (NYSE:BRK.A) released its 8-K filing on May 4, 2024, detailing its financial performance for the first quarter of 2024. The conglomerate, known for its broad portfolio including insurance, utilities, railroad, and manufacturing operations, reported a significant shift in earnings influenced by both operational activities and investment gains.

Company Overview

Berkshire Hathaway, a holding company led by CEO Warren Buffett (Trades, Portfolio), operates across various sectors with its core business in insurance, conducted through subsidiaries like Geico and Berkshire Hathaway Reinsurance Group. The firm leverages the cash flows from these operations to support other business ventures, including Burlington Northern Santa Fe (railroad) and Berkshire Hathaway Energy, alongside a host of manufacturing, service, and retail entities.

Financial Performance Highlights

The first quarter of 2024 saw Berkshire Hathaway achieving net earnings of $12,702 million, a stark contrast to the $35,504 million recorded in the same quarter the previous year. This year's earnings include $1,480 million from investment gains, significantly lower than the $27,439 million from the prior year, primarily due to a downturn in unrealized gains in equity security investments. The operating earnings stood at $11,222 million, up from $8,065 million in Q1 2023, indicating robust operational growth.

Operational Success Amidst Investment Volatility

The company's insurance operations showed remarkable improvement, with underwriting profits rising to $2,598 million from $911 million in the previous year. Investment income from insurance also saw an increase, contributing positively to the bottom line. Other segments, including the BNSF railroad and Berkshire Hathaway Energy, reported mixed results but continued to provide stable earnings contributions.

Strategic Financial Management

Berkshire Hathaway's strategic financial maneuvers included the repurchase of $2.6 billion worth of Class A and Class B shares during the quarter, reflecting confidence in the intrinsic value of the company despite market fluctuations. The firms insurance float, a critical indicator of insurance leverage, stood at approximately $168 billion, underpinning its insurance operation's financial health.

Analysis and Future Outlook

While the decrease in net earnings year-over-year primarily resulted from lower investment gains, the substantial increase in operating earnings highlights the company's operational strength and efficiency. The diverse portfolio of Berkshire Hathaway allows for a balanced risk management strategy, although it is subject to market volatilities, as seen in the investment segment.

Overall, Berkshire Hathaway's first quarter performance in 2024 paints a picture of a conglomerate with strong operational health and savvy financial strategies, poised to continue its legacy of growth and profitability. Investors are encouraged to view the detailed financial statements and notes available on the Berkshire Hathaway website to gain deeper insights into the company's comprehensive financial health.

For more detailed information, please refer to the official earnings release and consult with financial advisors to understand the implications of Berkshire Hathaway's performance on your investment portfolio.

Explore the complete 8-K earnings release (here) from Berkshire Hathaway Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance