Best Growth Stocks to Buy for May 17th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today May 17th:

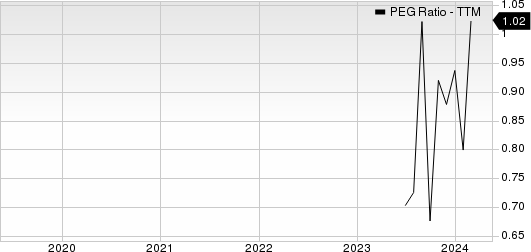

M-tron Industries, Inc. MPTI: This company which designs, manufactures and markets highly-engineered, high reliability frequency and spectrum control products and solutions, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.1% over the last 60 days.

M-tron Industries, Inc. Price and Consensus

M-tron Industries, Inc. price-consensus-chart | M-tron Industries, Inc. Quote

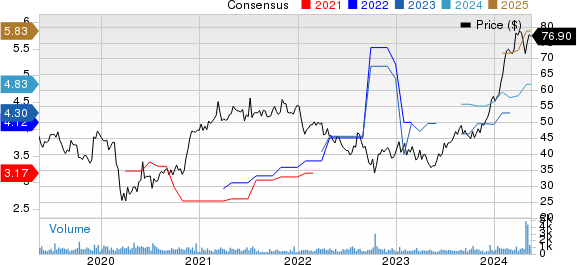

M-tron Industries has a PEG ratio of 0.64 compared with 1.49 for the industry. The company possesses a Growth Score of A.

M-tron Industries, Inc. PEG Ratio (TTM)

M-tron Industries, Inc. peg-ratio-ttm | M-tron Industries, Inc. Quote

AZZ AZZ: This company which is a global provider of metal coating services, welding solutions, specialty electrical equipment and highly engineered services to the markets of power generation, transmission, distribution and industrial in protecting metal and electrical systems used to build and enhance the world's infrastructure, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.5% over the last 60 days.

AZZ Inc. Price and Consensus

AZZ Inc. price-consensus-chart | AZZ Inc. Quote

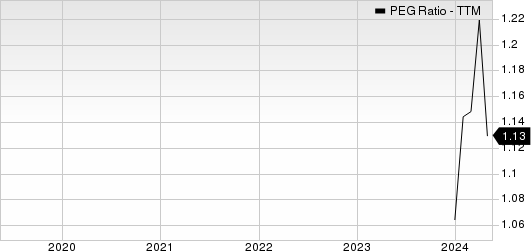

AZZ has a PEG ratio of 1.14 compared with 1.56 for the industry. The company possesses a Growth Score of B.

AZZ Inc. PEG Ratio (TTM)

AZZ Inc. peg-ratio-ttm | AZZ Inc. Quote

Agnico Eagle Mines AEM: This gold producer which has mining operations in Canada, Mexico and Finland, and exploration activities in Canada, Europe, Latin America and the United States, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 39.7% over the last 60 days.

Agnico Eagle Mines Limited Price and Consensus

Agnico Eagle Mines Limited price-consensus-chart | Agnico Eagle Mines Limited Quote

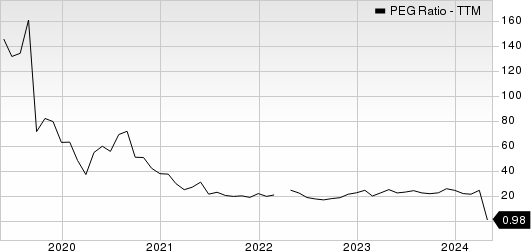

Agnico Eagle Mines has a PEG ratio of 0.81 compared with 1.79 for the industry. The company possesses a Growth Score of B.

Agnico Eagle Mines Limited PEG Ratio (TTM)

Agnico Eagle Mines Limited peg-ratio-ttm | Agnico Eagle Mines Limited Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AZZ Inc. (AZZ) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance