Biotech Stock Roundup: GILD's GSK' Q1 Earnings, DCPH Soars on Acquisition News & More

It was a busy week in the biotech sector with earnings reports from bigwigs Gilead Sciences, Inc. GILD and GSK plc GSK. Mergers and acquisitions continue to be in the spotlight as pharma and biotech majors look to bolster their product portfolio/pipeline.

Recap of the Week’s Most Important Stories:

DCPH Soars on Acquisition: Shares of cancer-focused biopharmaceutical Deciphera Pharmaceuticals, Inc. DCPH soared after the announcement of its acquisition by Japan-based ONO Pharmaceutical Co., Ltd. Per the terms of the deal, ONO will acquire all outstanding shares of Deciphera common stock for $25.60 per share in cash through a tender offer, followed by a merger of Deciphera with a wholly-owned subsidiary of ONO for a total equity value of $2.4 billion. The purchase price represents a premium of 74.7% to Deciphera’s closing share price of $14.65, and a premium of 68.8% to Deciphera’s 30-trading-day volume weighted average price on Apr 26, 2024.

The significant premium offered impressed investors. The acquisition is expected to close in the third quarter of 2024. The acquisition will add Deciphera’s only marketed product, Qinlock, approved for treating gastrointestinal stromal tumors, to ONO’s portfolio.

Q1 Results of Gilead and GSK: Gilead Sciences reported better-than-expected results, as its loss was narrower than expected and sales beat estimates. Total revenues of $6.7 billion beat the Zacks Consensus Estimate of $6.4, primarily due to higher HIV, Oncology and Liver Disease sales. Flagship HIV therapy Biktarvy’s sales increased 10% year over year to $2.95 billion, due to higher demand in the United States, Europe and other international markets.

While Veklury sales declined year over year due to the evolution of the pandemic, sales were better than estimates, providing an upside to sales. The company reiterated its product sales guidance of $27.1-$27.5 billion. Gilead expects to launch lenacapavir late next year, as the first and only twice-yearly subcutaneous prevention option.

Gilead also announced that the FDA approved an updated label with additional data, reinforcing the safety and efficacy profile of Biktarvy to treat pregnant people with HIV-1 (PWH) with suppressed viral loads. As a result of this update, Biktarvy is the only second-generation integrase strand transfer inhibitor-based single-tablet regimen with in-label clinical trial data and FDA approval in virologically suppressed adults who are pregnant.

GSK reported first-quarter core earnings of $1.09 per American depositary share, which beat the Zacks Consensus Estimate of 94 cents. Core earnings rose 16% year over year on a reported basis and 28% at constant exchange rate (CER). Quarterly revenues increased 6% on a reported basis and 10% at CER to $9.34 billion (£7.36 billion), which beat the Zacks Consensus Estimate of $8.98 billion. The upside can be attributed to rising HIV and vaccine product sales, partially offset by the declining COVID-19 product sales.

GSK raised its guidance for 2024. Management expects sales to increase toward the upper end of the previously-announced guidance of 5-7% (at CER). This upgrade came after the company won the Zejula royalty dispute appeal that resulted in higher royalty income than expected.

Updates from BMY: Bristol Myers BMY extended its collaboration with clinical-stage gene editing company Editas Medicine, Inc. EDIT by two years.

Per the collaboration, BMY and EDIT will research, develop, and commercialize autologous and allogeneic alpha-beta T cell medicines for the treatment of cancer and autoimmune diseases. The extension also has options to extend the collaboration for up to an additional two years. Under the collaboration, Bristol Myers Squibb has opted into 13 different programs across 11 gene targets to date. Two programs are currently in IND-enabling studies, and four are in late-stage discovery.

BMY also announced a multi-year strategic collaboration with Repertoire Immune Medicines to develop tolerizing vaccines for up to three autoimmune diseases. The collaboration aims to develop efficacious, selective and durable treatments for patients suffering from autoimmune disease by resetting the immune system. Under the terms of the agreement, Repertoire will receive tiered royalties, an upfront payment of $65 million, and up to $1.8 billion for achieving development, regulatory and commercial milestones.

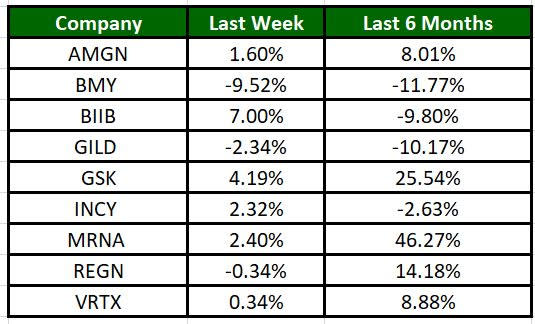

Performance

The Nasdaq Biotechnology Index has gained 2.50% in the past five trading sessions and Biogen’s shares have risen 7% during the same time frame. Over the past six months, shares of MRNA have risen 46.27%. (See the last biotech stock roundup here: Biotech Stock Roundup: BIIB, BMY’s Q1 Earnings, INCY’s Acquisition & Updates from VRTX)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more earnings and pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Editas Medicine, Inc. (EDIT) : Free Stock Analysis Report

Deciphera Pharmaceuticals, Inc. (DCPH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance