Crescent Capital BDC Inc (CCAP) Exceeds Quarterly Earnings Estimates with Strong First Quarter ...

Net Investment Income Per Share: Reported at $0.63, surpassing the estimated $0.57.

Net Income Per Share: Achieved $0.76, exceeding the quarterly estimate of $0.75.

Revenue: Total investment income reached $50.4 million, surpassing the estimated $46.76 million.

Net Asset Value (NAV) Per Share: Increased to $20.28 from $20.04 at the end of the previous quarter.

Dividends: Increased regular quarterly cash dividend to $0.42 per share and declared a supplemental cash dividend of $0.11 per share.

Portfolio Activity: Invested $73.9 million across seven new portfolio companies; exits, sales, and repayments totaled $98.4 million.

Liquidity and Capital Resources: Ended the quarter with $31.9 million in cash and cash equivalents; debt to equity ratio stood at 1.11x.

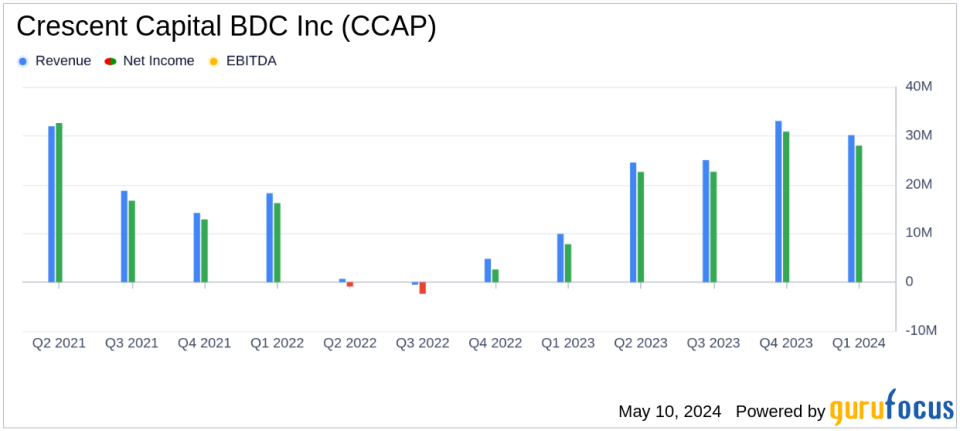

On May 8, 2024, Crescent Capital BDC Inc (NASDAQ:CCAP) disclosed its first-quarter financial results through an 8-K filing, revealing a robust performance that surpassed analyst expectations. The company reported a net investment income of $0.63 per share, outperforming the estimated earnings per share of $0.57, and declared a net income of $0.76 per share.

Company Overview

Crescent Capital BDC Inc is a business development company aimed at maximizing returns through current income and capital appreciation. The firm focuses on secured and unsecured debt investments in middle-market U.S. companies, leveraging the extensive experience and capabilities of its management team.

Financial Performance Insights

The company's net asset value (NAV) per share increased to $20.28 from $20.04 at the end of the previous quarter, indicating a positive trajectory in asset value amidst challenging market conditions. Total investment income rose to $50.4 million, up from $50.0 million in the prior quarter, driven by a diverse portfolio and strategic asset management.

Crescent Capital BDC also announced an increase in its regular quarterly cash dividend, raising it by $0.01 to $0.42 per share, alongside a supplemental cash dividend of $0.11 per share. These dividend increases reflect the company's strong cash generation capabilities and commitment to delivering shareholder value.

Operational Highlights and Portfolio Activity

As of March 31, 2024, Crescent Capital BDC's investment portfolio was valued at $1,563.3 million, slightly down from $1,582.1 million at the end of 2023. The portfolio primarily consists of unitranche and senior secured first lien debt, emphasizing high-quality, income-generating assets. The company invested $73.9 million across new and existing portfolio companies, demonstrating active portfolio management and strategic capital deployment.

Liquidity and Capital Resources

The company reported having $31.9 million in cash and cash equivalents, with substantial liquidity available through $343.6 million of undrawn capacity on its credit facilities. This strong liquidity position supports the company's operational flexibility and capacity for new investments.

Market Position and Future Outlook

Crescent Capital BDC's performance this quarter positions it well within the competitive landscape of middle-market investment companies. The strategic management of its robust and diversified portfolio, combined with effective capital deployment strategies, underpins its potential for sustained growth and profitability.

Conclusion

With a solid start to the year, Crescent Capital BDC Inc not only exceeded earnings expectations but also strengthened its financial position through strategic initiatives and prudent capital management. The company's focus on high-quality investments and shareholder value, combined with its strong market positioning, makes it a noteworthy entity in the asset management sector.

For further details on Crescent Capital BDC Inc's performance and strategic outlook, stakeholders and interested investors are encouraged to view the full earnings report and join the upcoming earnings conference call.

Explore the complete 8-K earnings release (here) from Crescent Capital BDC Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance