Criteo SA (CRTO) Q1 2024 Earnings: Substantial Growth and Strategic Share Repurchases

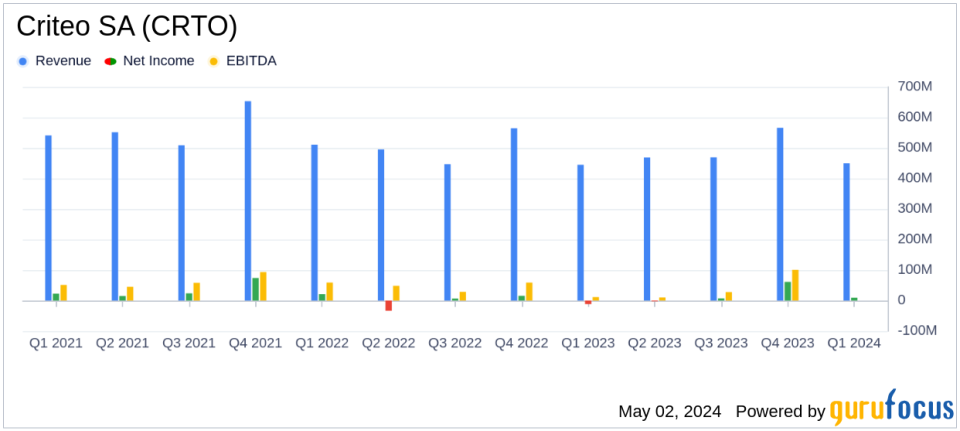

Revenue: Reported at $450 million, a 1% increase year-over-year, surpassing the estimated $244.82 million.

Net Income: Transitioned to a net income of $9 million from a net loss of $12 million the previous year, falling short of the estimated net income of $32.57 million.

Earnings Per Share (EPS): Achieved $0.12 diluted EPS, a significant recovery from a loss of $0.21 per share year-over-year, falling short of the estimated EPS of $0.54.

Gross Profit: Increased by 20% to $217 million, with gross profit margin expanding from 41% to 48% year-over-year.

Adjusted EBITDA: Rose by 83% to $71 million, reflecting effective cost management and increased Contribution ex-TAC.

Free Cash Flow: Decreased sharply by 91% to $1 million, indicating a substantial reduction in cash generated from operations.

Share Repurchases: Deployed $62 million towards share repurchases as part of capital return to shareholders.

Criteo SA (NASDAQ:CRTO), a global leader in commerce media, disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing on May 2, 2024. The company reported a significant improvement in both revenue and net income, showcasing a resilient performance despite the challenging market conditions. Criteo's strategic initiatives, including a $62 million share repurchase and a raised outlook for the full year, highlight its confidence in sustained growth.

Headquartered in Paris, Criteo stands at the forefront of the digital advertising market, specializing in real-time multichannel and cross-device marketing campaigns. Its innovative technology provides real-time ROI analysis, enabling dynamic adjustment of marketing strategies, crucial for retailers managing ad inventories and yield optimization.

Financial Highlights

For Q1 2024, Criteo reported a revenue of $450 million, a modest increase from $445 million in the same quarter the previous year. This growth is attributed to a 20% increase in gross profit, which rose to $217 million from $182 million, and a gross profit margin improvement from 41% to 48%. The net income showed a remarkable turnaround from a loss of $12 million in Q1 2023 to a profit of $9 million in Q1 2024.

The non-GAAP results were equally impressive, with Contribution ex-TAC up by 15% to $254 million and Adjusted EBITDA soaring by 83% to $71 million. Adjusted diluted EPS increased significantly by 60% to $0.80. However, the company experienced a decline in cash from operating activities, which dropped by 67% to $14 million, and a substantial decrease in Free Cash Flow by 91% to $1 million.

Operational and Strategic Developments

Criteo's operational success in Q1 2024 was driven by a 34% growth in Retail Media Contribution ex-TAC at constant currency. The expansion of platform adoption to 2,700 brands and approximately 225 retailers and marketplaces, including new partnerships in Central America, played a pivotal role. The company also achieved its first accreditation by the Media Rating Council for Retail Media measurement.

The significant capital deployment for share repurchases underscores Criteo's commitment to returning value to shareholders, with plans to return $150 million in 2024. This strategic move, coupled with the nomination of Ernst Teunissen to the Board, positions Criteo for robust governance and financial health.

Future Outlook

Encouraged by the strong performance in the first quarter, Criteo has raised its full-year 2024 guidance. The company now anticipates high-single-digit growth in Contribution ex-TAC at constant currency, up from the previous mid-single-digit forecast. The expected Adjusted EBITDA margin has also been adjusted upward to approximately 31% of Contribution ex-TAC.

In conclusion, Criteo's Q1 2024 results not only reflect a solid start to the year but also highlight the effectiveness of its strategic initiatives and operational efficiency. With an enhanced financial outlook and ongoing investments in innovation and market expansion, Criteo is well-positioned to maintain its leadership in the digital advertising industry and deliver continued shareholder value.

Explore the complete 8-K earnings release (here) from Criteo SA for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance