Cummins (CMI) Q1 Earnings Miss, Fall Y/Y, Sales Top Estimates

Cummins Inc. CMI reported first-quarter 2024 earnings of $5.10 per share, which declined from $5.55 per share recorded in the corresponding quarter of 2023. The bottom line also missed the Zacks Consensus Estimate of $5.11 per share. Cummins’ revenues totaled $8.40 billion, compared with $8.45 billion recorded in the year-ago quarter. The top line beat the Zacks Consensus Estimate of $8.35 billion.

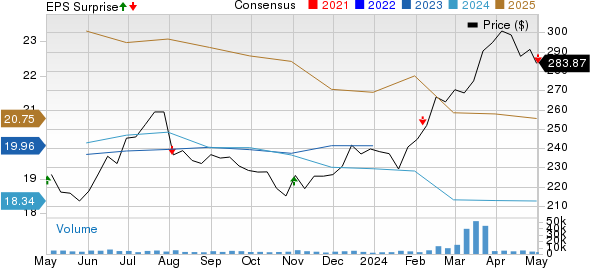

Cummins Inc. Price, Consensus and EPS Surprise

Cummins Inc. price-consensus-eps-surprise-chart | Cummins Inc. Quote

Key Takeaways

In the reported quarter, sales in the Engine segment were down 2% year over year to $2.9 billion. The metric topped our estimate of $2.8 billion. On-highway revenues inched up 1% due to strong demand in the North American truck market and pricing actions. International sales decreased 8% amid lower demand from Europe and China. The segment’s EBITDA fell to $414 million (accounting for 14.1% of sales) from $457 million (15.3% of sales) in the year-ago period but topped our estimate of $390 million.

Sales in the Distribution segment totaled $2.5 billion, up 5% year over year and in line with our estimate. Robust demand for power generation products and smart pricing led to revenue growth. Sales in North America inched up 2%, while international sales rose 14%. The segment’s EBITDA came in at $294 million (11.6% of sales), down from the year-ago quarter’s $335 million (13.9% of sales). The metric also missed our estimate of $323 million.

Sales in the Components segment totaled $3.3 billion, down 6% from the prior-year quarter but matched our forecast. Revenues in North America fell 5% and international sales contracted 8% on lower demand in Europe and China. The segment’s EBITDA was $473 million (14.2% of sales), lower than the year-ago figure of $507 million (14.3% of sales). The metric missed our estimate of $489 million.

Sales in the Power Systems segment rose 3% from the year-ago quarter to $1.4 billion but lagged our estimate of $1.42 billion. While power generation revenues rose 11% on the back of higher global demand (especially for the data center market), industrial revenues fell 8% amid weaker demand in oil and gas markets. The segment’s EBITDA rose to $237 million (17.1% of sales) from $219 million (16.3% of sales) and topped our estimate of $231 million.

Sales in the Accelera segment came in at $93 million, up 9% from the year-ago level but lagged our estimate of $111.7 million. The segment incurred a pretax loss of $101 million, which was wider than our estimate of $96.3 million. Costs associated with the development of electric powertrains, fuel cells and electrolyzers, as well as products to support battery electric vehicles, resulted in EBITDA losses.

Financials & Outlook

Cummins’ cash and cash equivalents were $2.54 billion as of Mar 31, 2024, up from $2.1 billion on Dec 31, 2023. Long-term debt totaled $5.7 billion, up from $4.8 billion as of Dec 31, 2023.

For full-year 2024, Cummins expects revenues to decline 2-5% year over year. EBITDA is forecast to be in the range of 14.5-15.5% of sales. Cummins continues to stick to its plan of returning nearly 50% of its operating cash flow to shareholders in the form of dividends.

Cummins currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Releases From the Auto Space

General Motors GM reported first-quarter 2024 adjusted earnings of $2.62 per share, which surpassed the Zacks Consensus Estimate of $2.08. The bottom line also increased from the year-ago quarter’s level of $2.21. Solid results of the GMNA segment led to the outperformance. Revenues of $43.01 billion beat the Zacks Consensus Estimate of $41.28 billion and increased from $39.9 billion recorded in the year-ago period.

GM had cash and cash equivalents of $17.64 billion as of Mar 31, 2024. The long-term automotive debt at the end of the quarter was $15.9 billion. For full-year 2024, GM now expects adjusted EBIT in the range of $12.5-$14.5 billion, up from $12-$14 billion guided earlier. Adjusted EPS is anticipated in the range of $9-$10, up from $8.50-$9.50, guided earlier. Adjusted automotive free cash flow is expected in the band of $8.5-$10.5 billion, higher than the prior forecast of $8-$10 billion.

Ford F reported first-quarter 2024 adjusted earnings per share (EPS) of 49 cents, which beat the Zacks Consensus Estimate of 42 cents but declined from 63 cents recorded in the year-ago quarter. The company’s consolidated first-quarter revenues came in at $42.8 billion, up 3.1% year over year.

Ford had cash and cash equivalents of $19.72 billion as of Mar 31, 2024. Long-term debt, excluding Ford Credit, totaled $19.4 billion at the end of the first quarter of 2024. For full-year 2024, Ford’s outlook for adjusted EBIT remained unchanged in the range of $10-$12 billion. However, the company now expects adjusted free cash flow in the range of $6.5-$7.5 billion, up from the previous outlook of $6-$7 billion. Capital spending is expected in the range of $8-$9 billion, narrower than the previous estimate of $8-$9.5 billion.

PACCAR PCAR recorded earnings of $2.27 per share in the first quarter of 2024, which surpassed the Zacks Consensus Estimate of $2.17 per share and increased from $2.25 per share recorded in the year-ago period. Consolidated revenues (including trucks and financial services) came in at $8.74 billion, up from $8.47 billion in the corresponding quarter of 2023. Sales from Trucks, Parts and Others were $8.2 billion, which surpassed the Zacks Consensus Estimate of $8.08 billion.

PACCAR’s cash and marketable debt securities amounted to $7.72 billion as of Mar 31, 2024, compared with $8.66 million as of Dec 31, 2023. The company declared a quarterly dividend of 27 cents per share. Capex and R&D expenses for 2024 are envisioned in the band of $700-$750 million and $460-$500 million, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance