Decoding Ameriprise Financial Inc (AMP): A Strategic SWOT Insight

Robust revenue growth and solid earnings per share underscore Ameriprise Financial's financial strength.

Strategic focus on asset and wealth management segments drives competitive advantage.

Market volatility and interest rate changes present both opportunities and threats to the company's performance.

Continued innovation and expansion in financial services are key to sustaining growth amidst industry challenges.

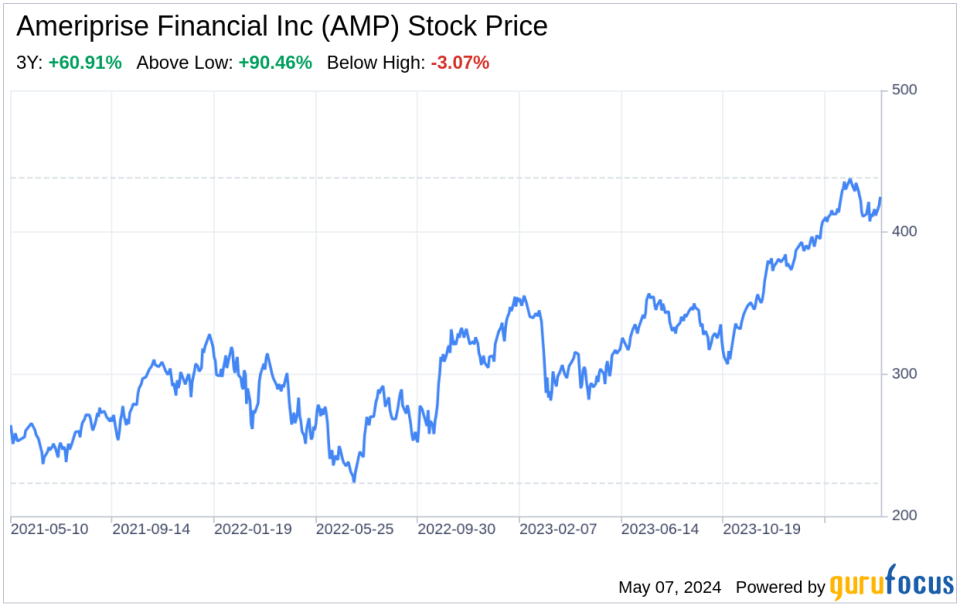

Ameriprise Financial Inc (NYSE:AMP) has released its 10-Q filing on May 6, 2024, providing a detailed view of its financial performance for the first quarter of the year. The company, a major player in the US market for asset and wealth management, boasts approximately $1.4 trillion in total assets under management and administration as of the end of 2023. With a network of around 10,000 advisors, Ameriprise Financial is well-positioned in the industry, deriving about 80% of its revenue from its asset and wealth management segments. The recent financial tables reveal a significant increase in net income, from $417 million in Q1 2023 to $990 million in Q1 2024, and a rise in total revenues from $3,845 million to $4,325 million over the same period. Earnings per share have also seen a substantial increase, both basic and diluted, indicating a strong financial position. This SWOT analysis will delve into the strengths, weaknesses, opportunities, and threats as presented in the latest SEC filing, offering readers a comprehensive understanding of Ameriprise Financial's current market standing and future prospects.

Strengths

Financial Performance and Brand Reputation: Ameriprise Financial's robust financial performance is a testament to its operational efficiency and strategic focus. The company's net income nearly doubled from $417 million in Q1 2023 to $990 million in Q1 2024, with total revenues increasing by over 12%. This financial strength is underpinned by a strong brand reputation and a loyal customer base, which have been instrumental in driving growth. The company's earnings per share have also seen a significant rise, indicating a healthy profitability ratio and shareholder value.

Asset and Wealth Management Dominance: With $1.4 trillion in assets under management and administration, Ameriprise Financial has cemented its position as a leader in asset and wealth management. The company's extensive network of advisors and its strategic focus on these segments have contributed to a consistent revenue stream, accounting for 80% of the company's total revenue. This focus has allowed Ameriprise Financial to leverage its expertise and scale to maintain a competitive edge in the market.

Weaknesses

Market Sensitivity and Interest Rate Exposure: Despite its strong financial performance, Ameriprise Financial is not immune to market volatility and interest rate fluctuations. These factors can significantly impact asset management fees, the value of market risk benefits, and the spread income generated on various financial products. The company's sensitivity to these market forces can lead to earnings volatility and may affect its long-term stability.

Operational Risks and Regulatory Compliance: As a financial institution, Ameriprise Financial faces operational risks, including the potential for system failures, data breaches, and cybersecurity threats. Additionally, the company must navigate a complex regulatory landscape, which can result in increased compliance costs and potential legal challenges. These factors can strain resources and divert attention from core business activities.

Opportunities

Technological Advancements and Digital Transformation: The ongoing digital transformation in the financial services industry presents Ameriprise Financial with opportunities to innovate and enhance its service offerings. By investing in technology and embracing digital channels, the company can improve customer experience, streamline operations, and tap into new market segments. This technological push can also lead to cost savings and increased operational efficiency.

Demographic Shifts and Growing Wealth Management Demand: Demographic trends, such as an aging population and increasing wealth accumulation, are driving demand for wealth management and financial planning services. Ameriprise Financial can capitalize on these trends by expanding its offerings and tailoring services to meet the evolving needs of its clients. This approach can help the company attract new customers and deepen existing relationships.

Threats

Competitive Pressure and Industry Consolidation: The financial services industry is highly competitive, with firms vying for market share and client assets. Industry consolidation and the emergence of fintech startups are intensifying competition, potentially eroding Ameriprise Financial's market position. The company must continuously innovate and adapt to maintain its competitive advantage and prevent client attrition.

Economic Downturns and Regulatory Changes: Economic downturns can adversely affect investment performance and client asset values, leading to reduced revenues for Ameriprise Financial. Additionally, changes in financial regulations can impose new constraints and increase compliance costs. The company must remain agile and proactive in managing these risks to sustain its growth trajectory.

In conclusion, Ameriprise Financial Inc (NYSE:AMP) exhibits a strong financial foundation, bolstered by its focus on asset and wealth management. However, it must navigate market sensitivities and operational risks while seizing opportunities for technological innovation and demographic-driven demand. The company's ability to adapt to competitive pressures and economic uncertainties will be crucial in maintaining its industry leadership and driving future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance