Discovering 3 Leading Japanese Dividend Stocks With Yields Up To 3.5%

Despite a backdrop of economic challenges and a modest uptick in bond yields, Japanese equities showed resilience last week, with the Nikkei 225 Index climbing by 1.5%. In such an environment, identifying robust dividend stocks can provide investors with potential stability and yield opportunities amidst market fluctuations.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Mitsubishi Shokuhin (TSE:7451) | 3.46% | ★★★★★★ |

Yamato Kogyo (TSE:5444) | 3.43% | ★★★★★★ |

Globeride (TSE:7990) | 3.49% | ★★★★★★ |

Nihon Parkerizing (TSE:4095) | 3.37% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.49% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.45% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.43% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.83% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.37% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

Click here to see the full list of 351 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

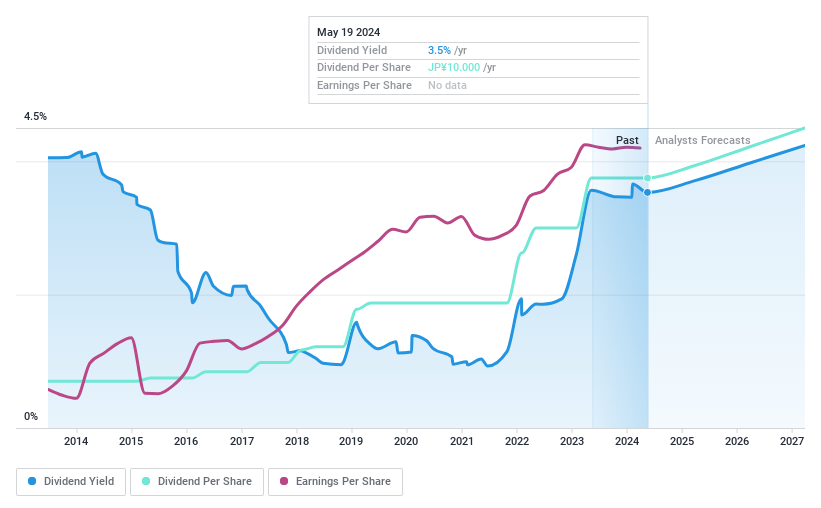

Systena

Simply Wall St Dividend Rating: ★★★★★★

Overview: Systena Corporation operates in Japan, focusing on solution and framework design, IT services, business solutions, and cloud businesses with a market capitalization of approximately ¥109.65 billion.

Operations: Systena Corporation's revenue is generated from its involvement in solution and framework design, IT services, business solutions, and cloud services within Japan.

Dividend Yield: 3.5%

Systena Corporation, trading at 38.4% below estimated fair value, offers a solid dividend yield of 3.53%, ranking in the top 25% of Japanese market payers. Over the past decade, dividends have shown consistent growth and stability, supported by a payout ratio of 69.4% and a cash payout ratio of 44.6%. Recent actions include a share repurchase program announced on May 13, 2024, planning to buy back ¥10 billion worth of shares to enhance shareholder returns.

Click to explore a detailed breakdown of our findings in Systena's dividend report.

The valuation report we've compiled suggests that Systena's current price could be quite moderate.

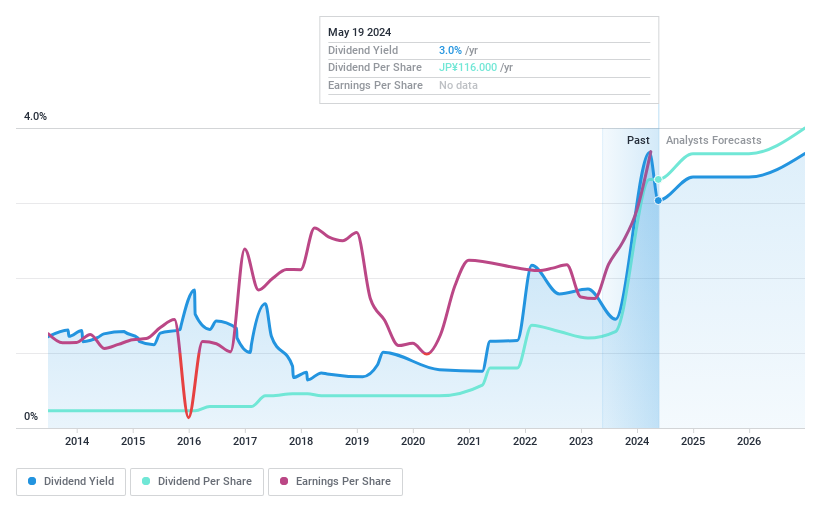

Noritsu Koki

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Noritsu Koki Co., Ltd. is a Japanese company that manufactures and sells audio equipment and peripheral products, with a market capitalization of approximately ¥136.49 billion.

Operations: Noritsu Koki Co., Ltd. primarily generates its revenue from the production and sale of audio equipment and related peripherals in Japan.

Dividend Yield: 3%

Noritsu Koki, trading at 54.5% below estimated fair value, presents a mixed dividend profile. While the company's dividends are supported by earnings with a payout ratio of 28.6% and cash flows with a cash payout ratio of 76.2%, its dividend history is marked by volatility and unreliability over the past decade. Despite significant earnings growth last year (269.9%), forecasts predict an average annual earnings decline of 5.4% over the next three years, alongside modest revenue growth projections (4.3% per year).

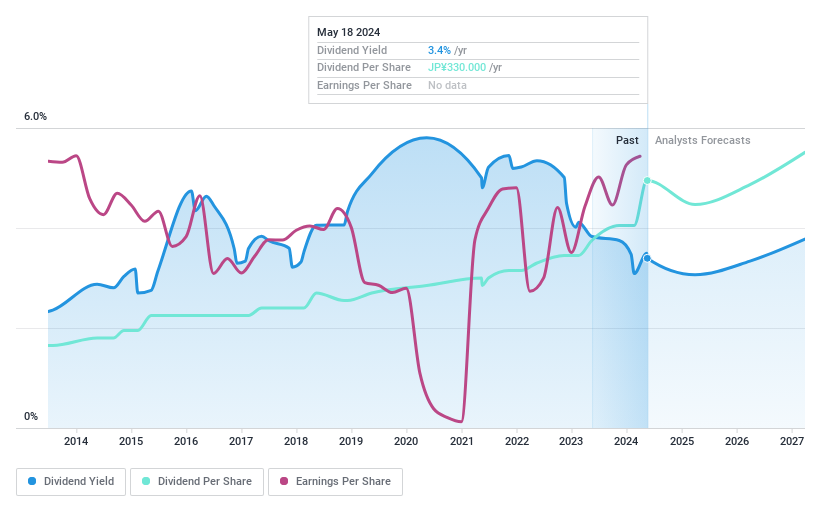

Sumitomo Mitsui Financial Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Mitsui Financial Group, Inc. operates a diversified financial services business offering banking, leasing, securities, credit card, and consumer finance services across regions including Japan, the Americas, Europe, the Middle East, Asia, and Oceania; it has a market capitalization of approximately ¥12.78 trillion.

Operations: Sumitomo Mitsui Financial Group, Inc. generates revenue through its Global Business Unit (¥1.38 billion), Market Business Unit (¥0.53 billion), Retail Business Unit (¥1.29 billion), and Wholesale Business Sector (¥0.84 billion).

Dividend Yield: 3.4%

Sumitomo Mitsui Financial Group has announced a share repurchase program and a stock split, signaling potential shareholder value enhancement. The company recently reported a 19.5% earnings growth and an increase in dividends from JPY 125 to JPY 135 per share, with future dividends expected at JPY 165. Trading at 26.2% below estimated fair value and with a stable dividend history over the past decade, Sumitomo Mitsui offers an attractive yield of 3.39%, well-covered by earnings with a payout ratio of 37.3%.

Dive into the specifics of Sumitomo Mitsui Financial Group here with our thorough dividend report.

Our valuation report here indicates Sumitomo Mitsui Financial Group may be undervalued.

Next Steps

Click this link to deep-dive into the 351 companies within our Top Dividend Stocks screener.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2317 TSE:7744 and TSE:8316.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance