Dunelm Group And Two More Top Dividend Stocks To Consider

As the FTSE 100 navigates cautiously ahead of upcoming UK inflation data, and global markets show mixed responses to varied economic signals, investors are keenly observing the landscape for stable investment opportunities. In such a market environment, dividend stocks like Dunelm Group offer potential as resilient income-generating assets.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.79% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.35% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.31% | ★★★★★☆ |

DCC (LSE:DCC) | 3.35% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.82% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.67% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 5.73% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.70% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.62% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.86% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

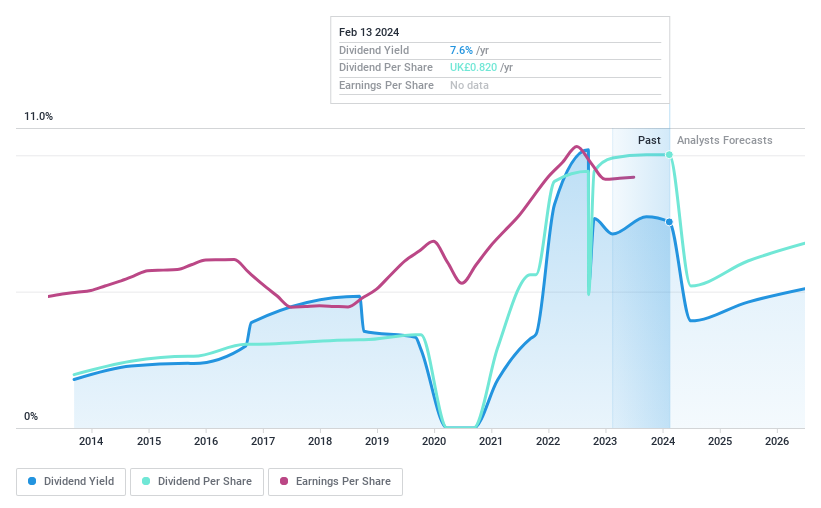

Dunelm Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a retailer specializing in homewares across the United Kingdom, with a market capitalization of approximately £2.16 billion.

Operations: Dunelm Group plc generates its revenue primarily through the sale of homewares, totaling £1.68 billion.

Dividend Yield: 7.3%

Dunelm Group's dividend history is marked by inconsistency, with volatile payments over the past decade. Despite this, its dividends are supported by a reasonable payout ratio of 58.1% and a cash payout ratio of 74.8%, suggesting that earnings and cash flows sufficiently cover the distributions. The stock's dividend yield stands at 7.31%, placing it in the top quartile of UK dividend payers. Additionally, Dunelm is currently valued at 36% below what is estimated to be its fair value, potentially offering an attractive entry point for investors focused on income generation combined with capital appreciation opportunities.

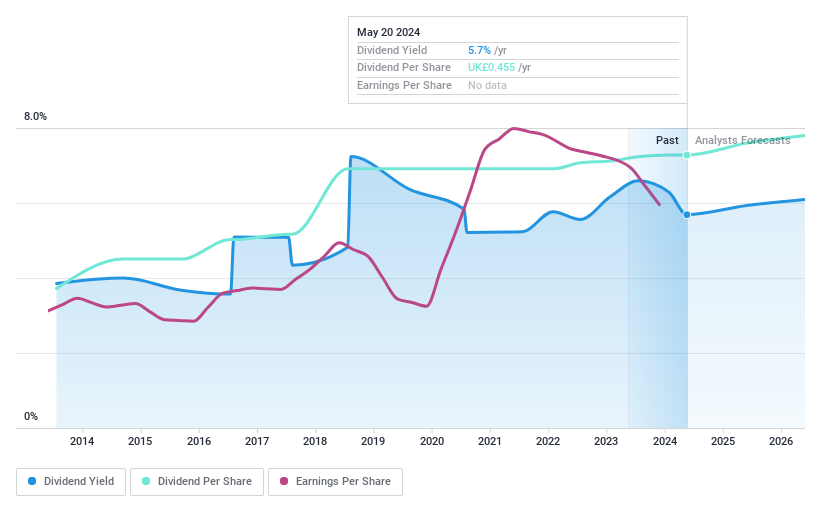

IG Group Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company specializing in online trading globally, with a market capitalization of approximately £2.98 billion.

Operations: IG Group Holdings generates approximately £954.70 million in revenue from its brokerage services.

Dividend Yield: 5.7%

IG Group Holdings offers a dividend yield of 5.69%, ranking in the top 25% of UK dividend payers. Despite a decade of stable and growing dividends, its payout is challenged by a high cash payout ratio of 153.2% and earnings coverage at 61.1%. The stock trades at a significant discount, valued at 55.8% below estimated fair value, suggesting potential for capital appreciation. Recent executive changes could signal strategic shifts; CFO Charlie Rozes will step down by July 2024, amidst modest revenue growth reported in Q3 (£240.1 million).

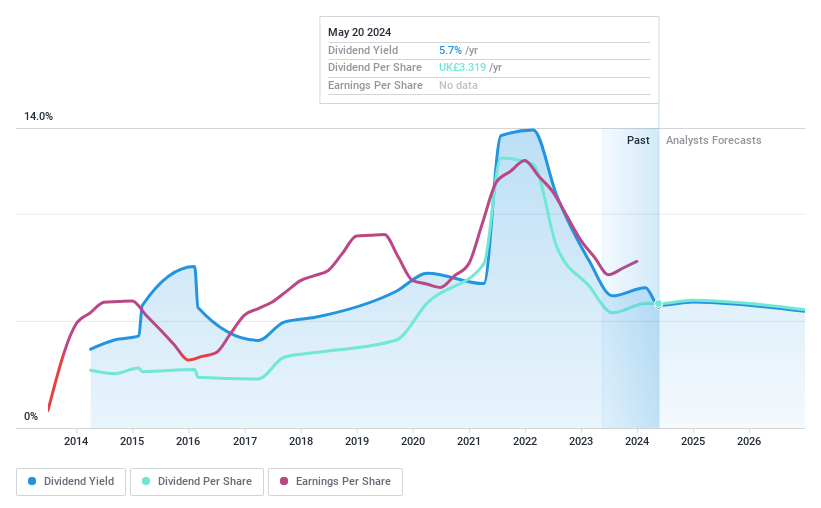

Rio Tinto Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rio Tinto Group is a global mining company that focuses on the exploration, mining, and processing of mineral resources, with a market capitalization of approximately £99.02 billion.

Operations: Rio Tinto Group generates its revenue primarily from four key segments: Iron Ore at $32.25 billion, Aluminium at $12.29 billion, Copper at $6.68 billion, and Minerals at $5.93 billion.

Dividend Yield: 5.7%

Rio Tinto Group's dividend profile presents a mixed scenario with a yield of 5.73%, placing it among the top UK dividend payers. However, its dividends have shown volatility over the past decade, despite recent increases. The dividends are reasonably covered by earnings and cash flows, with payout ratios of 70.1% and 84.8% respectively, suggesting sustainability from current income and operations. Recent executive changes and strategic presentations suggest ongoing adjustments in leadership and market positioning that could impact future performance.

Unlock comprehensive insights into our analysis of Rio Tinto Group stock in this dividend report.

Our valuation report here indicates Rio Tinto Group may be undervalued.

Taking Advantage

Access the full spectrum of 53 Top Dividend Stocks by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:DNLM LSE:IGG and LSE:RIO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance