Element's (ESI) Q1 Earnings Surpass Estimates, Revenues Lag

Element Solutions Inc. ESI recorded earnings of 23 cents per share in first-quarter 2024 compared with earnings of 18 cents in the year-ago quarter.

Barring one-time items, earnings came in at 34 cents per share. It beat the Zacks Consensus Estimate of 32 cents.

The company generated net sales of $575 million, flat year over year. The figure missed the Zacks Consensus Estimate of $601.8 million. Organic net sales rose 1%.

The company saw a recovery in electronics markets in the reported quarter. Its investment in high-value technologies drove favorable mix while the carryover of its pricing actions amid deflating raw materials prices led to higher margins in the industrial business.

ESI also delivered adjusted EBITDA growth of 13% on a year-over-year basis in the quarter.

Element Solutions Inc. Price, Consensus and EPS Surprise

Element Solutions Inc. price-consensus-eps-surprise-chart | Element Solutions Inc. Quote

Segment Highlights

Net sales in the Electronics segment rose 3% year over year to $349 million in the reported quarter. Organic net sales were up 4% from the previous year's reported figure. The figure fell short of our estimate of $368.1 million.

In the Industrial & Specialty segment, net sales declined 4% year over year to $226 million, with organic net sales dropping 3%. The figure was below our estimate of $250.5 million.

Financial Position

Element Solutions ended the quarter with cash and cash equivalents of $286.3 million, down around 1% from the prior quarter. Long-term debt was $1,918.9 million at the end of the quarter, flat sequentially.

Cash from operating activities was $58 million while free cash flow was $39 million for the reported quarter.

Outlook

ESI now expects adjusted EBITDA in the range of $515-$530 million for 2024. For second-quarter 2024, it sees adjusted EBITDA to be around $125 million.

The company anticipates generating a free cash flow in the range of $280-$300 million for 2024.

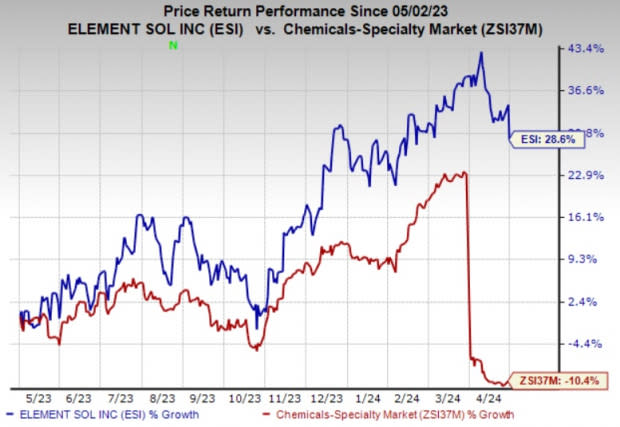

Price Performance

Shares of Element Solutions have gained 28.6% in a year compared with a 10.4% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ESI currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth a look in the basic materials space include Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy), and L.B. Foster Company FSTR and American Vanguard Corporation AVD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The consensus estimate for GFI’s first-quarter earnings has been stable in the past 60 days.

L.B. Foster is slated to report first-quarter results on May 7. The consensus estimate for FSTR’s first-quarter earnings is pegged at a loss of 16 cents per share. The company’s shares have rallied 114.7% in the past year.

American Vanguard is expected to report first-quarter results on May 14. The consensus estimate for AVD’ first-quarter earnings is pegged at 8 cents per share, indicating a year-over-year rise of 14.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance