Europa Oil & Gas (Holdings) plc (LON:EOG) Stocks Shoot Up 40% But Its P/S Still Looks Reasonable

Europa Oil & Gas (Holdings) plc (LON:EOG) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

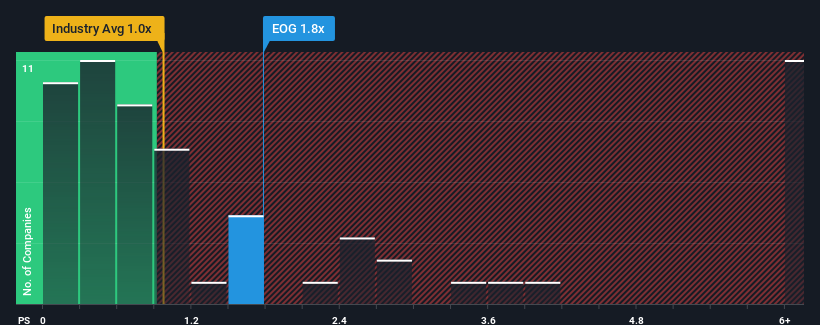

After such a large jump in price, when almost half of the companies in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1x, you may consider Europa Oil & Gas (Holdings) as a stock probably not worth researching with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Europa Oil & Gas (Holdings)

How Europa Oil & Gas (Holdings) Has Been Performing

Recent times have been quite advantageous for Europa Oil & Gas (Holdings) as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Europa Oil & Gas (Holdings)'s earnings, revenue and cash flow.

Is There Enough Revenue Growth Forecasted For Europa Oil & Gas (Holdings)?

The only time you'd be truly comfortable seeing a P/S as high as Europa Oil & Gas (Holdings)'s is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 165% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 10% shows it's a great look while it lasts.

With this in mind, it's clear to us why Europa Oil & Gas (Holdings)'s P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Key Takeaway

Europa Oil & Gas (Holdings)'s P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As detailed previously, the strength of Europa Oil & Gas (Holdings)'s recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Europa Oil & Gas (Holdings), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance