Eversource Energy (ES) Q1 2024 Earnings: Outperforms Analyst Projections

Reported Earnings Per Share (EPS): $1.49 for Q1 2024, up from $1.41 in Q1 2023, above estimates of $1.46.

Net Income: $521.8 million in Q1 2024, up from $491.2 million in Q1 2023, above the estimated $519.39 million.

Electric Transmission Segment Earnings: Increased to $176.7 million in Q1 2024 from $155.1 million in Q1 2023.

Natural Gas Distribution Segment Earnings: Rose to $190.6 million in Q1 2024 from $170.3 million in Q1 2023.

Water Distribution Segment Earnings: Improved to $5.4 million in Q1 2024 from $1.5 million in Q1 2023.

Dividend Announcement: Common dividend of $0.715 per share, payable on June 28, 2024.

2024 Earnings Projection: Reaffirmed non-GAAP EPS guidance of $4.50 to $4.67, with a compound annual growth rate of 5 to 7% from a 2023 base.

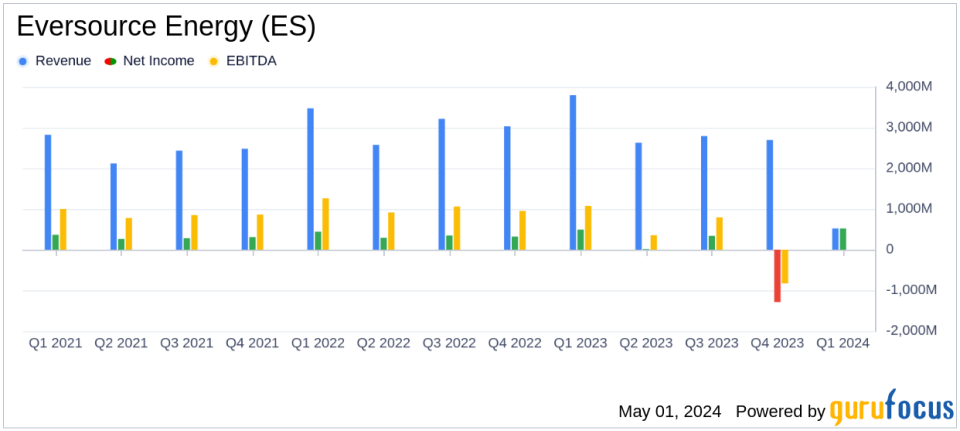

On May 1, 2024, Eversource Energy (NYSE:ES) announced its first-quarter financial results, revealing earnings that surpassed analyst expectations. The company reported a net income of $521.8 million, or $1.49 per share, for the first quarter of 2024, an increase from $491.2 million, or $1.41 per share, in the same period last year. This performance exceeded the estimated earnings per share of $1.46 and net income of $519.39 million forecasted by analysts. Eversource Energy also confirmed its commitment to a dividend of $0.715 per share, payable on June 28, 2024. For more details, you can view the full 8-K filing.

Eversource Energy, a diversified holding company, operates the largest energy delivery system in New England, serving over 4.4 million customers across multiple states. The company has recently focused on expanding its capabilities in renewable energy, notably with the operational launch of the South Fork Wind farm, a milestone as the first commercial-scale offshore wind facility in the U.S.

Segment Performance Highlights

The company's financial uplift was supported by significant growth across its major segments:

Electric Transmission: Earned $176.7 million, up from $155.1 million in Q1 2023, driven by increased investments in the transmission system to support regional energy needs and clean energy integration.

Electric Distribution: Reported earnings of $168.1 million, slightly up from $165.5 million in the previous year, benefiting from rate increases and infrastructure investments in Massachusetts, though offset by higher expenses.

Natural Gas Distribution: Saw a notable increase to $190.6 million from $170.3 million, attributed to rate increases and reduced operational costs.

Water Distribution: Improved to $5.4 million from $1.5 million, aided by acquisitions and lower depreciation, though challenged by increased expenses.

The company's consolidated earnings reflect a strategic focus on enhancing infrastructure and service reliability, alongside managing operational costs effectively. Eversource Energy's reaffirmation of its 2024 earnings projection between $4.50 and $4.67 per share aligns with its ongoing investments and operational strategies aimed at sustainable growth.

Strategic Developments and Forward Outlook

CEO Joe Nolan highlighted the operational success of the South Fork Wind farm and progress in divesting from certain offshore wind projects, aligning with Eversource's strategic shift towards optimizing its energy portfolio. The company continues to project a compound annual growth rate of 5 to 7 percent, underpinned by a robust $23.1 billion capital investment plan aimed at enhancing system resilience and transitioning towards cleaner energy solutions.

As Eversource Energy moves forward in 2024, its strategic initiatives appear well-positioned to support sustained growth and shareholder value, leveraging both operational excellence and strategic market positioning in the renewable sector.

For detailed financial analysis and future updates on Eversource Energy, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Eversource Energy for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance