Exploring ASX Growth Companies With High Insider Ownership: Emerald Resources Leads The Pack

Amidst a mixed performance in the Australian market, with sectors like IT and materials showing gains while communications and healthcare face declines, investors continue to navigate through these varied sectoral movements. In this context, understanding the importance of high insider ownership can offer valuable insights into growth companies on the ASX, potentially providing a layer of investor confidence during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

DUG Technology (ASX:DUG) | 28.3% | 43.3% |

Plenti Group (ASX:PLT) | 12.6% | 68.5% |

Let's dive into some prime choices out of from the screener.

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.54 billion.

Operations: The company generates revenue primarily from mine operations, totaling A$339.32 million.

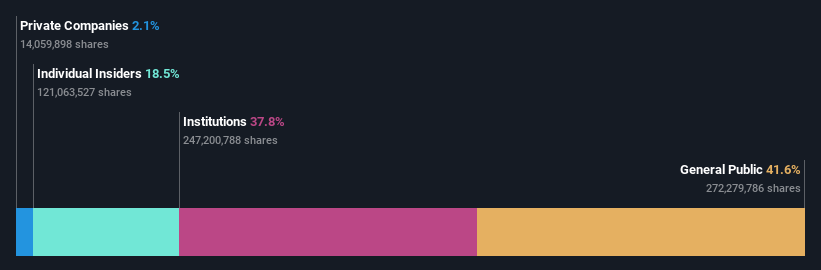

Insider Ownership: 18.5%

Emerald Resources, with substantial insider ownership, reported a significant increase in sales and net income for the half year ended December 31, 2023. Despite trading at a considerable discount to its estimated fair value, concerns include shareholder dilution over the past year. The company's revenue is expected to grow faster than the Australian market average, yet its forecasted Return on Equity is considered low for the coming years. Overall earnings are projected to grow significantly.

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited is a mining services company based in Australia, with operations extending to Asia and globally, boasting a market cap of approximately A$15.46 billion.

Operations: The company generates revenue primarily from three segments: lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

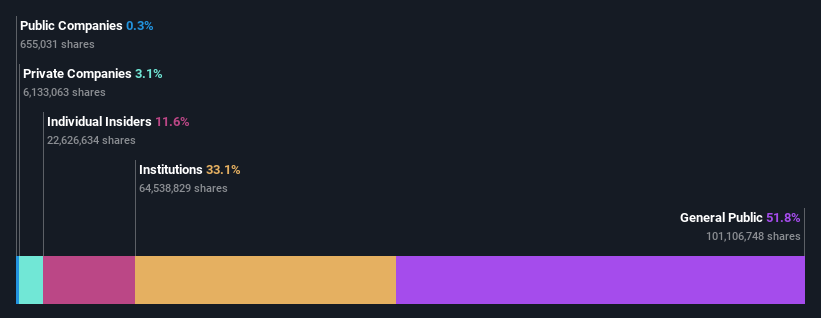

Insider Ownership: 11.6%

Mineral Resources, characterized by high insider ownership, is trading at 28.2% below its estimated fair value, signaling potential undervaluation. The company's earnings are expected to grow significantly at 29.19% annually, outpacing the Australian market forecast of 13.7%. However, challenges include a profit margin drop to 7.9% from last year's 16.3%, and earnings not sufficiently covering interest payments, indicating financial strain despite robust revenue and earnings growth forecasts.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of approximately A$5.45 billion.

Operations: The company generates its revenue from the development, marketing, sale, implementation, and support of integrated enterprise business software solutions across both domestic and international markets.

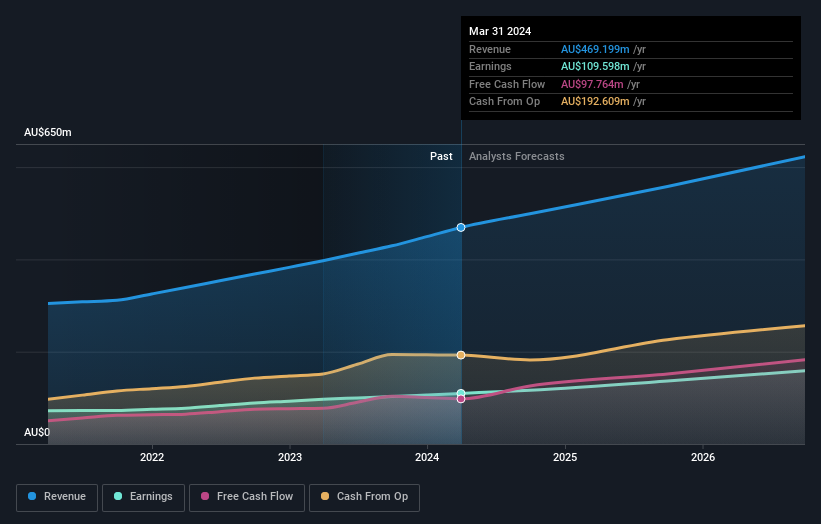

Insider Ownership: 12.3%

Technology One Limited, with high insider ownership, reported a revenue increase to A$240.83 million and net income to A$48 million for the first half of 2024. Earnings per share also rose from A$0.1273 to A$0.1475. The company's earnings are expected to grow by 13.94% annually, outperforming the Australian market forecast of 13.7%. Despite these positives, Technology One's revenue growth forecast of 11.2% yearly is robust but not exceptional, and its price-to-earnings ratio stands at 49.8x, below the industry average of 60.7x.

Unlock comprehensive insights into our analysis of Technology One stock in this growth report.

Our expertly prepared valuation report Technology One implies its share price may be too high.

Key Takeaways

Gain an insight into the universe of 90 Fast Growing ASX Companies With High Insider Ownership by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:MINASX:TNE and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance