Exploring Coca-Cola And Two Additional Leading Dividend Stocks

Amid fluctuating sentiments in the United States stock market, investors have recently experienced a mix of relief and caution following the Federal Reserve's decision to maintain interest rates, coupled with ongoing concerns about inflation. In this context, understanding the stability and potential resilience offered by leading dividend stocks like Coca-Cola becomes particularly relevant.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.14% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.01% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.25% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.85% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.84% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.75% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.94% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.79% | ★★★★★☆ |

Citizens & Northern (NasdaqCM:CZNC) | 6.29% | ★★★★★☆ |

Marine Products (NYSE:MPX) | 4.89% | ★★★★★☆ |

Click here to see the full list of 203 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

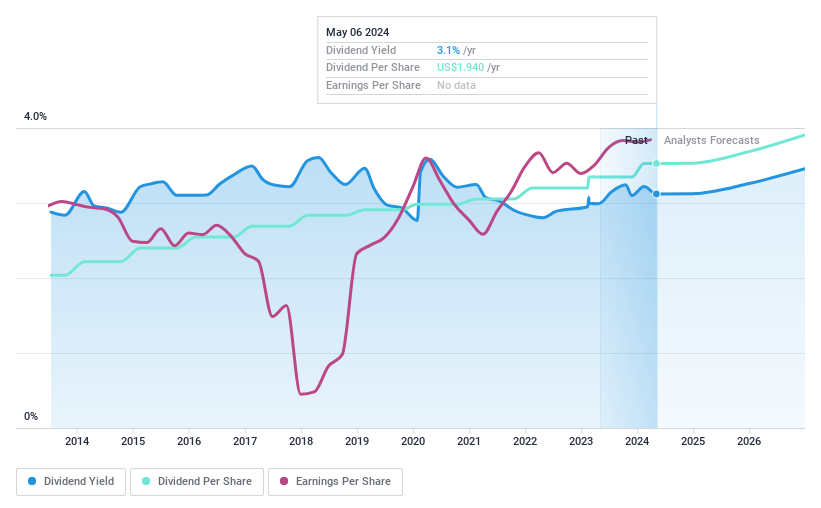

Coca-Cola

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Coca-Cola Company is a global beverage corporation that manufactures, markets, and sells a wide range of nonalcoholic drinks, with a market capitalization of approximately $267.83 billion.

Operations: Coca-Cola's revenue from non-alcoholic beverages totals approximately $46.07 billion.

Dividend Yield: 3.1%

Coca-Cola's dividend profile shows a stable history with a 10-year growth in payments, supported by a reasonable payout ratio of 74.7% and cash payout ratio of 83.4%, ensuring dividends are well-covered by earnings and cash flow. Despite this stability, its yield of 3.12% trails behind the top quartile of U.S. dividend payers at 4.73%. Recent corporate activities include executive changes and reaffirmation of quarterly dividends, maintaining investor confidence in its governance and dividend reliability amidst management transitions.

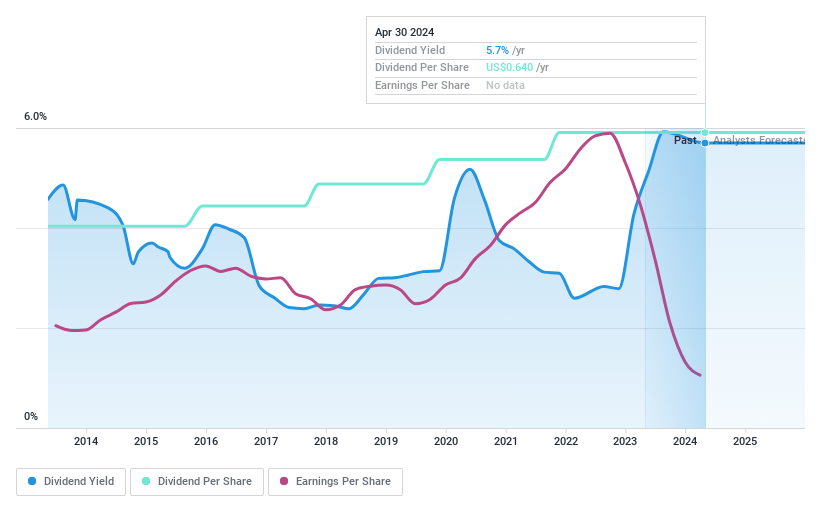

First Guaranty Bancshares

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Guaranty Bancshares, Inc., serving as the holding company for First Guaranty Bank, offers commercial banking services in Louisiana and Texas, with a market capitalization of approximately $142.18 million.

Operations: First Guaranty Bancshares, Inc. generates its revenue primarily through commercial banking operations within Louisiana and Texas.

Dividend Yield: 5.6%

First Guaranty Bancshares has maintained stable dividends over the past decade, with a recent declaration of a US$0.16 per share quarterly dividend, marking its 123rd consecutive payout. Despite this consistency, the company's recent financial performance shows some challenges: net interest income and net income have both decreased in the latest quarter compared to the previous year. Additionally, while its dividend yield of 5.63% ranks well above average in the U.S. market, it is currently not well covered by earnings due to a high payout ratio of 129.6%.

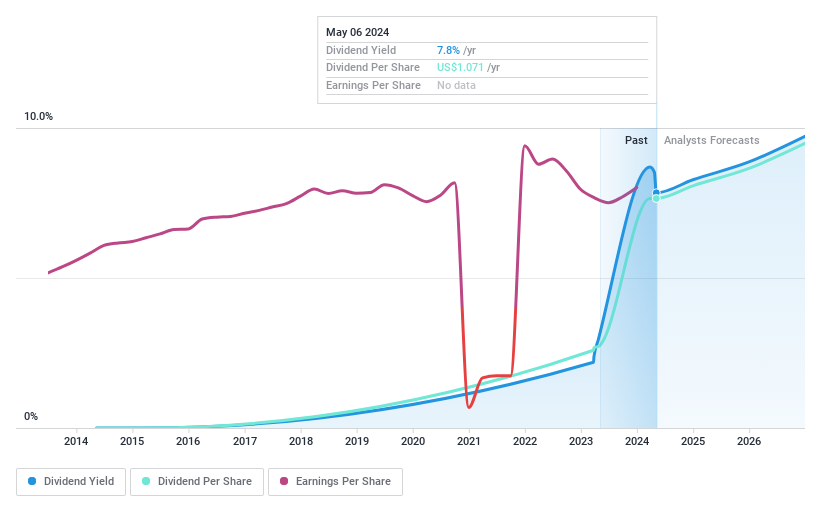

Noah Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Noah Holdings Limited operates as a wealth and asset management service provider, focusing on investment and asset allocation services for high net worth individuals and enterprises in Mainland China, Hong Kong, and internationally, with a market cap of approximately $0.90 billion.

Operations: Noah Holdings Limited generates revenue primarily through its Wealth Management Business, which contributed CN¥2.49 billion, and its Asset Management Business, with revenues of CN¥766.17 million.

Dividend Yield: 7.8%

Noah Holdings Limited, trading at 63.7% below estimated fair value, reported a revenue increase to CNY 3.29 billion and net income of CNY 1.01 billion for FY2023, with earnings per share rising slightly. Despite a recent special dividend proposal of RMB 1.54 per share awaiting shareholder approval on June 12, the company's ordinary dividend remains the same, indicating an unstable dividend track record. However, with a payout ratio of 53.3% and cash payout ratio at 44.1%, dividends are currently well-covered by both earnings and cash flow.

Unlock comprehensive insights into our analysis of Noah Holdings stock in this dividend report.

Our valuation report unveils the possibility Noah Holdings' shares may be trading at a discount.

Next Steps

Embark on your investment journey to our 203 Top Dividend Stocks selection here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:KO NasdaqGM:FGBI and NYSE:NOAH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance