Exploring EPL and Two More Solid Dividend Stocks in India

Amidst a vibrant tapestry of economic activity, India's stock market has recently showcased a blend of resilience and growth, capturing the attention of investors seeking robust opportunities. In this dynamic landscape, dividend-paying stocks like EPL and two others stand out as beacons for those prioritizing steady income streams and potential stability in their investment portfolios.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

EPL (BSE:500135) | 2.23% | ★★★★★★ |

Narmada Gelatines (BSE:526739) | 2.52% | ★★★★★★ |

Vinyl Chemicals (India) (BSE:524129) | 2.54% | ★★★★★★ |

PTC India (NSEI:PTC) | 4.10% | ★★★★★☆ |

Swaraj Engines (NSEI:SWARAJENG) | 3.86% | ★★★★★☆ |

Ruchira Papers (NSEI:RUCHIRA) | 3.93% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 2.87% | ★★★★★☆ |

Sun TV Network (NSEI:SUNTV) | 2.45% | ★★★★★☆ |

Bank of Baroda (NSEI:BANKBARODA) | 2.12% | ★★★★★☆ |

Power Grid Corporation of India (NSEI:POWERGRID) | 4.19% | ★★★★★☆ |

Click here to see the full list results from our Top Dividend Stocks screener.

Let's explore 3 standout options from the 62 results in the screener.

EPL (BSE:500135)

Simply Wall St Dividend Rating: ★★★★★★

Overview: EPL Limited is a company that specializes in the production and distribution of plastic packaging materials, including multi-layer collapsible tubes and laminates, with a market capitalization of approximately ₹61.27 billion.

Operations: EPL Limited generates its revenue primarily from the plastic packaging material segment, which accounted for ₹38.56 billion in sales.

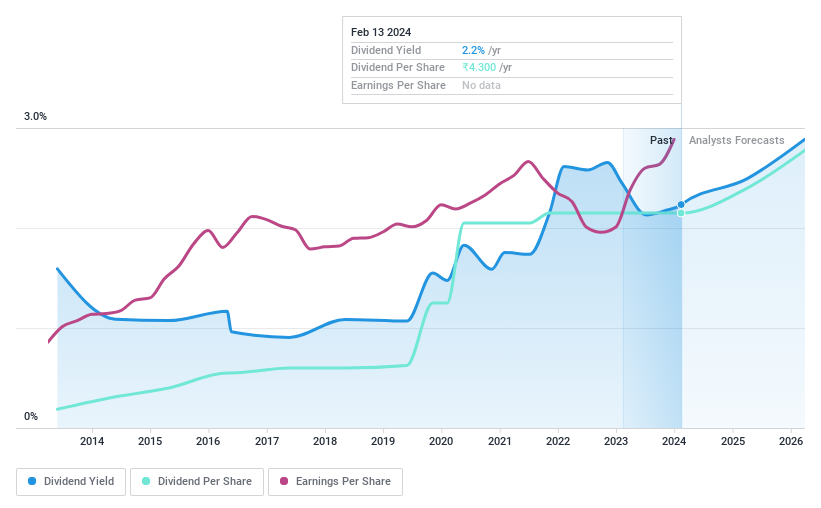

Dividend Yield: 2.2%

EPL Limited, trading under the ticker BSE:500135, presents a compelling case for dividend investors seeking stability and prudent financial management in the Indian market. Over the past decade, EPL has demonstrated a commitment to growing and reliable dividends, supported by a stable payout ratio around 49.7%. This consistency is underpinned by robust fundamentals: debt levels are managed satisfactorily with a net debt to equity ratio of 34.3%, and both earnings and cash flows comfortably cover dividend payments. The company's ability to reduce its debt over time while maintaining healthy profit margins—now at 7.1% up from last year's 5.3%—and an accelerated earnings growth in the recent year bodes well for sustainability. Although not top-tier in terms of yield, EPL's dividend yield stands above average in the Indian context at 2.23%, with expectations of significant earnings growth over the next three years adding to its appeal as a balanced choice for income-focused portfolios. Unlock comprehensive insights into our analysis of EPL stock in this dividend report.

ITC (NSEI:ITC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITC Limited is a diversified conglomerate with operations spanning across fast-moving consumer goods, hospitality, paperboards and paper, packaging, agriculture, and information technology sectors in India and abroad, boasting a market capitalization of approximately ₹5.08 trillion.

Operations: ITC Limited's revenue streams are primarily divided into its fast-moving consumer goods (excluding cigarettes) at ₹206.45 billion, cigarettes at ₹330.61 billion, agribusiness at ₹165.95 billion, paperboards and paper & packaging segment at ₹84.93 billion, and the hotel business contributing ₹29.81 billion.

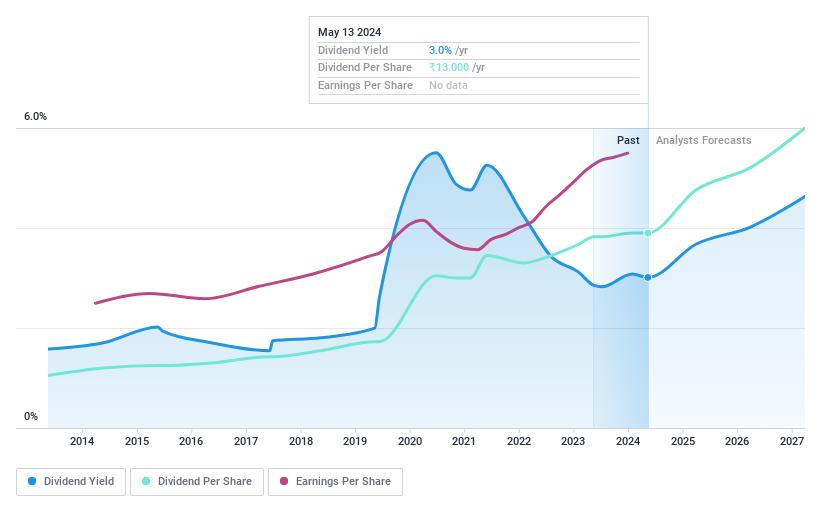

Dividend Yield: 3.2%

ITC, listed on the NSE, is a notable player in India's dividend stock arena, with a history of escalating dividend payments over the past decade. The company has managed to increase its earnings by an average of 9.7% annually over five years, outpacing this rate in the last year. Its robust net profit margin improvement and debt comfortably covered by operating cash flow indicate financial health; however, there's caution due to a high cash payout ratio exceeding free cash flows. ITC's current payout ratio suggests dividends are supported by earnings but raises questions about long-term sustainability without relying on existing cash reserves or future earnings growth which is expected but not at an aggressive pace. Click here and access our complete dividend analysis report to understand the dynamics of ITC.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Swaraj Engines Limited is an Indian company engaged in the manufacturing and sale of diesel engines, engine components, and spare parts primarily for tractors, with a market capitalization of approximately ₹28.97 billion.

Operations: Swaraj Engines Limited generates its revenue primarily through the sale of diesel engines and related components, amassing over ₹14.28 billion in this segment.

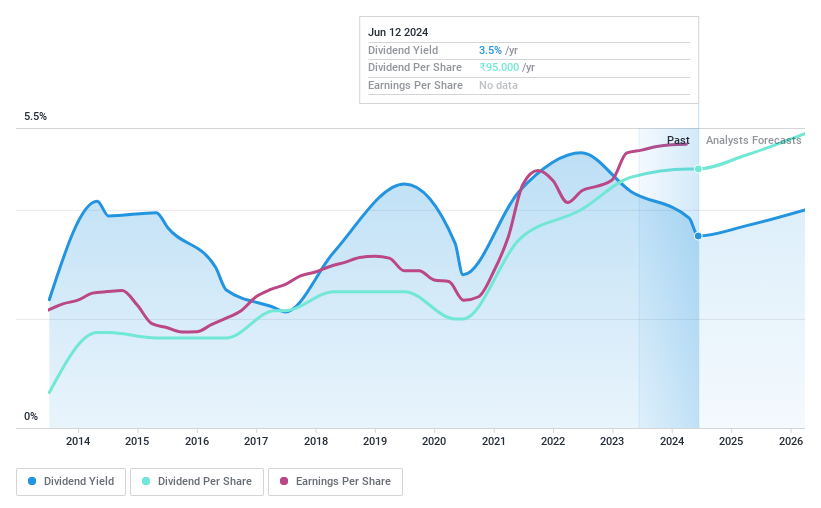

Dividend Yield: 3.9%

Swaraj Engines stands as a resilient contender in the Indian dividend stock landscape, showcasing a decade of rising dividend payments complemented by steady earnings growth of 14.9% annually over five years. The company's minimal debt increase and robust profit margins, which have improved to 9.6%, reflect a healthy financial state. With dividends well-covered by both earnings and cash flows, sustainability appears manageable despite some volatility in its dividend history. However, investors should note the less than significant forecast for profit growth and the modest increase in revenue expected, tempering expectations for future expansion. Navigate through the intricacies of Swaraj Engines with our comprehensive dividend report here.

In Summary

The Simply Wall St screener has been instrumental in pinpointing a selection of Indian dividend stocks that stand out for their potential. Dive into all 62 of the Top Dividend Stocks we have identified here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance