Exploring Three Premier Dividend Stocks In India

The Indian stock market has experienced a slight decline of 1.5% over the last week, yet it boasts an impressive growth of 41% over the past year with earnings expected to grow by 17% annually. In such a dynamic environment, dividend stocks that offer consistent payouts can be particularly appealing for investors seeking both stability and growth potential.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Bhansali Engineering Polymers (BSE:500052) | 4.13% | ★★★★★★ |

Castrol India (BSE:500870) | 3.85% | ★★★★★☆ |

Balmer Lawrie Investments (BSE:532485) | 4.38% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.95% | ★★★★★☆ |

Great Eastern Shipping (BSE:500620) | 3.62% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.58% | ★★★★★☆ |

Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.55% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.84% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.53% | ★★★★★☆ |

Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.64% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

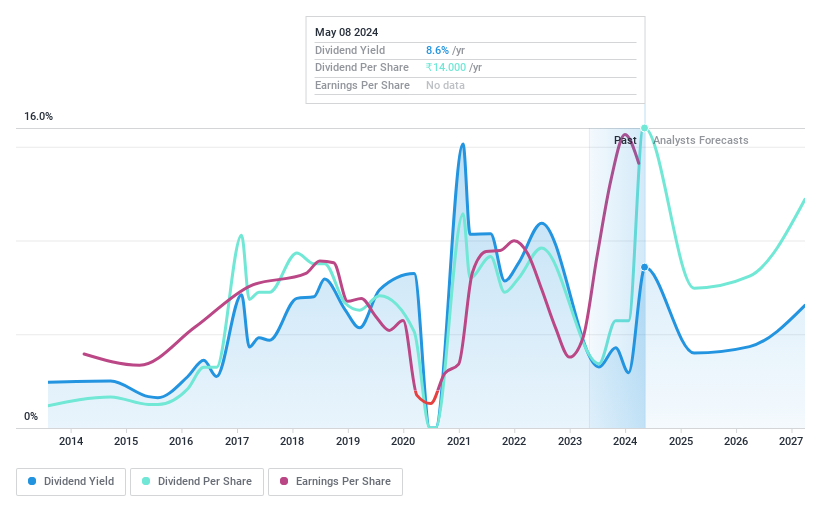

Indian Oil

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited operates in refining, pipeline transportation, and marketing of petroleum products across India, with a market capitalization of approximately ₹2.25 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily from petroleum products (₹83.35 billion) and petrochemicals (₹2.62 billion), along with contributions from other business activities (₹4.02 billion).

Dividend Yield: 8.6%

Indian Oil Corporation Limited recently announced a final dividend of INR 7.00 per share for 2023-2024, reflecting a commitment to shareholder returns despite fluctuating earnings. For FY 2024, the company reported a significant increase in net income to INR 417.30 billion, up from INR 97.92 billion the previous year, although quarterly results showed a decline in net income and revenue compared to the same period last year. The company's dividend history has been mixed with periods of volatility and unreliable growth patterns over the past decade, yet recent dividends are supported by earnings with a payout ratio of 39.6% and cash flows with a cash payout ratio of 56.8%.

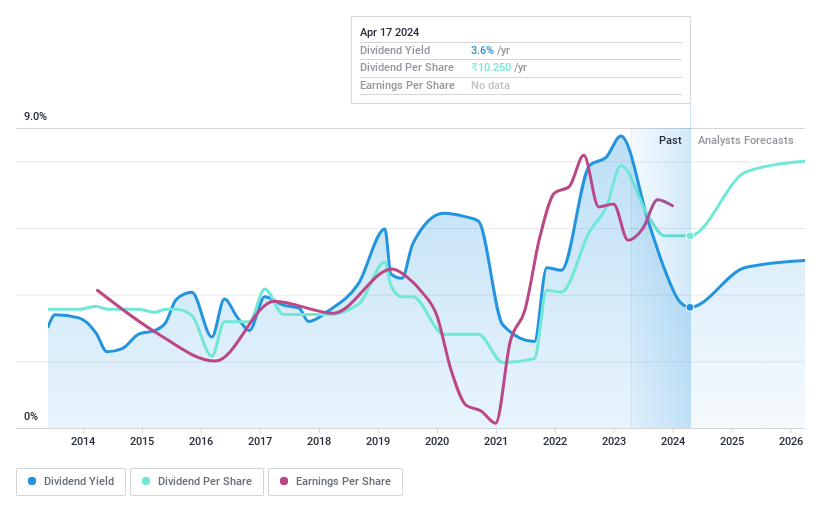

Oil and Natural Gas

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, operating both in India and internationally, focuses on the exploration, development, and production of crude oil and natural gas with a market capitalization of approximately ₹3.48 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through its refining and marketing segment in India, which brought in approximately ₹56.06 billion, with additional contributions from its onshore and offshore exploration and production segments, amounting to about ₹4.44 billion and ₹9.54 billion respectively; the company also earns around ₹0.97 billion from operations outside India.

Dividend Yield: 3.7%

Oil and Natural Gas Corporation (ONGC) has demonstrated a mixed track record in dividend reliability, with payments showing significant volatility over the past decade. Despite this, ONGC's dividends have grown, supported by a sustainable payout ratio of 30.8% and a cash payout ratio of 21.7%. The company's dividend yield stands at 3.7%, ranking in the top quartile of Indian market payers. Recent strategic alliances and business expansions indicate an ongoing commitment to growth and diversification in energy sectors, potentially impacting future financial stability and shareholder returns.

Delve into the full analysis dividend report here for a deeper understanding of Oil and Natural Gas.

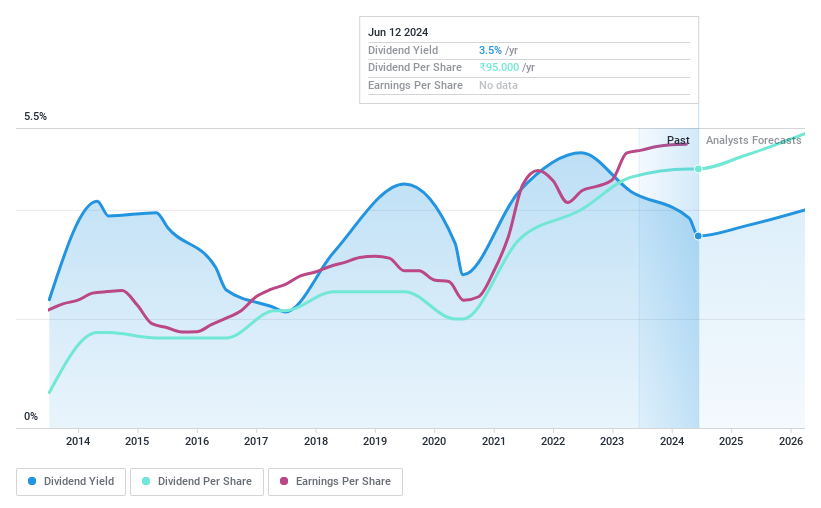

Swaraj Engines

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹29.55 billion.

Operations: Swaraj Engines Limited generates revenue primarily through the sale of diesel engines, engine components, and tractor spare parts, totaling ₹14.19 billion.

Dividend Yield: 3.9%

Swaraj Engines has shown a complex dividend profile, with a high recent announcement of INR 95 per share, reflecting an increase in its commitment to shareholder returns. Despite this, the company's dividend sustainability is questionable due to a cash payout ratio of 122% and earnings coverage concerns. The stock trades at a favorable P/E ratio of 21.4x compared to the broader Indian market. Recent regulatory challenges are not expected to impact financials significantly, maintaining the company's operational focus.

Key Takeaways

Delve into our full catalog of 24 Top Dividend Stocks here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:IOC NSEI:ONGC and NSEI:SWARAJENG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance