Exploring Three UK Growth Companies With High Insider Stakes

As the United Kingdom's markets navigate through a period of anticipation ahead of key inflation data and regulatory discussions, investors remain attuned to shifts within the FTSE 100 and broader economic indicators. In such a climate, exploring growth companies with high insider ownership may offer valuable insights, particularly as these firms often demonstrate a strong alignment between management’s interests and those of their shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 50.8% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Energean (LSE:ENOG) | 10.7% | 21.7% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

We're going to check out a few of the best picks from our screener tool.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc operates in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.89 billion.

Operations: Hochschild Mining's revenue is primarily generated from its operations at Inmaculada, contributing $396.64 million, followed by San Jose with $242.46 million, and Pallancata adding $54.05 million.

Insider Ownership: 38.4%

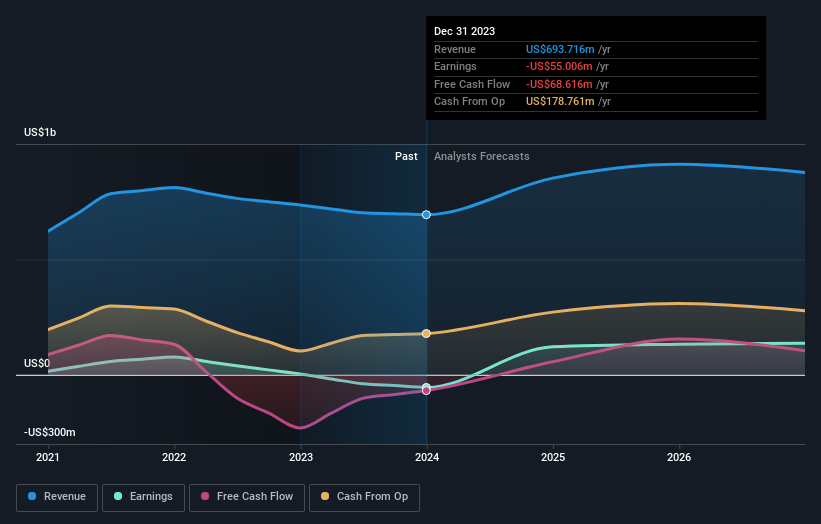

Hochschild Mining, a UK-based growth company with significant insider ownership, is navigating a challenging landscape. Despite a recent net loss of US$55.01 million for the fiscal year 2023, the company is optimistic about its future profitability and revenue growth. With insider buying outpacing selling in recent months, there's confidence from within. Additionally, Hochschild's strategic acquisitions and investments in Latin America indicate a proactive approach to growth, particularly with the promising Mara Rosa project in Brazil expected to bolster production at lower costs.

IWG

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately £2.07 billion.

Operations: The company generates its revenue primarily from the Americas (£1.05 billion), Europe, the Middle East, and Africa (£1.32 billion), Asia Pacific (£273 million), and Worka (£319 million).

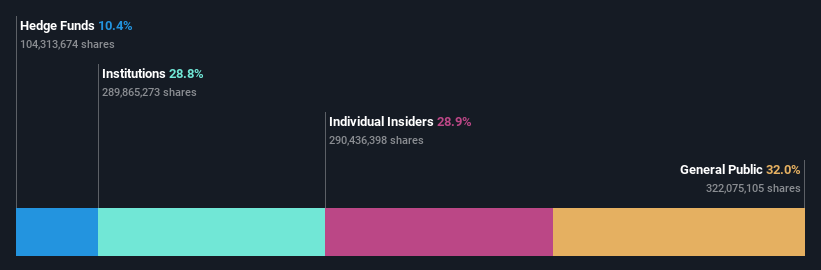

Insider Ownership: 28.9%

IWG, a UK-based company with high insider ownership, reported a slight increase in Q1 2024 revenue to $912 million. Despite this growth, the company faced a significant net loss of £215 million in fiscal year 2023. Looking ahead, IWG's revenue is expected to grow at 7.8% annually, outpacing the UK market forecast of 3.7%. The firm is also anticipated to turn profitable within three years, reflecting an optimistic outlook despite current challenges.

Get an in-depth perspective on IWG's performance by reading our analyst estimates report here.

Upon reviewing our latest valuation report, IWG's share price might be too pessimistic.

Kainos Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc operates as a provider of digital technology services across the UK, Ireland, North America, and Central Europe with a market capitalization of approximately £1.57 billion.

Operations: The company generates revenue through three primary segments: Digital Services at £223.12 million, Workday Products at £50.49 million, and Workday Services at £114.67 million.

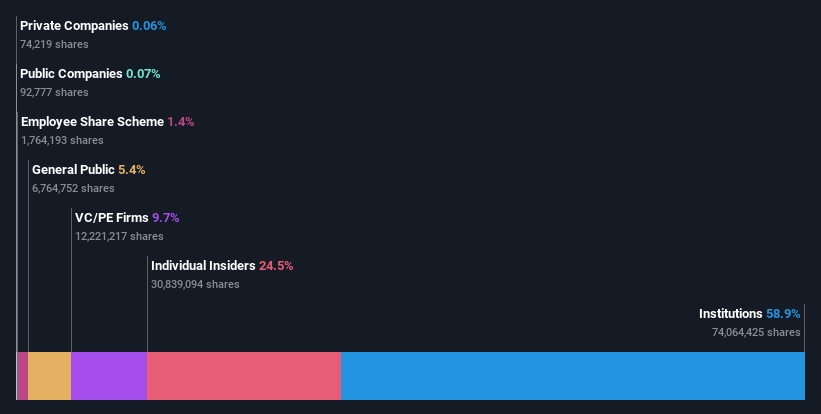

Insider Ownership: 24.5%

Kainos Group, a UK growth company with high insider ownership, recently reported a year-over-year sales increase to £382.39 million and net income growth to £48.72 million. The firm's earnings are expected to grow by 13.9% annually, slightly above the UK market average of 13.4%. Despite upcoming changes in its executive board effective September 2024, Kainos maintains a solid forecast with an anticipated high return on equity of 32.6% in three years, trading at 3.3% below its estimated fair value.

Summing It All Up

Delve into our full catalog of 64 Fast Growing UK Companies With High Insider Ownership here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:HOC LSE:IWG and LSE:KNOS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance