Exploring Top Dividend Stocks In Canada For May 2024

As the Canadian market navigates a landscape of shifting economic indicators and monetary policies, particularly influenced by U.S. inflation trends and Federal Reserve decisions, investors are closely monitoring how these factors impact market stability and investment opportunities. In this context, understanding what constitutes a resilient dividend stock becomes crucial, especially when considering the broader economic uncertainties and their potential effects on corporate earnings and dividend sustainability.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.46% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.13% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.55% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.40% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.78% | ★★★★★☆ |

Power Corporation of Canada (TSX:POW) | 5.32% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.24% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.95% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.96% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.42% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

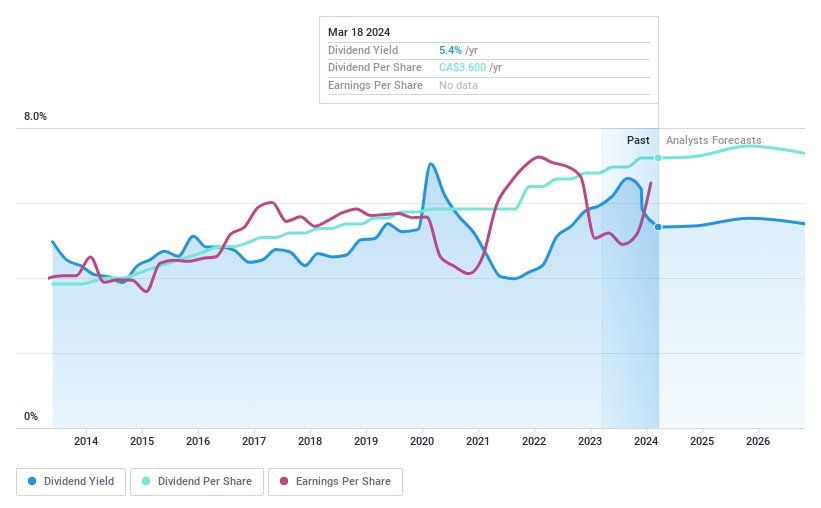

Canadian Imperial Bank of Commerce

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce (TSX:CM) is a diversified financial institution offering a range of financial products and services to various client segments across Canada, the U.S., and other international locations, with a market capitalization of approximately CA$61.76 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue through its key segments: Canadian Personal and Business Banking (CA$8.49 billion), Canadian Commercial Banking and Wealth Management (CA$5.31 billion), U.S. Commercial Banking and Wealth Management (CA$1.67 billion), and Capital Markets (CA$5.53 billion).

Dividend Yield: 5.4%

Canadian Imperial Bank of Commerce recently declared a stable dividend of CA$0.90 per share, maintaining reliability over the past decade with a current yield of 5.39%. The dividends are well-supported by earnings with a payout ratio of 53.4%, expected to remain sustainable at 51.4% in three years. However, its dividend yield is lower than the top quartile in the Canadian market, which averages 6.39%. Recent activities include multiple fixed-income offerings and preferred stock buybacks, reflecting a proactive financial strategy despite being dropped from the S&P/TSX Preferred Share Index earlier this month.

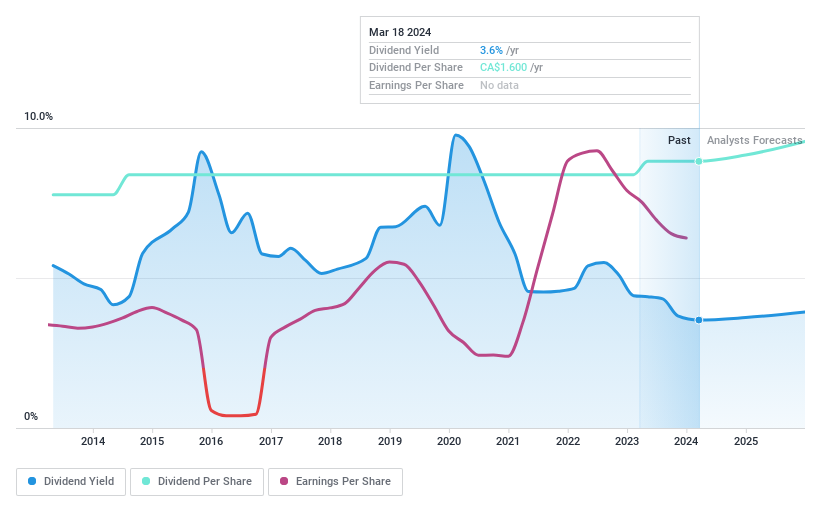

Russel Metals

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company with operations in Canada and the United States, boasting a market capitalization of approximately CA$2.35 billion.

Operations: Russel Metals Inc.'s revenue is primarily generated from three segments: Metals Service Centers with CA$2.95 billion, Energy Field Stores at CA$982.20 million, and Steel Distributors contributing CA$429 million.

Dividend Yield: 4.2%

Russel Metals has consistently increased its dividend over the past decade, ensuring reliability with a current yield of 4.24%. Despite trading below fair value by 5.6%, its dividends are well-covered by earnings and cash flows, with payout ratios of 40.3% and 32.1% respectively. However, its yield falls short of the top quartile in Canada at 6.41%. Recent financials show a dip in Q1 sales and net income, but it remains financially robust with significant cash reserves post-debt redemption.

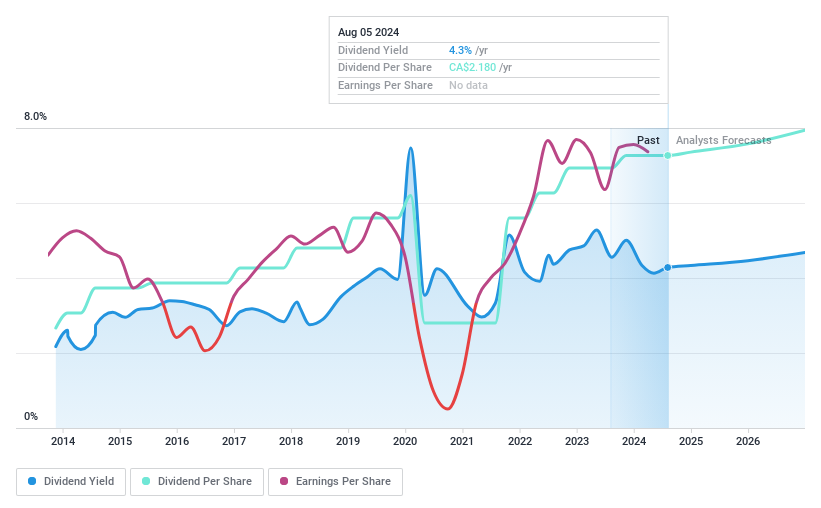

Suncor Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of approximately CA$68.67 billion.

Operations: Suncor Energy Inc. generates its revenue through integrated energy operations across Canada, the United States, and other international locations.

Dividend Yield: 4.1%

Suncor Energy offers a dividend yield of 4.06%, below the top quartile in Canada. Despite this, its dividends are sustainably covered by both earnings and cash flows, with payout ratios at 35.2% and 35.1% respectively, indicating financial prudence. However, the company's dividend history over the past decade has been marked by volatility and inconsistency in growth. Recently reported Q1 results show increased production but a decrease in net income to CAD 1.61 billion from CAD 2.05 billion year-over-year, potentially impacting future dividends.

Navigate through the intricacies of Suncor Energy with our comprehensive dividend report here.

Our valuation report unveils the possibility Suncor Energy's shares may be trading at a discount.

Turning Ideas Into Actions

Explore the 34 names from our Top Dividend Stocks screener here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CM TSX:RUS and TSX:SU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance