Exploring Top Dividend Stocks In Germany For May 2024

As of May 2024, the German market has shown a slight downturn with the DAX index falling by 0.36%, reflecting a cautious stance from investors amidst mixed signals from European Central Bank policymakers regarding future monetary easing. This context sets an interesting stage for investors considering dividend stocks, which traditionally appeal to those looking for potentially steadier returns in uncertain times. In exploring top dividend stocks in Germany, it's crucial to consider companies with robust financial health and a history of consistent dividend payouts, especially in an environment where economic indicators and central bank policies are closely intertwined with market performance.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.16% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.44% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.63% | ★★★★★★ |

MLP (XTRA:MLP) | 4.80% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.50% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.08% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.02% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.82% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.79% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

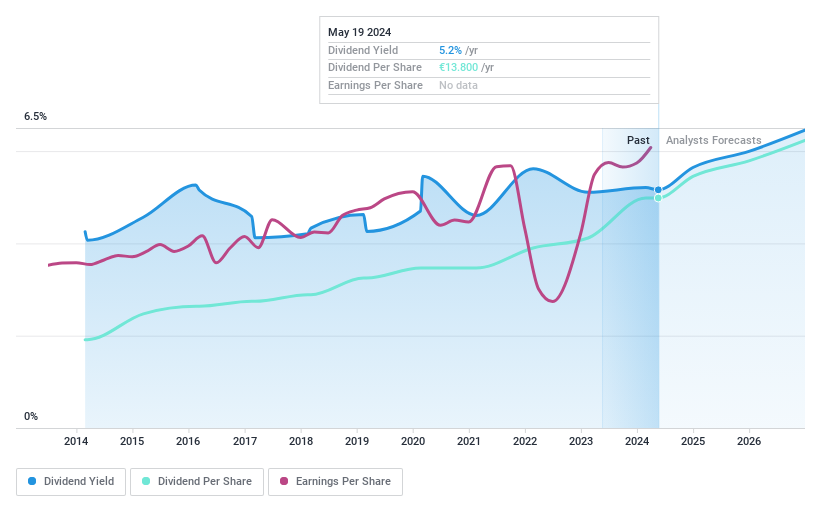

Allianz

Simply Wall St Dividend Rating: ★★★★★★

Overview: Allianz SE operates globally, offering property-casualty insurance, life/health insurance, and asset management services with a market capitalization of approximately €103.78 billion.

Operations: Allianz SE generates revenue through three primary segments: property-casualty insurance (€73.12 billion), life/health insurance (€44.96 billion), and asset management (€3.23 billion).

Dividend Yield: 5.2%

Allianz SE, a stalwart in the German market, recently affirmed its 2024 operating profit target at €14.8 billion and reported a substantial increase in quarterly net income to €2.475 billion from €2.032 billion year-over-year. The company's commitment to shareholder returns is evident with an increased dividend payout ratio and a dividend per share of €13.80 for 2023, marking a significant rise of 21.1% from the previous year. With dividends well-covered by earnings (payout ratio: 65.1%) and cash flows (cash payout ratio: 24%), alongside a consistent track record of dividend growth over the past decade, Allianz balances attractiveness with sustainability in its dividend strategy.

Click here to discover the nuances of Allianz with our detailed analytical dividend report.

Our valuation report unveils the possibility Allianz's shares may be trading at a discount.

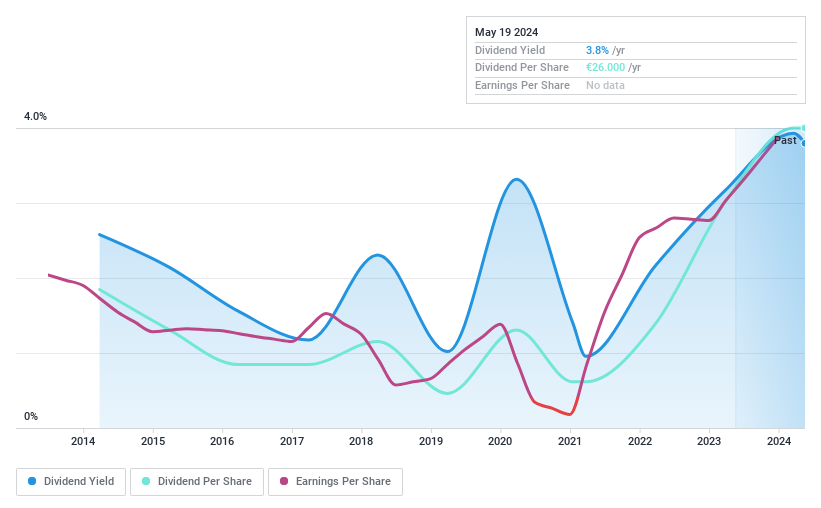

KSB SE KGaA

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA is a global manufacturer and supplier of pumps, valves, and related services with a market capitalization of approximately €1.15 billion.

Operations: KSB SE & Co. KGaA generates its revenue primarily through three segments: pumps (€1.51 billion), valves (€0.36 billion), and KSB Supremeserv (€0.94 billion).

Dividend Yield: 3.8%

KSB SE & Co. KGaA reported a significant increase in earnings for 2023, totaling €152.3 million, up from €103.65 million in the previous year, with sales rising to €2.82 billion. The company maintains a low payout ratio of 29.9%, ensuring dividends are well-covered by earnings and cash flows (cash payout ratio: 26.2%). Despite trading at 72.3% below estimated fair value and showing potential undervaluation relative to peers, KSB's dividend history has been marked by instability over the past decade, reflecting volatility in payments despite recent increases proposed for both ordinary and preference shares at €26 and €26.26 respectively.

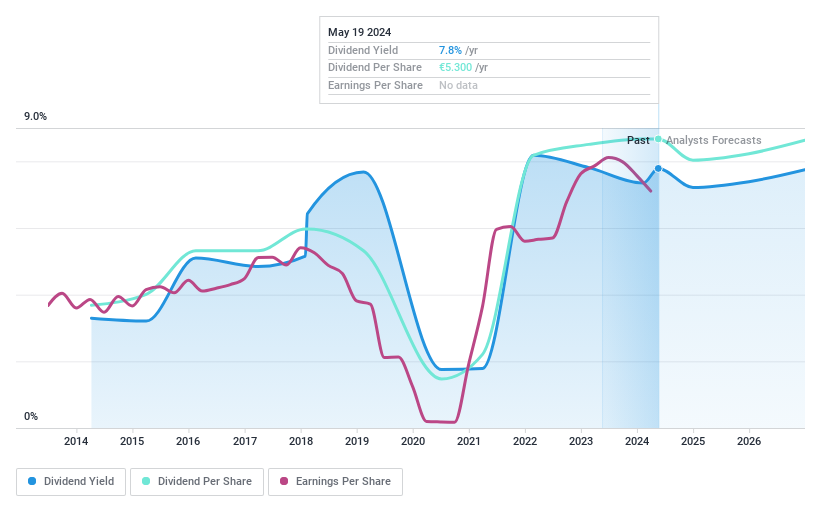

Mercedes-Benz Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercedes-Benz Group AG is a global automotive company based in Germany, with a market capitalization of approximately €69.47 billion.

Operations: Mercedes-Benz Group AG generates revenue through three primary segments: Mercedes-Benz Cars (€110.66 billion), Mercedes-Benz Vans (€20.57 billion), and Mercedes-Benz Mobility (€26.93 billion).

Dividend Yield: 7.8%

Mercedes-Benz Group AG's dividend sustainability is supported by a moderate payout ratio of 41.9%, with dividends well-covered by earnings and cash flows (cash payout ratio: 71.6%). Despite trading at a substantial discount to estimated fair value, the company faces challenges with declining earnings forecasted at -1.4% annually over the next three years and high debt poorly covered by operating cash flow. Recent board changes and consistent dividend increases, including a recent rise to €5.30 per share, highlight strategic shifts and shareholder commitment amidst financial headwinds.

Seize The Opportunity

Delve into our full catalog of 29 Top Dividend Stocks here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St , where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ALV XTRA:KSB and XTRA:MBG .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance