Exploring Top Dividend Stocks In The UK For May 2024

As the FTSE 100 shows signs of upward movement, tracking gains in Asian markets and buoyed by positive global economic indicators, the United Kingdom's financial landscape appears poised for interesting developments. In such a dynamic market environment, dividend stocks continue to attract attention for their potential to offer investors steady income streams amidst fluctuating conditions.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.98% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.33% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.71% | ★★★★★☆ |

DCC (LSE:DCC) | 3.32% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.89% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.67% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 5.74% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.67% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.55% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.84% | ★★★★★☆ |

Click here to see the full list of 52 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

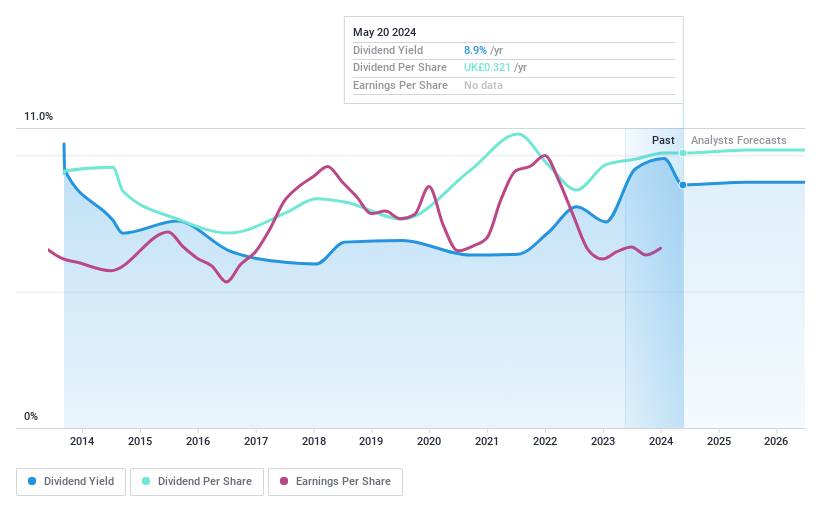

City of London Investment Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market capitalization of approximately £176 million.

Operations: City of London Investment Group PLC generates its revenue primarily from asset management, which accounted for $73.72 million.

Dividend Yield: 8.9%

City of London Investment Group's dividend yield stands at 8.91%, placing it among the top 25% of UK dividend payers. However, its dividends are not well-supported, evidenced by a payout ratio of 112.5% and coverage issues with both earnings and cash flows (cash payout ratio at 89.6%). Despite these challenges, dividends have grown over the past decade, although they've been marked by volatility. Recent affirmations maintain an unchanged interim dividend of £0.11 per share, amidst moderate earnings fluctuations and executive board changes aimed at strengthening governance.

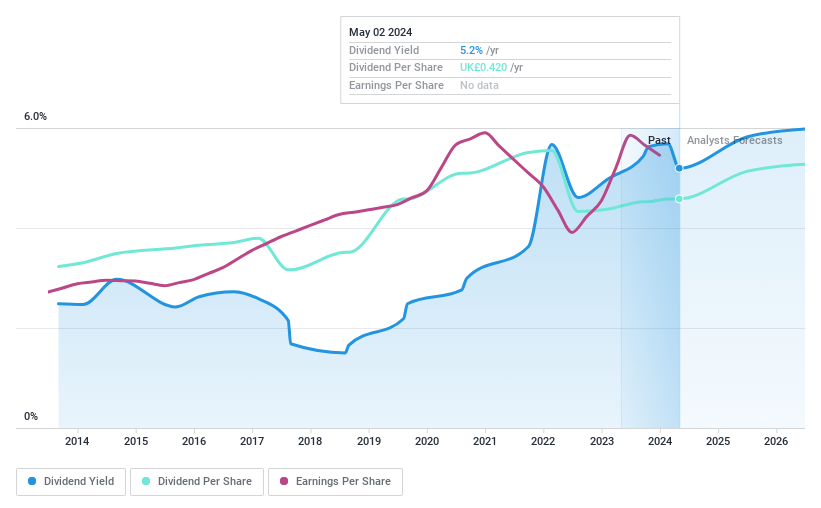

Hargreaves Lansdown

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Lansdown plc is a UK-based company offering investment services to individuals and corporates, with a market capitalization of approximately £4.26 billion.

Operations: Hargreaves Lansdown plc generates revenue primarily through its asset management segment, which brought in £753.30 million.

Dividend Yield: 4.7%

Hargreaves Lansdown reported a slight increase in sales to £368.2 million but a decrease in net income to £135.2 million for the half-year ended December 2023. Despite this, the company raised its interim dividend to £0.132 per share, maintaining a payout ratio of 66%, indicating earnings coverage of dividends. However, with a history of volatile dividends and a dividend yield lower than the top UK payers at 4.67%, its attractiveness as a stable dividend stock may be limited, despite reasonable financial performance and ongoing digital transformations under new executive leadership.

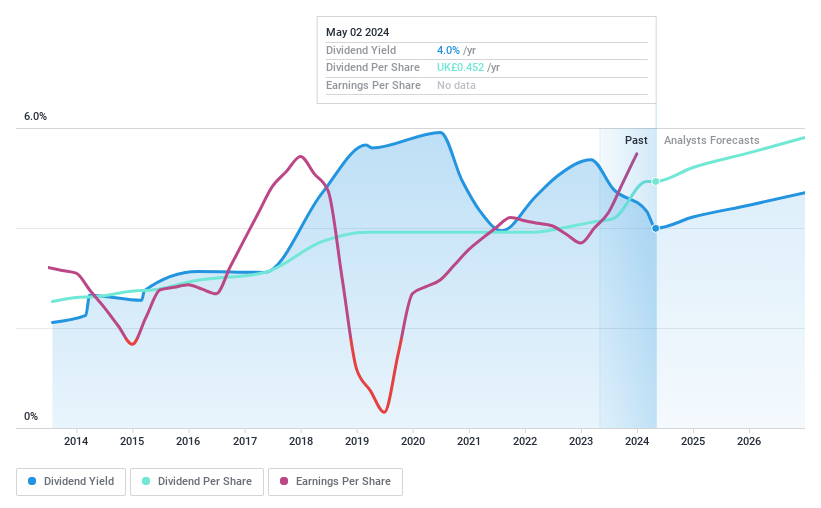

Keller Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc is a specialist in geotechnical services operating across North America, Europe, Asia-Pacific, the Middle East, and Africa, with a market capitalization of approximately £0.99 billion.

Operations: Keller Group plc generates £2.97 billion in revenue from its geotechnical services across various global regions.

Dividend Yield: 3.3%

Keller Group offers a 3.33% dividend yield, which is modest compared to the UK's top dividend payers. The company has maintained stable dividends over the past decade, supported by a payout ratio of 36.8% and cash payout ratio of 32.2%, indicating both earnings and cash flow adequately cover the dividends. Recently, Keller declared a final dividend of £0.313 per share at its AGM on May 15, 2024, reflecting a commitment to shareholder returns despite its lower yield relative to some peers in the market.

Key Takeaways

Get an in-depth perspective on all 52 Top Dividend Stocks by using our screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CLIGLSE:HL. and LSE:KLR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance