Exploring TSX Dividend Stocks In May 2024

As of May 2024, the Canadian market continues to be a focal point for investors seeking stability and growth amidst global economic fluctuations. This environment underscores the appeal of dividend stocks, which are particularly valued for their potential to provide steady income streams and resilience during varied market conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.47% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.13% | ★★★★★★ |

Savaria (TSX:SIS) | 3.00% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.54% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.06% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.88% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.50% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

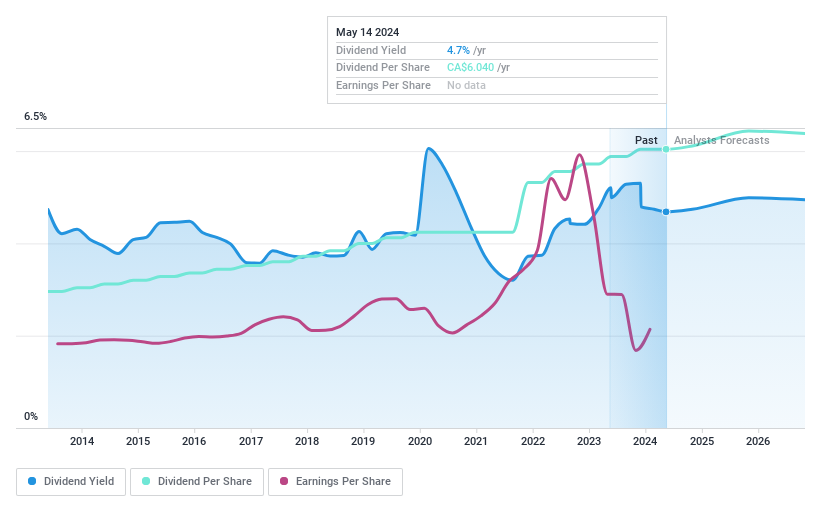

Bank of Montreal

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers a range of financial services mainly in North America, with a market capitalization of approximately CA$93.78 billion.

Operations: Bank of Montreal generates its revenue from various segments, with Canadian Personal and Commercial Banking leading at CA$9.97 billion, followed by U.S. Personal and Commercial Banking at CA$9.40 billion, BMO Wealth Management at CA$7.57 billion, and BMO Capital Markets at CA$6.33 billion.

Dividend Yield: 4.7%

Bank of Montreal's dividend stability is underscored by a decade of consistent payouts, currently supported by an 81.3% payout ratio, with forecasts showing continued coverage at 50.9% in three years. Despite trading 37.1% below estimated fair value and offering a modest yield of 4.68%, which is lower than the top quartile of Canadian dividend stocks, the dividends are seen as reliable. However, its profit margins have declined from last year's 34.6% to 16.6%, reflecting some financial pressure despite a low allowance for bad loans at 88%.

Unlock comprehensive insights into our analysis of Bank of Montreal stock in this dividend report.

Our valuation report unveils the possibility Bank of Montreal's shares may be trading at a premium.

North West

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer offering food and everyday products and services to rural communities and urban neighborhoods in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of approximately CA$1.85 billion.

Operations: The North West Company Inc. generates CA$2.47 billion in revenue primarily from its retail operations focusing on food and everyday items across various regions including northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 4%

North West Company has demonstrated a consistent ability to grow and support its dividends, with payments increasing over the last decade and a stable 10-year track record. Although its dividend yield of 4.02% is below the top quartile in Canada, it trades at 46% under fair value and maintains healthy coverage through earnings (payout ratio: 56.8%) and cash flows (cash payout ratio: 82.8%). Recent financials show continued growth in sales and net income, reinforcing the sustainability of its dividends.

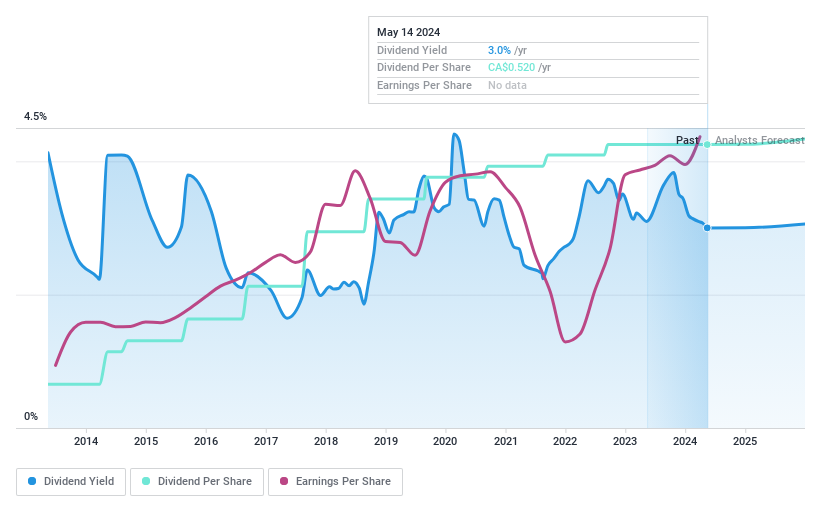

Savaria

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Savaria Corporation specializes in accessibility solutions for the elderly and physically challenged, operating across Canada, the United States, Europe, and internationally with a market cap of approximately CA$1.23 billion.

Operations: Savaria Corporation operates in the accessibility solutions sector, serving the elderly and physically challenged across various global markets.

Dividend Yield: 3%

Savaria Corporation has maintained a consistent dividend, recently declaring CAD 0.0433 per share. Despite a modest yield of 3%, which is below the top quartile in Canada, its dividends are well-covered with an earnings payout ratio of 82.3% and cash payout ratio of 51.9%. The company's recent performance shows improvement, with net income rising to CAD 11.05 million from CAD 6.04 million year-over-year and sales projected to reach approximately CAD $1 billion in 2025, indicating potential for sustained dividend payments despite past shareholder dilution.

Click here to discover the nuances of Savaria with our detailed analytical dividend report.

Upon reviewing our latest valuation report, Savaria's share price might be too pessimistic.

Turning Ideas Into Actions

Delve into our full catalog of 32 Top TSX Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BMO TSX:NWC and TSX:SIS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance