Here's Why Greencore Group (LON:GNC) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Greencore Group (LON:GNC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Greencore Group with the means to add long-term value to shareholders.

See our latest analysis for Greencore Group

How Fast Is Greencore Group Growing Its Earnings Per Share?

Over the last three years, Greencore Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Greencore Group's EPS shot up from UK£0.062 to UK£0.078; a result that's bound to keep shareholders happy. That's a impressive gain of 26%.

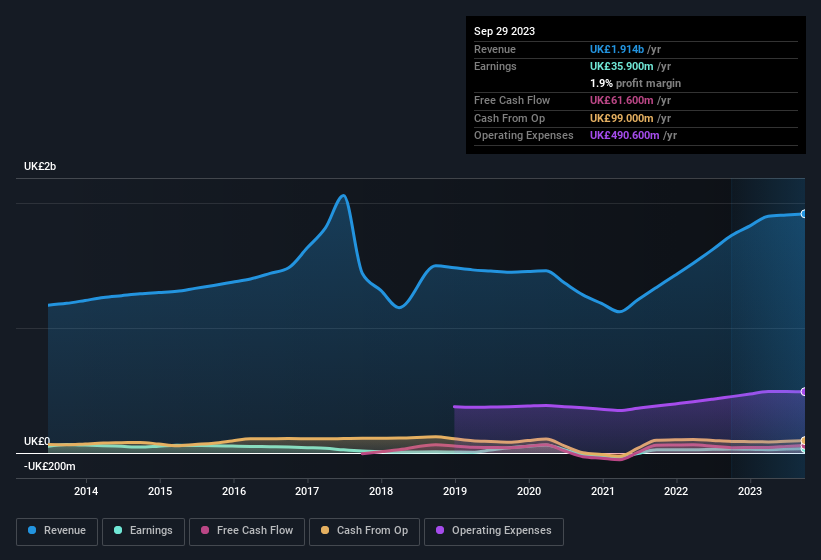

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Greencore Group maintained stable EBIT margins over the last year, all while growing revenue 10% to UK£1.9b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Greencore Group's forecast profits?

Are Greencore Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the UK£52k that Independent Non-Executive Director Anne O’Leary spent buying shares (at an average price of about UK£1.05). Purchases like this clue us in to the to the faith management has in the business' future.

Should You Add Greencore Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Greencore Group's strong EPS growth. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. To put it succinctly; Greencore Group is a strong candidate for your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Greencore Group. You might benefit from giving it a glance today.

Keen growth investors love to see insider buying. Thankfully, Greencore Group isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance