High Insider Ownership Growth Companies In The UK For May 2024

As the UK market anticipates the Bank of England's latest monetary policy decisions and navigates through various economic uncertainties, investors continue to seek stable yet promising opportunities. In this context, growth companies with high insider ownership can be particularly appealing, as they often demonstrate a strong alignment of interests between management and shareholders, potentially offering resilience amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 43.9% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 28.9% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Judges Scientific (AIM:JDG) | 11.6% | 25.3% |

Let's uncover some gems from our specialized screener.

888 Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: 888 Holdings plc operates as an online betting and gaming company offering products and solutions across the UK, Ireland, Italy, Spain, and other global markets, with a market capitalization of approximately £0.40 billion.

Operations: The company generates its revenue through three primary segments: Retail (£535 million), UK&I Online (£658.50 million), and International (£517.40 million).

Insider Ownership: 20.1%

Earnings Growth Forecast: 72.6% p.a.

888 Holdings is trading significantly below its estimated fair value and is expected to become profitable within the next three years, with earnings projected to grow substantially. Despite challenges in covering interest payments with earnings, the company's revenue growth is anticipated to outpace the UK market average. Recent strategic moves include a £400 million fixed-income offering and plans to divest its U.S. operations, aiming for cost savings and reduced exposure to competitive pressures in that region.

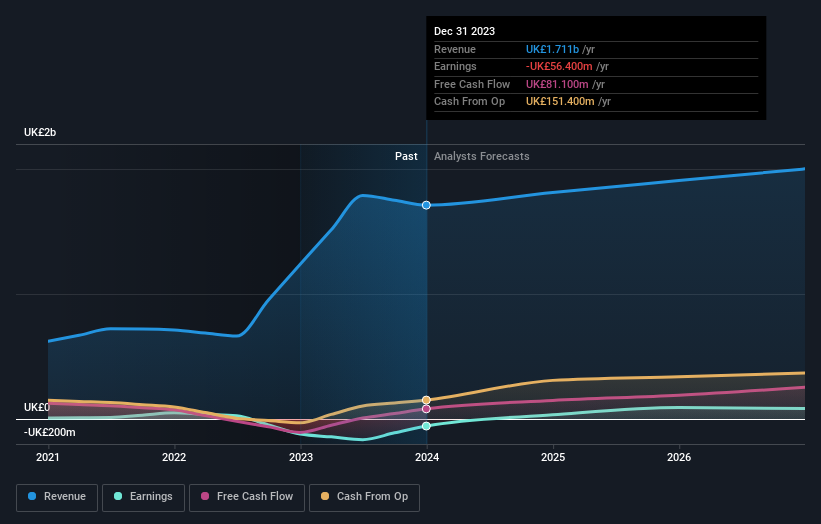

IWG

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately £1.94 billion.

Operations: The company generates revenue primarily through its operations in the Americas (£1.05 billion), Europe, the Middle East, and Africa (£1.32 billion), with additional contributions from Asia Pacific (£273 million) and Worka (£319 million).

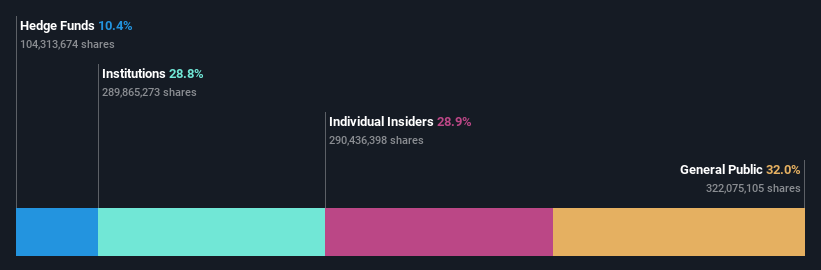

Insider Ownership: 28.9%

Earnings Growth Forecast: 101.7% p.a.

IWG plc, a UK-based growth company with high insider ownership, reported a slight revenue increase in Q1 2024 to $912 million. Despite this, the firm faced significant challenges in 2023 with a net loss widening to GBP 215 million. Looking ahead, IWG is expected to reverse its fortunes, forecasting profitability within three years and revenue growth at 8% annually—outpacing the UK market's average of 3.5%. However, its forecasted Return on Equity remains low at 11.6%.

Get an in-depth perspective on IWG's performance by reading our analyst estimates report here.

Our expertly prepared valuation report IWG implies its share price may be lower than expected.

J D Wetherspoon

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J D Wetherspoon plc is a UK-based company that manages a chain of pubs and hotels across the United Kingdom and the Republic of Ireland, with a market capitalization of approximately £0.91 billion.

Operations: The company generates £2 billion in revenue from its pub operations.

Insider Ownership: 25.8%

Earnings Growth Forecast: 20.6% p.a.

J D Wetherspoon, a UK growth company with notable insider ownership, has shown resilience with a 3.3% quarterly sales increase and an 8.3% year-to-date rise in like-for-like sales as of April 2024. Despite challenges from one-off items impacting earnings, the company's profit forecasts are optimistic, projecting significant growth above market expectations at 20.6% annually. However, financial strains are evident as interest coverage remains weak and profit margins have declined to 2.1%, down from last year's 3.6%. Insider transactions have been minimal but predominantly purchases over the past three months, suggesting some confidence among insiders in the firm’s trajectory.

Where To Now?

Click here to access our complete index of 59 Fast Growing UK Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:888 LSE:IWG and LSE:JDW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance