Hunting for Hidden Champions in Europe

In his book, “Hidden Champions of the 21st Century”, the business consultant Hermann Simon discusses the idea that small to mid-sized firms, which operate in niche markets and are market leaders in their industries, tend to become very successful. In this article, we will use his findings to identify the top ranking Hidden Champions in the market, analyse how they have performed, and randomly select a few Hidden Champions for particular focus.

What makes these companies “Hidden”?

A key element of “hidden” companies is that the range of products they make often go unnoticed by consumers, as they often form part of the supply chain. It may be that the company supplies the equipment, components, or systems that contribute towards the end product, reducing their own “distinctiveness”.

These types of companies include some of the following: Jungbunzlauer, the Austrian-Swiss company that provides the citric acid for every Coca-Cola produced and sold in the world, Mumbai based Essel Propack, one of the global market leaders for laminated tubes for toothpastes and other similar products, and Switzerland’s Lantal, a global leader in customised cabin interiors for passenger aircraft, whose customers include the likes of Boeing and Airbus.

Additionally, there is a desire for these Hidden Champions to remain hidden and maintain a low profile, so that they may continue to focus on what counts - their business. The book credits Jim Collins for making a telling distinction between “show horses” and “plough horses”. He explained that “The plough horses do not put much time or effort into grooming their public image, so they save time and energy to concentrate on their true purpose: conducting good business”.

However, a trend has started to take swing, which shows that more and more Hidden Champions are beginning to unveil themselves. At the time of writing, in 2009, Hermann Simon had found that the number of hidden champions listed on the stock exchange had risen sixfold in the last decade.

Finding the Hidden Champions

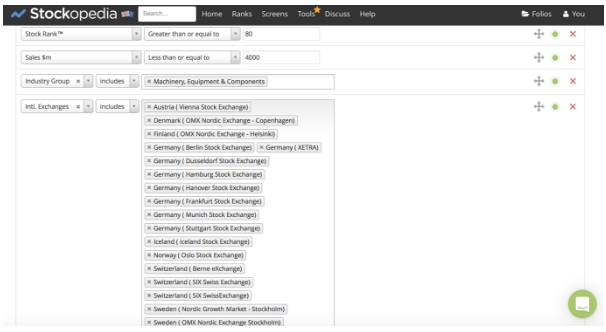

The initial step in modelling Hermann Simon’s strategy is to filter for the top 20% of stocks in the market with the strongest blend of Quality, Value and Momentum. That was done by using Stockopedia’s StockRanks.

In his book, he specified that the companies he was looking for must also generate revenues below $4 billion, drawing focus on only smaller to mid-sized companies.

He also found that the highest proportion of Hidden Champions are found in the industrial goods sector - just under 70% according to research found in the book. After further examination of industry grouping, the Machinery, Equipment and Components industry group was considered to offer the best prospect of finding candidates, due to its smaller and more specific market segments.

Hermann Simon also found that the majority of Hidden Champions were found in German-speaking and Scandinavian countries. He estimated that “80% of all midsize world market leaders” came from these regions. The screening, see here, reflects those initial criteria.

Many Hidden Champions have market leading positions, with most owning over 50% of the global market share with their product. In fact, Hermann Simon found that “On average, they are more than twice the size of their strongest competitors” and are “Number one, two or three in the global market”. While this isn’t an easily ‘screenable’ rule, the initial screen produces a set of results from which a review of a company’s financial reports is sufficient to find the relevant data.

How do these companies tend to perform?

In his findings, Hermann Simon found it surprising that so many of the respondents had low satisfaction ratings for their profit situation. According to the research, the Hidden Champions examined showed to have an average pre-tax ROI of 13.6% over the last ten years. Using a realistic tax rate of 30%, the after-tax ROI would stand at 9.5%, far superior to the 3.5% of the Fortune Global 500 in 2007. Similarly impressive was the ROE of 24.2% over the same period. The above average levels of profitability are a common characteristic of Hidden Champions even if higher profits aren’t a main focus.

In his book, Hermann Simon quotes Reinhold Würth when discussing the importance of growth to a company. He says, “He often compares his company to a tree: as long as a tree grows, it is healthy. If it stops growing, it dies. Only growth keeps a company young, dynamic and agile.”

The average annual growth rate of a Hidden Champion is 8.8%, meaning that these companies double their size every 8.2 years. This annual growth rate has been accelerating in recent years, and this trend is set to continue due to the rapid globalisation that is now taking place.

Market leadership may be the single most decisive factor as to where lies the true success of the Hidden Champions. In his research, Hermann Simon found that 65.9% of Hidden Champions were world market leaders and over 75% are market leaders in Europe. Over the last decade both their absolute and relative market shares have increased. 84.1% have seen an increase in their market shares, with only 11.9% experiencing a decline.

There is a reason as to why these companies manage to obtain market leadership. They secure this status by becoming the best in technology, quality, market awareness, innovation and reputation. This has allowed them to charge higher prices for their good/services typically in the range of 10-15%, leading to improved margins of profitability.

Unlike most, Hidden Champions generally tend to benefit from downturns and crises. As the weaker competitors succumb to the difficult times, the market shares are redistributed, with the Hidden Champions often exploiting the opportunity to strengthen their market leading positions.

Company Focus

Three companies have been randomly selected, which ostensibly meet the criteria of the Hidden Champions. Each has been considered against Stockopedia’s algorithms to determine their fundamental strengths, to illustrate and validate Hermann Simon’s theory.

Valmet (VALMT: HEL)

Share price: €14.51

Market cap: £1.87bn

StockRank: 80

Valmet, a Finnish company, listed on the Nasdaq Helsinki, is a global developer and supplier of technologies, automation and services for the pulp, paper and energy industries. The company’s customer base includes the likes of BP, Mondi and RWE.

For its paper business line, it manufactures tailor-made board and paper machines, tissue production lines, as well as standalone products. Its pulp and energy division includes complete pulp mills, multifuel boilers, emission control systems and biotechnology solutions. The automation business focuses on quality control systems, performance solutions and safety solutions. Its services range from paper machine clothing and filter fabrics, mill and plant improvements to energy and environmental solutions. For its product offering, it states that “Valmet has the widest offering and leading market position in all markets”. The company’s market positions, which it mentions on its website, are as follows: #1 in tissue, board and paper, #1-2 in services and pulp, #1-3 in automation and energy.

The company has an industrial history, which dates back 200 years, although it only recently floated in January 2014. Since its inception, the company has seen its share price appreciate by 111.20%. It has set a clear strategy to try and continue this kind of performance. It aims to ensure that net sales for stable business grow at two times the market growth, and that net sales for capital business exceed the market growth.

The company still looks very attractive through Stockopedia’s algorithms. It has very good quality and momentum characteristics, whilst still being reasonably priced. The rolling PEG, a good measure when comparing a company’s value to its growth prospects, currently stands at 0.55, indicating that the company can currently be bought at a discount to its proper value. Additionally, the company also maintains an aggressive dividend strategy, the current forecast dividend yield is 3.36% and the company is targeting a dividend payout of at least 50% of net profit in the coming years.

B&B Tools AB (BBTO-B: STO)

Share price: SEK195

Market cap: £497.4m

StockRank: 80

B&B Tools, which is the largest supplier of industrial consumables, industrial components and related service for the industrial and construction sectors in the Nordic region, was founded in 1906. Its shares currently trade on the Nasdaq Stockholm.

Its industrial consumables division consists of products such as tools, machinery, personal protective equipment, fastening elements and workplace equipment. The industrial components are largely centered around bearings, seals, transmission and automation. The variety of services it provides include logistics solutions, inventory optimization, efficient maintenance planning in addition to the service workshops for electronic motors, gears, etc. It is the leading supplier in industrial consumables and industrial components for its Swedish, Norwegian and Finnish markets.

The financial health of the company is commendable, with a Piotroski F-Score of 7/9, showing that the company’s profitability, leverage and operating efficiency is steadily improving. It looks relatively cheap on a forecast P/E ratio of 13, whilst its P/FCF of 13.7 suggests that there is more than sufficient cash that can be used by the company to either re-invest in the company, to pay down debt, or re-distribute to shareholders in the form of dividend payments. The company believes that its strong balance sheet and low debt have placed it in a strong position for attractive corporate acquisitions in the future.

The company also seems to be growing rapidly, with its EPS 3-year compound annual growth rate at an impressive 17.5%. To match this, its DPS per share has also been seen a 3-year compound annual growth rate of 18.6%. Furthermore, the company is aiming to drastically improve its profitability, which it defines as operating profit in relation to working capital (P/WC), from its current level of 27% to 45%.

Washtec AG (WSU: ETR)

Share price: €59.89

Market cap: £690.1m

StockRank: 86

Washtec provides car wash technology in more than 70 countries worldwide, with its 35,000 car washes used by more than two million vehicles every day. The company is the market and innovation leader in the car wash business. According to its research, the company is the clear market leader in Europe, with respect to market share and market coverage, despite intense competition.

Fundamental analysis of the company shows that it has the characteristics of a high flyer, with strong quality and momentum rankings. Its valuation may look a little stretched, however, as this is often the case with high quality growth stocks.

The industry median for ROCE and ROE, important profitability indicators, are 8.42% and 7.90% respectively. Washtec AG has a remarkable ROCE of 39.9% and a ROE of 36.5%. Rather unsurprisingly, its operating margins are also more than twice the industry median.

With regard to momentum, brokers have been consistently increasing its EPS forecasts over the past year, indicating that this trend may be set to continue. The EPS growth looks even more spectacular when compounded over a 3-year period, seeing a 41.4% increase annually.

An attractive dividend policy has also been adopted by the company. Its current dividend yield stands at 3.60%, and its DPS has increased by 48.6% on a 3-year annual compound growth rate. It is also returning cash to shareholders in the form of share buybacks. In 2015, the result of this strategy along with the share price appreciation returned a staggering total of 145.4% to shareholders.

Criticisms of the Hidden Champions

These extremely specialized companies that operate in tiny niche markets can equally fail in the long-term due to their lack of risk diversification. However, their ability to consistently innovate and preserve their market leading positions is what differentiates these so-called Hidden Champions from other companies. Hans Riegel of Haribo, once made the following observation, “Risk is actually reduced if you focus on what you are really good at”.

Additionally, operating in a niche market is seen as a clear limit to the size to which a firm can grow. Although there is some truth to this, globalisation has meant that new markets have opened up, and these new markets can act as sources of future growth. There are also cases in which the Hidden Champions purposely decide not to grow, sometimes due to the risk element or the cyclical nature of their markets.

The strong export orientation of these companies mean that they are very susceptible to currency fluctuations. However, as is the case with companies such as Washtec AG, most of the value creation and revenue recognition takes place in the respective regions themselves, hence the impact of currency fluctuations is mitigated.

The Hidden Champions may also be subject to a certain degree of price volatility, given their closeness to their focus markets, but this is generally a short-term concern and offset by strong fundamentals.

The validity of the Hidden Champions

Despite the criticisms levied, the random stock selections demonstrate that Hermann Simon’s Hidden Champions are readily identifiable on the stock market by adopting his criteria and applying basic research methodology.

Over the long term, the product quality, closeness to the customer, and after-sales service that gives these companies their competitive advantage, provides them with the foundations of success. Their simplicity and constant decentralisation enables them to focus on their core competencies, avoid costly mistakes and quickly respond to changes in customer needs or to new technological developments.

Around one third of the hidden champions under investigation in the book have survived for over 100 years. This further emphasises the continuity and durability of these uncomplicated and focused companies.

All data accurate as at 26/03/2017

Read More about Valmet on Stockopedia

Read more investing articles & commentary from keelancooper

Yahoo Finance

Yahoo Finance