ICU Medical Inc. Reports Mixed Q1 2024 Results, Adjusted EPS Beats Estimates

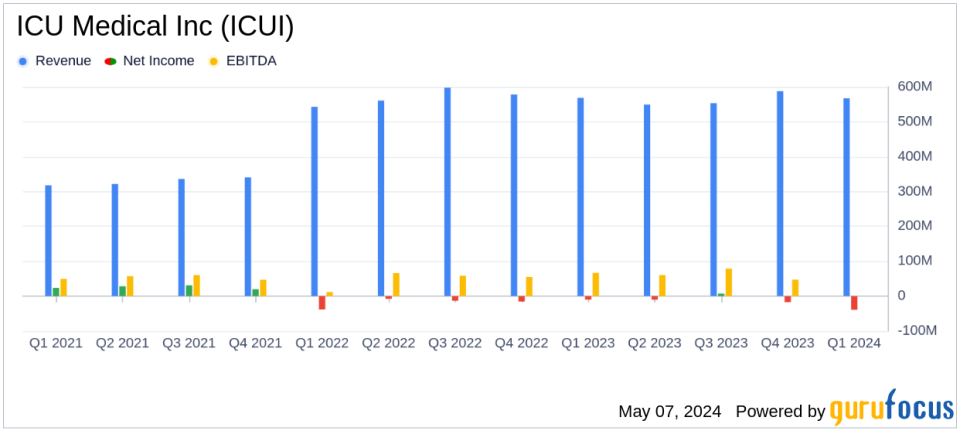

Revenue: Reported at $566.7 million, slightly below the previous year's $568.6 million and above the estimated $552.25 million.

Net Loss: Increased to $(39.5) million from $(9.8) million year-over-year, significantly above the estimated net income of $19.45 million.

Earnings Per Share (EPS): GAAP net loss per diluted share worsened to $(1.63) from $(0.41) year-over-year; adjusted diluted EPS was $0.96, surpassing the estimated $0.82.

Gross Margin: Decreased to 33% from 34% in the comparable period last year.

Adjusted EBITDA: Declined to $78.8 million from $102.0 million in the first quarter of the previous year.

Product Line Performance: Consumables revenue increased to $244.1 million from $236.1 million, while Infusion Systems and Vital Care saw declines.

Operational Highlights: Total operating expenses increased to $195.9 million from $182.6 million, driven by higher selling, general, and administrative costs as well as restructuring and integration expenses.

On May 7, 2024, ICU Medical Inc (NASDAQ:ICUI), a prominent player in the infusion therapy industry, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a revenue of $566.7 million, a slight decrease from $568.6 million in the previous year's same quarter. Despite the revenue's near stability, the company faced a significant widening in its net losses, reporting a GAAP net loss of $39.5 million, or $1.63 per diluted share, compared to a net loss of $9.8 million, or $0.41 per diluted share, a year ago.

Company Overview

ICU Medical, headquartered in San Clemente, California, is a global leader in the manufacture and sale of innovative medical devices used in infusion therapy and critical care applications. The company's product portfolio includes IV solutions, systems, and services. ICU Medical has significantly expanded its market presence following its acquisitions of Hospira Infusion Systems in 2017 and Smiths Medical in 2022. The company primarily operates in the United States, which accounts for over 63% of its sales.

Financial Performance Analysis

The first quarter results reflect a challenging period for ICU Medical, with a decrease in gross margin from 34% to 33% year-over-year. This reduction in profitability can be attributed to various factors including increased costs and operational challenges. The adjusted diluted earnings per share (EPS) stood at $0.96, which, despite a decline from $1.74 in the prior year, surpassed the analyst estimates of $0.82. This indicates a resilient underlying business performance amidst the reported losses.

Segment Performance and Challenges

Revenue by product line showed mixed results; the consumables segment grew by $8 million, reaching $244.1 million, while infusion systems and vital care segments witnessed declines. Notably, the vital care segment, which includes revenue from Pfizer contract manufacturing, saw a decrease of $5.5 million. These fluctuations highlight the varying demand dynamics across ICU Medicals diverse portfolio.

Strategic and Operational Highlights

Despite the financial strains, ICU Medical is continuing its strategic initiatives to enhance operational efficiency and market reach. The company's focus remains on integrating its recent acquisitions and leveraging their synergies to improve its competitive stance in the market. However, the increased net losses and operational expenses pose challenges that need addressing to ensure long-term sustainability and profitability.

Outlook and Investor Sentiment

The company's outlook for the upcoming quarters remains cautious yet optimistic, with strategies aimed at cost optimization and revenue growth. The investor sentiment may be tested by the increased losses, but the beat on adjusted EPS provides a silver lining that might support investor confidence.

Conclusion

ICU Medicals Q1 2024 results present a complex picture marked by stable revenues but increased losses. As the company navigates through its post-acquisition phase and ongoing market challenges, its ability to adapt and optimize its operations will be crucial. Investors and stakeholders will likely keep a close watch on how ICU Medical balances growth initiatives with profitability in the challenging healthcare market.

For detailed financial figures and further information, readers are encouraged to refer to the official SEC filings.

Explore the complete 8-K earnings release (here) from ICU Medical Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance