Inspired (NASDAQ:INSE) Misses Q1 Sales Targets

Gaming company Inspired (NASDAQ:INSE) missed analysts' expectations in Q1 CY2024, with revenue down 2.8% year on year to $63.1 million. It made a non-GAAP loss of $0.40 per share, down from its loss of $0.05 per share in the same quarter last year.

Is now the time to buy Inspired? Find out in our full research report.

Inspired (INSE) Q1 CY2024 Highlights:

Revenue: $63.1 million vs analyst estimates of $64.9 million (2.8% miss)

EPS (non-GAAP): -$0.40 vs analyst estimates of -$0.06 (-$0.34 miss)

Gross Margin (GAAP): 67.7%, down from 74.3% in the same quarter last year

Free Cash Flow was -$800,000 compared to -$6.5 million in the previous quarter

Market Capitalization: $250.8 million

“As we begin 2024, we remained focused on our long-term strategy to shift a greater proportion of our earnings to our aggregate digital business, which includes our Virtual Sports and Interactive segments. In the first quarter, our digital business accounted for 76% of our Adjusted EBITDA contribution1 compared to 69% in the prior year. At the same time our strategy of moving our retail business in the capital light direction is taking hold as well,” said Lorne Weil, Executive Chairman of Inspired.

Specializing in digital casino gaming, Inspired (NASDAQ:INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

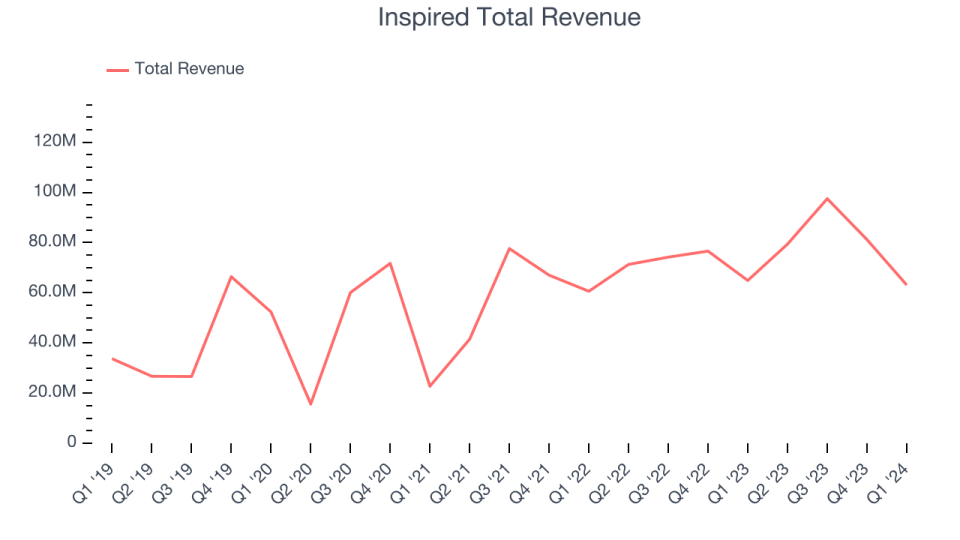

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Inspired's annualized revenue growth rate of 19.3% over the last five years was solid for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Inspired's recent history shows its momentum has slowed as its annualized revenue growth of 14.1% over the last two years is below its five-year trend.

We can better understand the company's revenue dynamics by analyzing its three most important segments: Gaming, Leisure, and Virtual Sports, which are 38%, 29.5%, and 19.7% of revenue. Over the last two years, Inspired's revenues in all three segments increased.Gaming revenue (land-based casino games) averaged year-on-year growth of 25.5% while Leisure (digital gaming and sports betting) and Virtual Sports (gaming terminals and amusement machines) averaged 14.3% and 17.7%.

This quarter, Inspired missed Wall Street's estimates and reported a rather uninspiring 2.8% year-on-year revenue decline, generating $63.1 million of revenue. Looking ahead, Wall Street expects revenue to decline 6.6% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

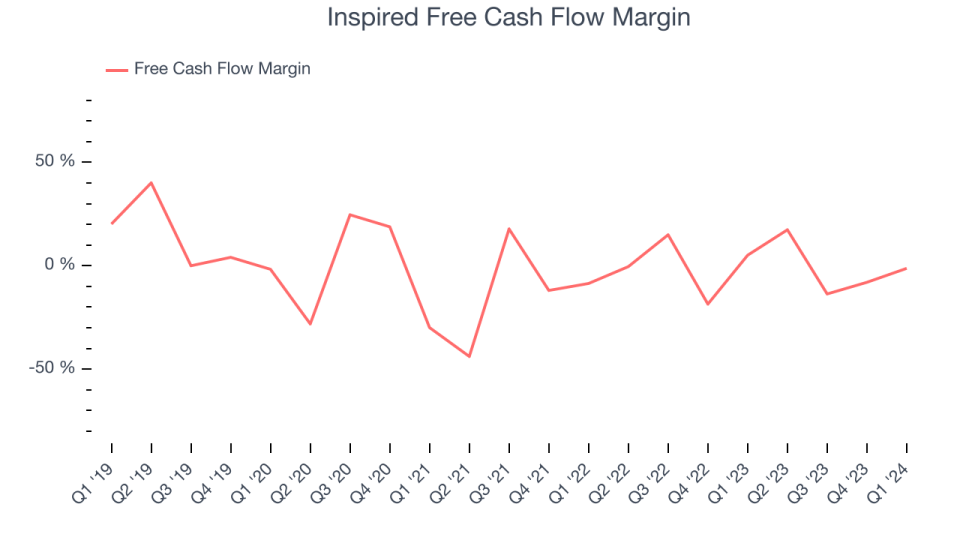

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Inspired's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 1.1%.

Inspired burned through $800,000 of cash in Q1, equivalent to a negative 1.3% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter. Over the next year, analysts predict Inspired will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 2.1% will increase to positive 16.2%.

Key Takeaways from Inspired's Q1 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates. Overall, this was a bad quarter for Inspired. The stock is up flat after reporting and currently trades at $9.44 per share.

So should you invest in Inspired right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance