Mastercard (MA) Ties Up to Ease Global Digital Payments

Mastercard Incorporated MA teamed up with the embedded finance platform powered by Hub71, ABHI, in a bid to offer peace of mind for working individuals of the UAE and upgrade the digital payment infrastructure of the country. ABHI, a leading fintech company in the MENAP region, provides a holistic suite of products and services, encompassing Earned Wage Access (EWA), payroll solutions and SME financing.

The partnership will provide ABHI’s EWA users the Salary Advance Cards built with Mastercard technology. The new cards can be availed by the users through the ABHI phone app, round-the-clock open call center, or via the company they are linked with.

This, in turn, will enable ABHI’s customers to make hassle-free as well as safe local and international online payments by offering access to Mastercard’s extensive global payments network. The ulterior motive of the partnership will remain to provide an easier way for working individuals to access Earned Salaries. Additionally, the recent move is expected to boost MA’s revenues derived from its value-added services and solutions suite.

Also, on the same day of announcing the Mastercard-ABHI collaboration, Mastercard and the Cooperative Bank of Oromia unveiled the Coopbank Prepaid Mastercard and introduced Community Pass technology across Ethiopia. The Coopbank Mastercard provides a refined and secure card management solution, designed specifically for international travelers, to facilitate easy and safe global financial transactions.

This prepaid card enables users to make online purchases worldwide across a wide range of digital platforms and e-commerce sites, wherever Mastercard is accepted. Users can manage their transactions effortlessly by using a dedicated mobile app that offers robust card management features.

The twin moves reflect Mastercard’s broader motive of infusing greater digitization across different countries of the globe. A rapidly expanding digital economy, spurred by increased Internet penetration and the higher usage of smartphones, continues to prompt MA to capitalize on its suite of advanced payment solutions and establish a solid global digital footprint.

The support of a global payment technology leader like Mastercard, whose digital arm is built with the help of partnerships and substantial technology investments, infuses a sense of confidence and security into businesses.

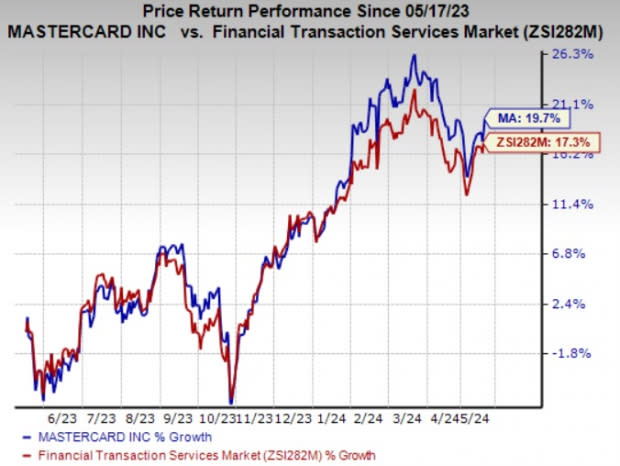

Shares of Mastercard have gained 19.7% in the past year compared with the industry’s 17.3% growth. MA currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Business Services space are Duolingo, Inc. DUOL, Clean Harbors, Inc. CLH and FTI Consulting, Inc. FCN. Duolingo sports a Zacks Rank #1 (Strong Buy), and Clean Harbors and FTI Consulting carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Duolingo outpaced estimates in each of the last four quarters, the average surprise being 115.22%. The Zacks Consensus Estimate for DUOL’s 2024 earnings is pegged at $1.74 per share, which indicates a nearly five-fold increase from the prior-year reported figure. The consensus mark for revenues suggests an improvement of 37.8% from the prior-year figure. The consensus mark for DUOL’s 2024 earnings has moved 13% north in the past seven days.

Clean Harbors’ earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 0.65%. The Zacks Consensus Estimate for CLH’s 2024 earnings suggests an improvement of 6.7% from the prior-year reported figure. The consensus estimate for revenues suggests growth of 8.3% from the prior-year reported figure. The consensus mark for CLH’s 2024 earnings has moved 1.1% north in the past 30 days.

The bottom line of FTI Consulting outpaced estimates in each of the last four quarters, the average surprise being 27.82%. The Zacks Consensus Estimate for FCN’s 2024 earnings suggests an improvement of 6.6% from the prior-year reported figure. The consensus estimate for revenues suggests growth of 6.5% from the prior-year reported figure. The consensus mark for FCN’s 2024 earnings has moved 0.9% north in the past 30 days.

Shares of Duolingo, Clean Harbors and FTI Consulting have gained 23.9%, 49.4% and 25.6%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance