Meta & Netflix Face Post-Earnings Pressure: A Buying Opportunity?

Earnings season has continued to roll along at a rapid pace, with this week’s reporting docket notably stacked. We’ve heard from several market heavyweights, including Meta Platforms META and Netflix NFLX.

Shares of each faced selling pressure post-earnings, erasing a chunk of the year-to-date gains we’ve seen from each stock. It raises a valid question – is the selling overdone, or is this a rich opportunity for investors? Let’s take a closer look at each company’s quarterly release.

Netflix

Concerning headline figures, Netflix posted a 17% beat relative to the Zacks Consensus EPS estimate and posted sales modestly ahead of the consensus, with both items showing considerable growth from the year-ago periods.

Image Source: Zacks Investment Research

Total subscribers were reported at 269.6 million, reflecting a 16% jump year-over-year. Still, the real surprise in the quarterly release was that the company will no longer report quarterly membership numbers starting next year in 2025 Q1, likely explaining the knee-jerk reaction post-earnings.

Nonetheless, Netflix enjoyed a solid quarter, posting $2.1 billion in free cash flow and seeing its year-to-date operating margin moving higher to 28.1% (20.6% in FY23). The company also maintained its free cash flow outlook of $6 billion for FY24 and repurchased 3.6 million shares throughout the period.

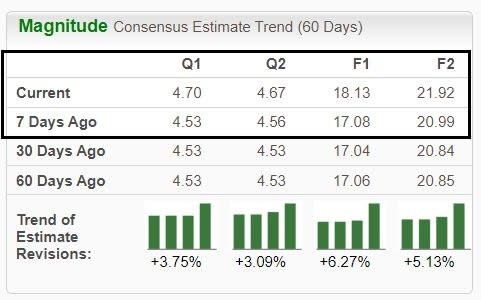

Earnings expectations have moved higher following the release, a bullish near-term sign. Netflix is currently a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company’s growth outlook remains bright, with consensus expectations for its current fiscal year suggesting 50% earnings growth on 15% higher sales. The stock sports a Style Score of ‘A’ for Growth.

Meta Platforms

Technology heavyweight Meta Platforms also posted a double beat, exceeding the Zacks Consensus EPS estimate by 9% and posting a modest 0.5% sales surprise. The company’s improved operational efficiencies have aided its profitability significantly, with earnings up 80% relative to the year-ago period.

The sell-off post-earnings can be attributed to Meta's announcement of higher capital expenditures for the current fiscal year, which were raised to a band of $35 - $40 billion (previously $30 - $37 billion). Meta raised its CapEx to accelerate its infrastructure investments for its artificial intelligence (AI) roadmap, expecting higher CapEx for next year as well to support its efforts.

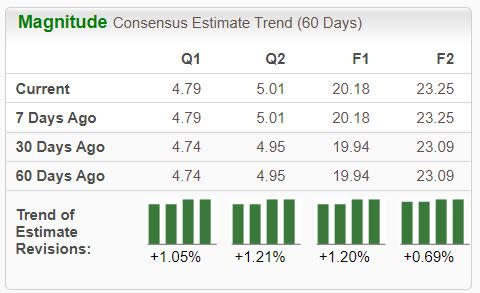

Analysts' revisions remain positive, but investors can expect adjustments in the coming days.

Image Source: Zacks Investment Research

Still, the company’s advertising business continues to deliver, with average price per ad climbing 6% year-over-year alongside a 20% climb in ad impressions across its family of apps. And to top it off, the company’s operating margin moved well higher to 38% (25% previously), reflecting its improved profitability.

Bottom Line

Earnings season is always exciting, with companies finally unveiling what’s transpired behind closed doors.

So far, the period has been primarily positive, with the big banks’ results not causing any spooks. Netflix NFLX and Meta Platforms META faced post-earnings selling pressure despite both posting solid quarterly results.

Netflix has seen positive earnings estimate revisions post-earnings, a bullish sign. Meanwhile, higher CapEx for Meta scared off some investors, but the stock remains a prime long-term play for those bullish on artificial intelligence (AI).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance