MoneySupermarket's robust third quarter

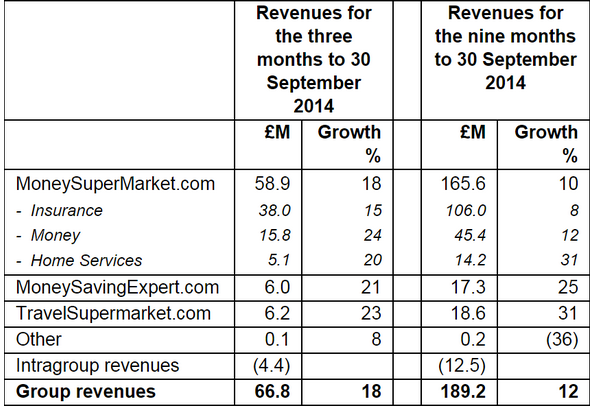

The UK's largest price comparison website, Moneysupermarket (StockRank 86), has seen a robust third quarter with revenue growth of 18% on a year ago. This compares to 9% revenue growth in the first half of 2014 and 10% during the whole of 2013. A key driver has been the stabilisation of motor insurance rates as it has encouraged consumers to shop around for better deals.

In the third quarter of 2014 Moneysupermarket generated 57% of group revenue from its insurance division. Falling motor insurance premium rates have meant that this area has seen a subdued performance recently with drivers opting to stay with their existing insurance provider.

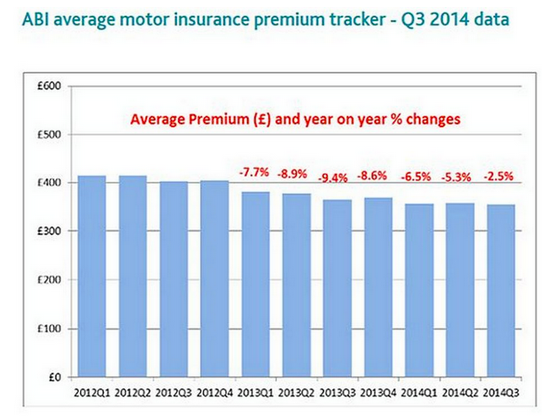

The insurance industry is cyclical, though, and as such we are now starting to see UK motor insurance premiums flatten out. In the third quarter of 2014 the annual rate of decline in UK motor premiums was 2.5% which compares to a decline of 5.3% in Q2 2014.

This shift helped lift the performance of Moneysupermarket's key insurance division with Q3 revenue growth of 15% on a year ago. This compares to only 4% revenue growth from the insurance division in the first half of 2014 and 6% in the whole of 2013.

Moneysupermarket TV advert

The second largest division at Moneysupermarket is Money (credit and non-credit) at 24% of Q3 group revenue. Money saw 24% revenue growth in Q3, on a year ago, due to improved demand for credit products (loans and credit cards) - this compares to only 6% revenue growth in H1 2014.

Moneysupermarket Q3 and year to date

Moneysupermarket is benefiting from the UK economic recovery as this supports consumer demand for financial products. The two other group websites are Moneysavingexpert and Travelsupermarket which each made up 9% of group revenue in the third quarter.

These two websites are seeing rapid growth with revenue for both up by over a fifth in Q3 on a year ago. The strong revenue expansion and potential for these businesses will help diversify Moneysupermarket over time.

In terms of the risk profile and the group needs is to maintain its market share and head off competitors like comparethemarket.com. Moneysupermarket has been successful in achieving this to date by outspending rivals in areas like advertising and IT investment.

A further risk is increased regulation in the comparison sector as this could affect the amount paid for customer referrals. In October the Big Deal website accused the UK's largest price comparison websites of giving a higher prominence to companies that pay referral commissions.

Turning to the growth outlook, and the price comparison sector will benefit as consumers increasingly purchase financial products online. The take-up of smartphones and tablets will also help with this an area in which Moneysupermarket has been investing heavily in.

Moneysupermarket had net debt of £18.1m at the end of September 2014 and trades on 19.4X forecast profits for the year to December 2014. For 2015 the forecast P/E falls to 18X with a yield of 3.8% and for 2016 the P/E falls to 16.7% with a yield of 4.1%.

While the dividend yield is attractive it is only 1.5X covered by profits in the next two years which doesn't leave much margin for error. However, the economic recovery in the UK, and the bottoming out of the motor insurance premium cycle, suggests that the trading outlook is positive.

Yahoo Finance

Yahoo Finance