News Corporation (NWSA) to Report Q3 Earnings: What's in Store?

News Corporation NWSA is set to report third-quarter fiscal 2024 results on May 8.

The Zacks Consensus Estimate for revenues is pegged at $2.48 billion, indicating an increase of 1.35% from the year-ago quarter’s levels.

The consensus mark for earnings has moved south 7.1% to 13 cents per share in the past 30 days.

The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 45.25%.

Let’s see how things might have shaped prior to the announcement.

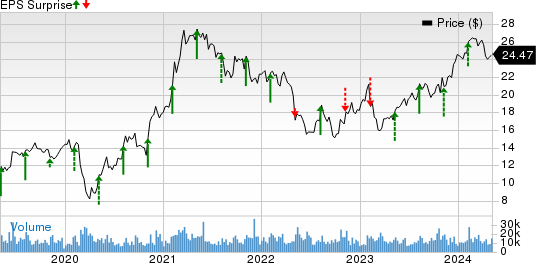

News Corporation Price and EPS Surprise

News Corporation price-eps-surprise | News Corporation Quote

Factors to Consider

In the fiscal third quarter, the company is expected to have showcased its resilience and innovation through a range of initiatives aimed at expanding its customer base and enhancing retention rates.

The introduction of new products, such as carbon credit indices, along with the development of advanced analytics, is expected to have significantly contributed to the company's growth trajectory. This strategic focus on innovation is likely to have bolstered customer engagement and loyalty.

The escalating demand for New York customer tools reflects a global trend of tightening regulations and increasing sanctions by governments worldwide. This trend is likely to have continued in the quarter to be reported, further fueling the company's expansion efforts.

The integration of OPIS and CMA has garnered significant traction across various industries, including metal, sustainability, carbon plastics, renewables and biofuels. This integration is expected to have driven higher yields and maintained steady retention rates, underscoring the company's commitment to delivering value across diverse sectors.

However, challenges persist in the Book Publishing segment, where lower sales due to decreased consumer demand and underperformance in frontlist titles have hurt revenues. Despite these headwinds, a resurgence in physical book sales and improved returns are expected to have positively impacted top-line growth. Notably, in the fiscal second quarter, the segment recorded revenues of $550 million, marking a 4% year-over-year increase.

In navigating the dynamic digital real estate landscape, NWSA remains focused on optimizing its Digital Real Estate segment. However, macroeconomic factors, such as elevated mortgage rates, are likely to have dampened lead and transaction volumes and posed challenges to top-line growth. Despite these hurdles, the company continues to explore opportunities for growth and adaptation in an evolving market environment.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here, as you can see below.

News Corporation currently has an Earnings ESP of -36.84% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

NVIDIA NVDA has an Earnings ESP of +2.50% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA is scheduled to release first-quarter 2024 results on May 22. The Zacks Consensus Estimate for NVDA’s earnings is pegged at $5.49 per share, indicating growth of 403.67% from the year-ago quarter’s reported figure.

Arista Networks ANET has an Earnings ESP of +3.76% and a Zacks Rank #2 at present.

ANET is set to report first-quarter 2024 results on May 7. The Zacks Consensus Estimate for the company’s earnings is pegged at $1.74 per share, indicating a rise of 21.68% from the year-ago quarter’s reported figure.

Docebo DCBO has an Earnings ESP of +8.00% and a Zacks Rank #3 at present.

Docebo is set to report first-quarter 2024 results on May 9. The Zacks Consensus Estimate for DCBO’s earnings is pegged at 17 cents per share, indicating growth of 88.89% from the year-ago quarter’s reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

News Corporation (NWSA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Docebo Inc. (DCBO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance