NVR Inc (NVR) Surpasses Analyst Expectations with Strong Q1 Earnings

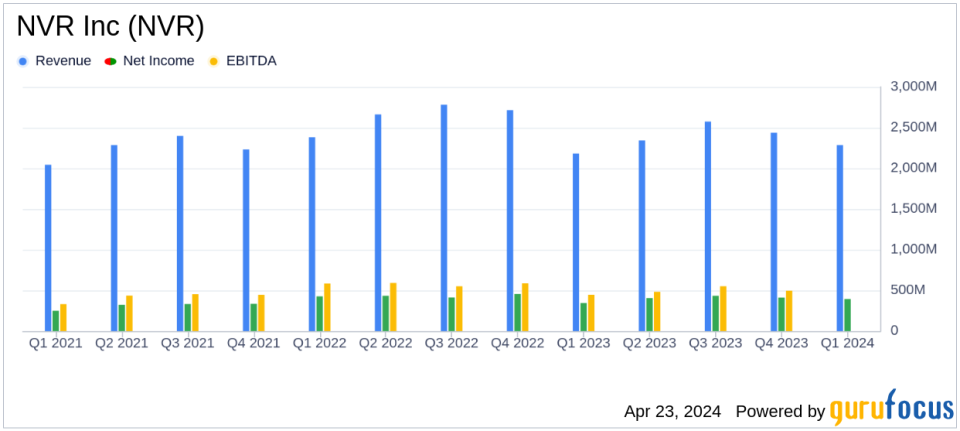

Net Income: $394.3M for Q1 2024, up 14% year-over-year, surpassing estimates of $345.6M.

Earnings Per Share: $116.41, an increase of 17% from Q1 2023, exceeding the estimate of $103.97.

Revenue: $2.33B, a 7% increase from the previous year, surpassing the estimated $2.221B.

Homebuilding Revenue: Rose by 7% to $2.29B in Q1 2024 compared to $2.13B in Q1 2023.

Mortgage Banking: Closed loan production totaled $1.38B, up 11% year-over-year.

Effective Tax Rate: Decreased to 16.2% in Q1 2024 from 20.6% in Q1 2023, contributing to net income growth.

New Home Orders: Increased by 3% to 6,049 units in Q1 2024 from 5,888 units in the same period last year.

NVR Inc (NYSE:NVR), a prominent player in the U.S. homebuilding and mortgage banking sectors, reported a notable increase in its first-quarter earnings, surpassing analyst expectations. The company announced its financial results on April 23, 2024, through its 8-K filing. NVR's net income for the quarter ending March 31, 2024, stood at $394.3 million, or $116.41 per diluted share, compared to $344.4 million, or $99.89 per diluted share, in the same period last year. This represents an increase of 14% in net income and 17% in diluted earnings per share year-over-year.

Company Overview

NVR Inc operates under three brands: Ryan Homes, NVHomes, and Heartland Homes, covering a broad geographic area in the United States including the Mid-Atlantic, North East, Mid-East, and South East. Besides homebuilding, NVR also engages in mortgage banking and title services, enhancing its market footprint and revenue streams.

Financial and Operational Highlights

For Q1 2024, NVR's consolidated revenues reached $2.33 billion, a 7% increase from $2.18 billion in Q1 2023. The homebuilding segment alone generated revenues of $2.29 billion, up by 7% year-over-year. This growth was supported by a 3% increase in new orders and a 10% rise in settlements. The average sales price for new orders climbed to $454,300, indicating a favorable market response and pricing power.

The mortgage banking segment also showed robust performance with closed loan production totaling $1.38 billion, an 11% increase from the previous year. This segment's income before tax grew by 3% to $29.0 million.

Challenges and Market Conditions

Despite the positive revenue and income figures, NVR experienced a slight decrease in its gross profit margin in the homebuilding segment, which dipped to 24.5% from 24.6% in Q1 2023. Additionally, the average settlement price saw a 2% decrease. These figures suggest some cost pressures and market adjustments that could impact future profitability if not managed effectively.

Strategic Financial Position

NVR's balance sheet remains strong with cash and cash equivalents of approximately $2.84 billion as of March 31, 2024. The company's strategic management of assets and liabilities, coupled with effective operational execution, positions it well for sustained growth. The lower effective tax rate of 16.2%, down from 20.6% due to higher income tax benefits, also contributed positively to the net income.

Analysis and Outlook

The first quarter results of NVR Inc reflect a resilient business model and effective market strategies that have allowed the company to outperform analyst expectations and navigate challenging market conditions. The increase in backlog units and dollar balances indicates a healthy demand pipeline, which is crucial for future revenue streams. However, monitoring the gross margin and settlement prices will be essential in maintaining profitability.

Investors and stakeholders should consider both the strengths in NVR's operational strategies and the potential challenges posed by market volatility and cost pressures. The company's ability to maintain a robust order book and manage costs will be critical in sustaining its growth trajectory.

Conclusion

NVR Inc's performance in the first quarter of 2024 positions it as a strong contender in the homebuilding and mortgage banking industry. With strategic operations and a solid financial base, NVR is well-equipped to capitalize on market opportunities and navigate potential challenges in the upcoming quarters.

Explore the complete 8-K earnings release (here) from NVR Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance