Reliance's (RS) Earnings & Revenues Miss Estimates in Q1

Reliance, Inc. RS posted profits of $302.9 million or $5.23 per share in first-quarter 2024, down from $383.1 million or $6.43 per share in the year-ago quarter.

Barring one-time items, the company recorded earnings of $5.30 per share. It lagged the Zacks Consensus Estimate of $5.51.

The company recorded net sales of $3,644.8 million, down around 8.1% year over year. The top line lagged the Zacks Consensus Estimate of $3,733.1 million.

Reliance, Inc. Price, Consensus and EPS Surprise

Reliance, Inc. price-consensus-eps-surprise-chart | Reliance, Inc. Quote

Volumes and Pricing

Reliance reported a 1.7% year-over-year decrease in shipments (thousand tons sold) to 1,494. The figure beat our estimate of 1,480.4. The average selling price per ton dropped by 6.9% year over year to $2,442. It was lower than our estimate of $2,509.

Reliance experienced an uptick in demand for non-residential construction, particularly in sectors like public infrastructure, manufacturing and energy infrastructure. The momentum is expected to continue into the second quarter of 2024, with an anticipated ongoing strength in these sectors. The commercial aerospace demand remained relatively stable, a trend that Reliance predicts will continue in the upcoming quarter, with some variability depending on supply chain factors and production rates. Military and space-related aerospace demand is likely to remain consistently strong during the same period.

The broader manufacturing sector, including industrial machinery, consumer products, and heavy equipment, saw a slight decline in demand, attributed mainly to a downturn in agricultural equipment and consumer products. This was partially mitigated by a rise in industrial machinery activities.

Lastly, the semiconductor market showed a seasonal improvement after a flat fourth quarter of 2023 but remained below early 2023 levels. Despite this, Reliance holds a positive long-term outlook for the semiconductor industry, buoyed by the CHIPS Act and major U.S. semiconductor fabrication projects.

Financial Position

At the end of the first quarter of 2024, Reliance had $934.9 million in cash and cash equivalents while carrying $1.15 billion in total outstanding debt. There were no borrowings under its $1.5-billion revolving credit facility. In the first quarter of 2024, Reliance generated cash flow from operations of $126.3 million.

Outlook

Reliance projects a stronger-than-usual seasonal recovery in demand for the second quarter of 2024 despite ongoing macroeconomic and geopolitical uncertainties. The company expects its tons sold to increase by 2.5-4.5% from first-quarter 2024 levels, with about 2% of this growth coming from new acquisitions completed on Apr 1, 2024. At the same time, the average selling price per ton sold is anticipated to drop 1-3%, leading to short-term gross profit margin pressure as Reliance works through higher-cost inventory. Consequently, the company forecasts adjusted earnings per share to range between $4.70 and $4.90 for the second quarter of 2024.

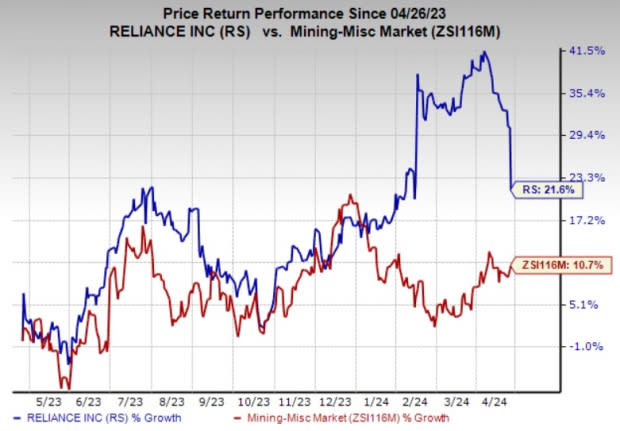

Price Performance

Reliance’s shares have rallied 21.6% in the past year compared with a 10.7% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Reliance currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy), and Carpenter Technology Corporation CRS and Ecolab Inc. ECL, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The Zacks Consensus Estimate for GFI’s first-quarter earnings has been stable in the past 60 days. The company’s shares have increased 13.5% in the past year.

CRS is slated to report fiscal third-quarter results on May 1. The consensus estimate for CRS’ fiscal third-quarter earnings is pegged at 94 cents per share, indicating a year-over-year surge of 147.4%. CRS beat on earnings in three of the last four quarters, delivering an average surprise of 12.2%. The company’s shares have risen 69.5% in the past year.

Ecolab is slated to report first-quarter results on Apr 30. The consensus estimate for ECL’s first-quarter earnings is pegged at $1.33 per share, indicating a year-over-year surge of 51.1%. ECL beat on earnings in each of the last four quarters, delivering an average surprise of 1.7%. The company’s shares have rallied 35.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Reliance, Inc. (RS) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance