Sanmina Corp (SANM) Q2 Fiscal 2024 Earnings: Aligns with Analyst Projections

Revenue: Reported $1.83 billion, slightly below the estimated $1.858 billion.

GAAP Operating Margin: Achieved 4.1%, reflecting operational efficiency.

GAAP Diluted EPS: Posted $0.93, falling short of the estimated $1.20.

Non-GAAP Diluted EPS: Recorded $1.30, surpassing the estimated $1.20.

Cash Flow from Operations: Generated $72 million, indicating strong cash management.

Ending Cash and Cash Equivalents: Stood at $651 million, demonstrating solid liquidity.

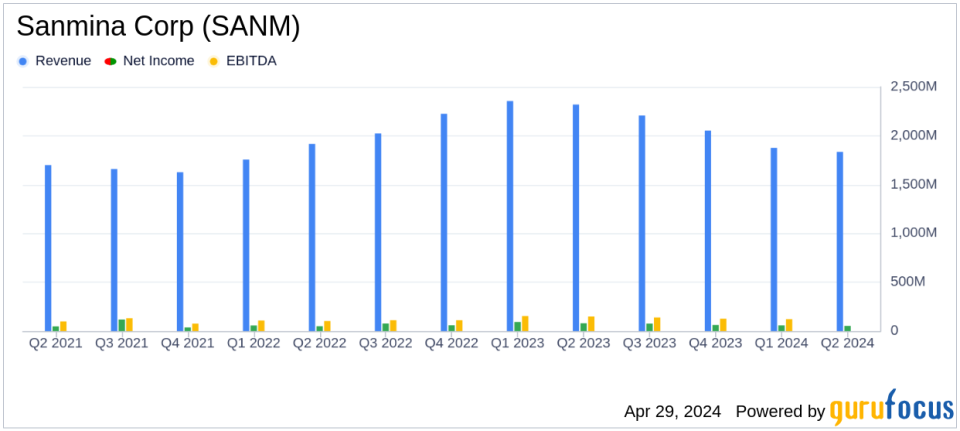

On April 29, 2024, Sanmina Corp (NASDAQ:SANM), a leader in integrated manufacturing solutions, announced its financial results for the second quarter of fiscal year 2024. The company reported a revenue of $1.83 billion and a non-GAAP diluted earnings per share (EPS) of $1.30, which aligns closely with analyst expectations of $1.20 EPS on $1.858 billion revenue. For a detailed look at the company's financials, refer to their recent 8-K filing.

Sanmina Corporation operates primarily in the communications networks, storage, industrial, defense, and aerospace sectors, offering comprehensive manufacturing solutions and services. The company's performance this quarter reflects its resilience in a challenging macroeconomic environment, marked by certain market recoveries and ongoing global uncertainties.

Financial Overview

The company's revenue of $1.83 billion represents a slight underperformance against analyst expectations but shows strategic management in navigating market fluctuations. The GAAP operating margin stood at 4.1%, with a non-GAAP operating margin of 5.4%, highlighting efficient operational control. Cash flow from operations was reported at $72 million, with ending cash and cash equivalents totaling $651 million.

Operational and Market Challenges

Sanmina's CEO, Jure Sola, commented on the quarter's outcomes, stating, "Our focused execution and operating discipline yielded financial results in line with our outlook." He also noted the beginnings of positive movement in some previously depressed markets. Despite these gains, the company remains cautious about the ongoing macroeconomic uncertainty and geopolitical tensions affecting global operations.

Looking Forward

For the fiscal third quarter ending June 29, 2024, Sanmina anticipates revenue to be between $1.8 billion and $1.9 billion, with GAAP diluted EPS expected to range from $0.95 to $1.05, and non-GAAP diluted EPS projected between $1.22 and $1.32. These forward-looking statements are based on current expectations and could vary significantly based on a range of factors.

Detailed Financials

The balance sheet as of March 30, 2024, shows total assets of $4.686 billion and total liabilities and stockholders' equity of $4.686 billion. A detailed review of the income statement reveals a net income attributable to common shareholders of $52.485 million for the quarter, with a basic and diluted EPS of $0.94 and $0.93, respectively.

Strategic Implications and Investor Outlook

Sanmina's ability to meet analyst projections and maintain stable financial performance underscores its strategic positioning within the technology sector. The company's focus on operational efficiency and market adaptability continues to play a critical role in navigating uncertain economic landscapes. Investors and stakeholders are likely to watch closely how Sanmina manages potential market improvements and challenges ahead.

For more detailed information and updates, please visit Sanmina's official website or consult their financial statements and upcoming earnings webcast.

Explore the complete 8-K earnings release (here) from Sanmina Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance