Skechers (SKX) Q1 Earnings Beat Estimates, Sales Rise Y/Y

Skechers U.S.A., Inc. SKX delivered impressive first-quarter 2024 results, with the top and bottom lines outpacing the Zacks Consensus Estimate. Also, both metrics improved year over year. The company's performance improved due to the strong brand appeal and high demand for its comfort-focused products, complemented by robust marketing and distribution efforts.

Demand for comfort technology products, advantageous pricing, and increases in wholesale and direct-to-consumer sales positively impacted the outcomes. Management is focused on its long-term growth plan, which involves expanding its international footprint and deepening its direct-to-consumer connections. The company is aiming to reach a sales goal of $10 billion by 2026, reflecting its optimistic outlook and confidence in its prospects.

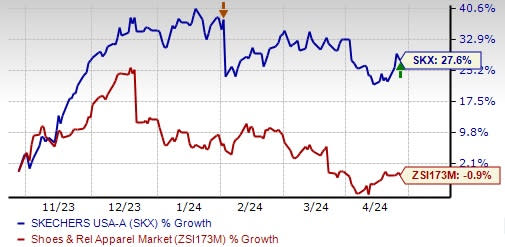

Over the past six months, shares of this Zacks Rank #3 (Hold) company have gained 27.6% against the industry’s 0.9% decline.

Skechers U.S.A., Inc. Price, Consensus and EPS Surprise

Skechers U.S.A., Inc. price-consensus-eps-surprise-chart | Skechers U.S.A., Inc. Quote

Q1 Highlights

Skechers posted first-quarter earnings of $1.33 per share, outpacing the Zacks Consensus Estimate of earnings of $1.10. Also, the bottom line rose 30.4% from the year-earlier quarter.

SKX generated sales of $2,251.6 million, lagging the consensus estimate of $2,186 million. However, the top line grew 12.5% year over year, driven by 15.2% growth in international sales and a 7.8% increase in domestic sales. Increases in domestic and international sales were driven by robust direct-to-consumer (“DTC”) and Wholesale sales. On a constant-currency basis, total sales grew 13.4%.

We note that the company’s wholesale sales increased 9.8% year over year to $1.42 billion, while DTC rose 17.3% to $829.9 million. Our estimate for wholesale and DTC sales was pegged at $1.35 billion and $839.4 million, respectively.

Wholesale sales increased 5.9% year over year in the Americas (“AMER”), 11.5% in Europe, the Middle East & Africa (EMEA) and 15.3% in the Asia Pacific (“APAC”). Wholesale average selling price per unit was flat, whereas the unit volume increased 9.9% year over year.

DTC sales growth included increases of 8% in domestic DTC sales and 24.1% in international DTC sales. The DTC unit volume rose 15.5% and the average selling price grew 1.6%. Also, growth of 10.5% in the AMER, 16.5% in the APAC and 62.4% in the EMEA aided the segment’s performance.

Region-wise, sales increased 7.8% year over year to $1.02 billion in the AMER, 17.4% to $627.6 million in the EMEA and 15.9% to $604.5 million in the APAC. We expected sales from the AMER and APAC regions to increase 9.2% and 17.7%, respectively, for the quarter under review.

Image Source: Zacks Investment Research

Margins & Costs

Gross profit increased 20.7% year over year to $1.18 billion. Also, the gross margin expanded 360 basis points (bps) to 52.5%, primarily driven by lower costs per unit due to a decline in freight costs and higher average selling prices. We expected the metric to expand 50 bps to 49.4% for the quarter under review.

Total operating expenses grew 16.9% year over year to $882.8 million. The metric, as a percentage of sales, increased 150 bps to 39.2%. We expected total operating expenses to rise 12% for the quarter.

Selling expenses grew 21.7% from the year-ago period to $156.5 million. Also, general and administrative expenses jumped 15.9% to $726.3 million. Increased costs resulted from higher brand demand creation expenditure, along with elevated facility costs, such as rent and depreciation.

Other Financial Aspects

As of Mar 31, 2024, cash and cash equivalents totaled $1.02 billion, whereas short-term investments amounted to $88.6 million.

Skechers ended the quarter with long-term borrowings of $112.5 million and shareholders’ equity of $4.15 billion, excluding non-controlling interests of $407.6 million. The total inventory decreased 10.8% year over year to $1.36 billion. The company incurred a capital expenditure of $57.1 million in the quarter.

In the first quarter of 2024, management repurchased 1 million shares of its Class A common stock for $60 million. As of Mar 31, 2023, $205.7 million was available under SKX’s share buyback program.

Store Update

As of Mar 31, 2024, SKX had 5,203 stores, including 565 domestic stores, 1,106 international locations, and 3,532 distributors, licensee and franchise stores.

In the first quarter, the company opened 10 domestic stores, 42 international stores, and 95 distributors, licensee and franchise stores. It closed eight domestic stores, 21 international stores, and 83 distributor, licensee and franchise stores in the same period.

Outlook

For 2024, management targets sales between $8.73 billion and $8.88 billion compared with the previously mentioned $8.6 billion and $8.8 billion. It predicts earnings per share (“EPS”) between $3.95 and $4.10 compared with the previously stated $3.65 and $3.85. Management anticipates a capital expenditure of $325-$375 million for 2024.

For the second quarter of 2024, SKX is likely to achieve sales between $2.18 billion and $2.23 billion and EPS between 85 cents and 90 cents.

Key Picks

A few better-ranked stocks are American Eagle Outfitters Inc. AEO, Abercrombie & Fitch Co. ANF and The Gap, Inc. GPS.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 12.5% and 3.3% from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 22.7%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently flaunts a Zacks Rank of 1. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year earnings and sales indicates growth of 19.1% and 5.6% from the year-ago period’s reported figures.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. The company sports a Zacks Rank of 1 at present.

The Zacks Consensus Estimate for The Gap’s current fiscal-year earnings and sales indicates declines of 0.3% and 4.9% from the year-ago period’s reported figures. GPS has a trailing four-quarter average earnings surprise of 180.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance