Small cap investors are right... size does matter

Size matters, right? For the past 35 years some of the most influential voices in finance have claimed that small stocks outperform large stocks. In fact, the so-called size effect has been credited as one of the main drivers of long-term stock market returns. But not everyone is convinced. Some complain that the effect disappears for long periods, or only really wins big in January. Others claim that profits from a small stock strategy get wiped out when you factor in trading costs. Could it be that big profits at the small end of the market simply don't exist?

Well, new research claims to have debunked all of these concerns. It turns out the size effect does exist. And it's very much a powerful force in the market - but only if you combine it with another key ingredient: quality.

Quality… minus junk

In late 2013, Cliff Asness and his team of quant researchers at US fund management firm AQR Capital, came up with a strategy called Quality Minus Junk. Their research found that safe, profitable, growing, and well managed companies don't get the credit they deserve - in the form of significantly higher share prices. So a QMJ strategy that buys high-quality stocks and shorts low-quality stocks earns significant risk-adjusted returns.

AQR's research came a time when 'quality' was rising through the ranks as a factor that investors were taking seriously. Last year, investment adviser Research Affiliates looked at the effectiveness of using quality and value factors together, in The Moneyball of Quality Investing. Even Eugene Fama and Ken French, who originally introduced the famous three-factor model, made improvements to it last year, with a five factor model that uses a quality component.

Small beats big

The latest development in this chain of events is that AQR has found that if you apply the QMJ strategy to small stocks, the size effect becomes much more pronounced. In their latest paper “Size Matters, If You Control Your Junk" they show that small quality stocks outperform large quality stocks.

What they found sounds intuitive. That is, small stocks generally tend to be more 'junky' than big stocks. They're small for a reason. They might be unprofitable, growth might be slow (or static), they're risky and they don't offer attractive returns to investors. With so many junky companies around, it turns out the size effect gets lost. But if you dump the junk and focus on quality, the size effect breezes back in like a long lost friend.

One of the most interesting observations from the AQR study concerns risk. Typically, investors relate high risk to potentially high returns. But in small stocks, it's actually the lower volatility, higher quality stocks which produce the best returns:

“...the riskiest small stocks – the small junk stocks – are not the securities that drive a significant positive size premium, as a risk story implies. Rather, it is the low-volatility, high-quality stocks that seem to drive the high expected returns."Trading the size effect

So if you want to look for good quality small caps, how can you do it and what will you find? Well, this sort of screening is ideally suited to Stockopedia's StockRanks, which includes an individual Quality Rank. This scores and ranks every company in the market based on a range of financial measures, including profitability factors, fundamental momentum and financial risk. You can read more about it here. Using the StockRanks portal you can filter these lists in numerous ways, including by size.

Name | Mkt Cap £m | Quality Rank | Sector |

95.9 | 99 | Financials | |

150 | 99 | Basic Materials | |

252.8 | 99 | Consumer Cyclicals | |

129.7 | 99 | Financials | |

77.8 | 99 | Consumer Cyclicals | |

117.3 | 98 | Industrials | |

67.3 | 98 | Technology | |

164 | 98 | Industrials | |

286.3 | 98 | Technology | |

96.7 | 98 | Technology |

Here is the current crop of top ranking Quality Rank small caps. Among them is children's toy company Character Group, which has seen its shares storm ahead by 22% since the start of the year when Ed highlighted them in his “New Year Naps" piece. Promotional products business 4imprint has also performed well, up 10% in 2015. Both those shares have Quality Ranks of 99/100 - and have done for at least the past two months. Others on an upward trend include asset manager City of London Investment Group and Finnish paper and packaging company Powerflute Oyj.

But not all them have done well in recent months. Companies like air conditioning business Andrew Sykes and Utilitywise, an intermediary in the energy market, have both endured year-long negative price momentum. This reinforces the fact that a portfolio approach to usingStockRanks is important.

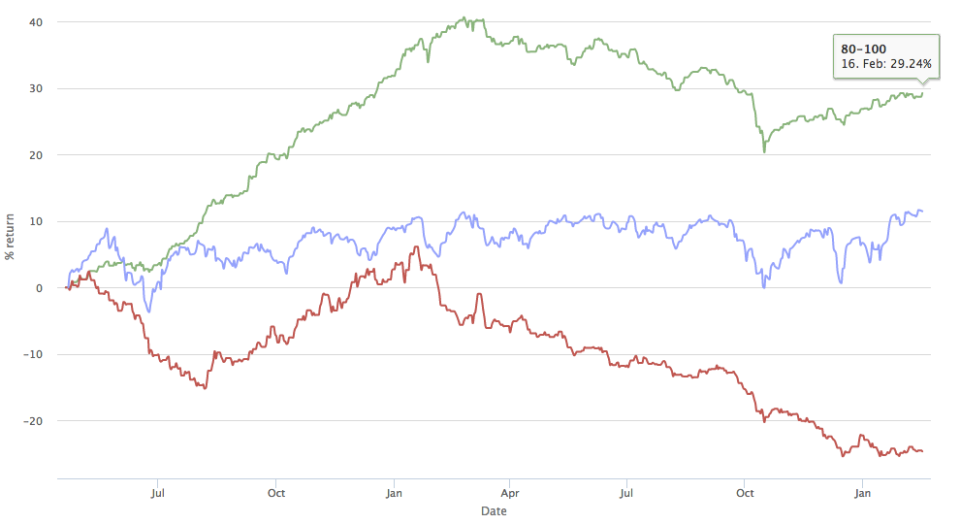

Since we began tracking StockRanks in 2013, a basket of annually rebalanced small-cap stocks in the top 20% of the market for Quality Rank has returned 29.2%. The bottom 20% - lowest quality stocks - has lost 24.6%

These performance figures are an indication about the influence of quality as an individual factor in an investing strategy. In practice it's likely to be much safer to use combinations of factors, including the likes of value and momentum.

But overall, the results of the latest research into the size effect support what many investors might feel is logical - that small stocks have the potential to outperform large stocks. But crucially, among a myriad of low quality junk hanging about at the small end of the market, this small cap size effect is hidden. But pick out those stocks that are profitable, growing, low volatility, stable and good allocators of capital, and you could play the size effect to your advantage.

To find out more about Stockopedia's StockRanks, why not catch up with our recent webinar. You can click here to see our library of investing ebooks and see our Subscription Plans to take a two-week free trial to Stockopedia.

Read More about Character on Stockopedia

Discuss Character on Stockopedia

Yahoo Finance

Yahoo Finance