Steve Wozniak: Apple Tax Criticism 'Warranted'

The co-founder of Apple (NasdaqGS: AAPL - news) has described criticism of the technology giant's tax policies as "extremely warranted".

Steve Wozniak who stayed with the company until 1987, said the only way to make tax fairer was to make firms pay it on their income, like individuals do.

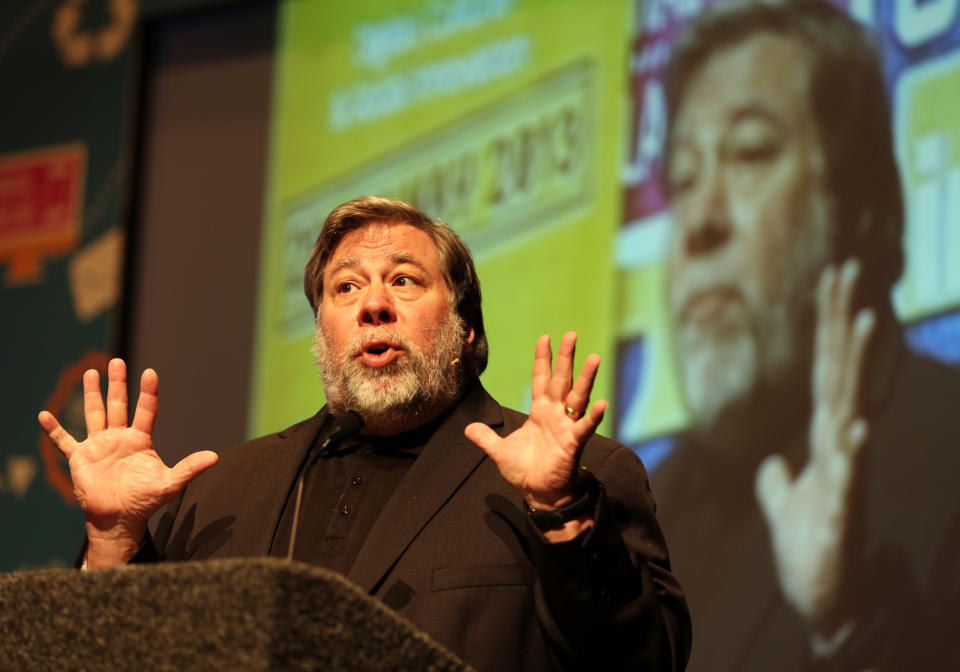

The multimillionaire inventor was in the UK to speak at a conference in Northern Ireland.

The event came amid a row over the tax paid by major multinationals like Apple and Google (NasdaqGS: GOOG - news) .

He told Sky News: "Criticism of Apple's tax policies is extremely warranted, in my mind, but my explanation is rather long and difficult.

"Apple itself, you'd think, would say, 'My gosh, there's systems. We have to go for the way we can maximise our profits.

"For example, I know some people who are, like, lawyers. They work in California, but they pretend, they make it seem like they work in Nevada, so they can avoid the high state income tax.

"That's ethically wrong. On a personal level we always know when it's wrong.

"For a corporation, there's no such thing as personal ethics. It's like you will do anything, any scheme you can, to maximise your profits."

Mr Wozniak, who set up Apple with $300 dollars each from him and friend Steve Jobs, was giving his speech in Londonderry.

Google, Starbucks and Amazon, as well as Apple, have been criticised for using complicated accounting methods to limit their tax bills.

Google boss Eric Schmidt was on Sunday forced to mount a defence of the company's tax policy after MP Margaret Hodge accused his company of "doing evil".

Mr Wozniak told the conference the only solution was to tax large firms like individuals.

He said: "People are not taxed on profit; they are taxed on income. Corporations should be taxed the same as people, in my mind that is how it should be, that would make things fair and right.

"That means corporations pay taxes on all of their revenues or people only pay it on a tiny amount called profit and until we rectify that, the whole problem is just with us forever.

"That is why the rich get richer and the poor get poorer and I am always for the individual being much more important than their training; same reason I created the Apple computer at the start, it was to empower the little guy."

Many of the firms using controversial, although legal, methods have registered their businesses for tax purposes in neighbouring Ireland (Other OTC: IRLD - news) .

Irish premier Enda Kenny has brushed off attacks on Ireland's tax regime for helping multinationals avoid billions in tax - insisting he was backing plans for global tax transparency and an end to tax havens.

David Cameron is urging the rest of the EU to back global action against what he has described as "staggering" losses to national exchequers.

The issue has become increasingly contentious as an ever-larger amount of Britain's national product is earned by foreign-based multinationals and sovereign wealth funds.

It is due to be discussed, at the request of the UK, France and Germany, at the next G8 summit in Loch Erne, near Enniskillen, Northern Ireland in June.

Host Mr Cameron will use the event to press the case against international tax secrecy and for an end to tax havens.

Mr Wozniak is credited with being the inventor of the first Apple and Apple II computers in the 1970s and is thought to be worth $100m (£65m).

More From Sky News

Yahoo Finance

Yahoo Finance