StockRank Movers - Games Workshop wields the Warhammer

The great Warren Buffett once said he likes to buy ‘quality merchandise when it is marked down.’ He has previously proved adept at picking up companies with a strong franchise that are undervalued by the market because of temporary problems. The toymaker, Games Workshop, has been through a restructuring programme which has placed downward pressure on the share price over the last few years. Nevertheless, the company has a strong brand, commands impressive pricing power, and the StockRank has recently jumped from 79 to 95. Is this an opportunity for investors to buy a good company at a cheap price?

Quality merchandise

Pricing competition is common across the toy market. Toymakers like Hornby have to make do with operating margins of just 0.6% and a ROCE of just 1%. Games Workshop on the other hand has high operating margins (14%) and a good Return on Capital Employed (31%). How do they do it? The company has built a cult around the design and manufacture of miniature figures and games. It is somewhat insulated pricing competition because the firm is the sole producer of many products like the Warhammer figurines.

The firm also has a loyal customer base which puts it in a good position to charge high prices. Our own Paul Scott noted that the ‘slightly odd customers that these shops attract are probably very loyal, as they are locked into that nerdy lifestyle, and probably won't be getting married anytime soon.’ These customers tend to value “quality above price”. For example, a set of ‘Disruptive Attack Squad’ figurines costs £105 (image below). Most figurines need to be glued together and painted with paintsets that can cost as much as £99. The diehard Warhammer fan will allegedly buy an entire set of new figures if they make just one mistake on one figurine.

Strong profit margins could also be supported by the firm’s lean business model. The company has 418 stores across 20 countries. 324 of these are one man stores, located on small sites. This limits overhead costs and would make it cheaper to open new stores as the company expands. Finally, the company has a strong balance sheet with no gross gearing and a current ratio of 2, suggesting that the company could be in a good position to service short-term debt.

Bargain Price?

Despite these strengths, the company is cheap with a PE ratio of just 13.7 and an overall ValueRank of 78, putting it in the cheapest 22% of the market. Perhaps this cheapness can be partly attributed to the fact that the company operates in an unusual business. Even the company’s annual report for 2014 noted that ‘we are a unique business and understand that some people find us and our product a little odd and possibly a little quirky too.’ Furthermore, many investors feel that the company faces longer-term threats from the rise of computer gaming, as well as 3D printing, which would likely enable collectors to design and print their own miniatures.

Quite often, after a period of losses, it can take a long time for the stock market to forgive and forget. Companies can therefore remain undervalued for a long period of time. Perhaps the market is finding it hard to forget the problems caused by the restructuring programme. The company recently switched from a multi-man to a one-man per store model. This process involved staff changes, new working hours, new sites, and had a negative impact on profits and the share price.

In January 2014, the firm reported that revenues had fallen from £67.5m to £60.5m, while earnings had dropped from 25.4p to 17.6p per share. The company explained that ‘the rapid transition from multi-man stores to one-man stores and the reduction of trading hours across the Group caused disruption in our retail chain.’ Workshop’s share price dropped from £7.10 (14 Jan) to £5.47 (16 Jan). The price still hasn’t fully recovered as the stock currently trades at £5.69.

Where is Games Workshop heading?

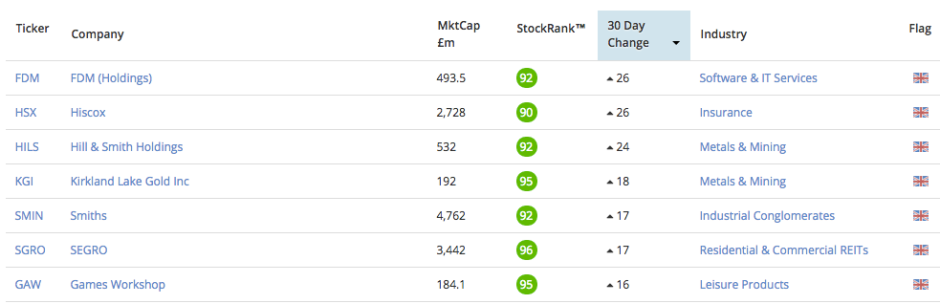

The economist John Maynard Keynes warned investors that ‘the market can stay irrational longer than you can stay solvent.’ In other words, a company may be undervalued, but investors won’t make any money until the rest of market recognises and exploits the investment opportunity, driving the price up. There is evidence that investors are beginning to warm to Games Workshop. The share price has risen by 13% since the beginning of July, helping the MomentumRank rise to 69 while the overall StockRank has risen to 95 (see below).

This trend has been supported by the publication of the annual report, which suggests that the firm could be on the road to recovery. Revenues were down, partly because of unfavourable exchange rates against the dollar and euro. At the same time, profits and earnings were up as operating expenses fell by £4.2 million. The company saved £1.8 million by reducing retail store costs. It saved another £2.4 million by restructuring the company’s European operations. It is difficult for a company to keep growing profits by cutting costs. However, the company’s management team has ‘set a goal of getting the business into sales [ie. revenue] growth in 2015/16.’ The firm hopes to achieve this by opening more stores in North America and Continental Europe.

So it seems that Games Workshop is recovering from its restructuring programme and could be positioned for future growth. The share price has started to recover, but the company has a low PE ratio and still trades at £5.69, which is well below the price it traded at before the restructure. Is the stock due a larger rerating? Please feel free to leave your own opinions below...

Read More about Games Workshop on Stockopedia

Discuss Games Workshop on Stockopedia

Yahoo Finance

Yahoo Finance