StockRank Movers - May 12th: The Maiden Dividend Anomaly

The American business magnet, John D. Rockefeller once said: 'Do you know the only thing that give me pleasure? It's to see my dividends coming in.' Dividends are of course cash payments that companies pay out to shareholders on an interim or annual basis. All other things being equal, a company that pays a dividend could, in theory, be more attractive to many investors. This week we explore whether investors can make money by investing in high StockRank stocks that pay maiden dividends.

The Maiden Dividend Anomaly

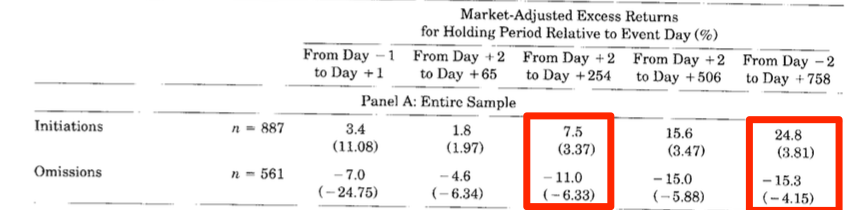

How does the market respond when companies announce maiden dividends? Research by academics Michaely, Thaler and Womack (1995) looked at the share price performances of companies that initiated - or omitted - the payment of cash dividend payments between 1964 and 1988. They found that:

These trends may in part be down to something called the 'clientele effect' - the observation that investors tend to be attracted to different types of companies. A stock that introduces a dividend will naturally broaden its appeal to income investors. For example, institutions could have a preference, or even a requirement, to buy shares in dividend-paying companies

More anecdotal evidence suggests that companies with improving fundamentals may be better placed to support dividend payments. This has been particularly evident during the past five years in the housebuilding sector, with companies like Persimmon and Barratt Developments quick to respond to improving conditions by rewarding shareholders. Another construction firm that's set to notch up its third consecutive year of dividends is Redrow….

Redrow (RDW)

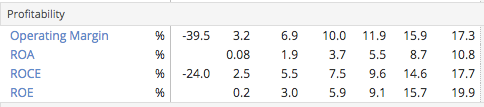

Redrow (RDW) is a relatively new dividend payer. 2015 is expected to be the third consecutive year that Redrow pays a dividend (6p per share). The company paid out 1p per share in 2013 and 3p per share in 2014. Redrow has notched up dividend payments as fundamentals have improved across the board. Over the last twelve months:

This has been supported by rising house prices. Redrow's recent financial papers reveal that although materials and labour costs have risen, this has been offset by house price inflation. Whilst overheads increased in absolute terms, they reduced as a percentage of revenues.

As Redrow became more profitable, the company's StockRank gradually drifted upwards (see chart below). Notice how the StockRank jumped in February 2014 and September 2014. The StockRank shot up as Redrow released:

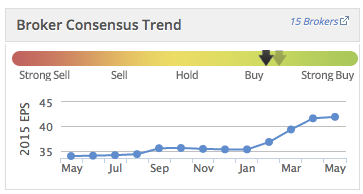

The market as well as analysts are becoming increasingly confident about this company. Redrow has beaten the market by 35% over the last twelve months. Over the same timeframe, the EPS estimates for this company have risen from 33.9p per share to 41.8p per share (see image below).

It is also interesting to note that the company's share price has risen by 7% since the general election last week. The Help to Buy scheme was introduced by the Conservative Government back in 2013. Redrow's annual report attributes much of its success over recent years to the Help to Buy scheme (see here). It is therefore most plausible that the market responded favourably to the Conservative Party's victory last week. More good news came on 11 May, when the Bank of England announced that it had kept interest rates at record low levels (0.5%).

Conclusions

So Redrow is an interesting case in point. Over recent years, the company has become more profitable, brokers are upping the numbers and the company has resumed dividend payments. Are there more opportunities out there? Investors who want to learn more about dividend investment strategies should check out our free ebook, How to Make Money in Dividend Stocks. Stockopedia subscribers can also screen the market for high dividend payers using our Income GuruScreen strategies, which can be found here.

Read More about Redrow on Stockopedia

Discuss Redrow on Stockopedia

Yahoo Finance

Yahoo Finance