TerrAscend (TSE:TSND) shareholders have endured a 85% loss from investing in the stock three years ago

TerrAscend Corp. (TSE:TSND) shareholders should be happy to see the share price up 15% in the last quarter. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 85% in that time. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for TerrAscend

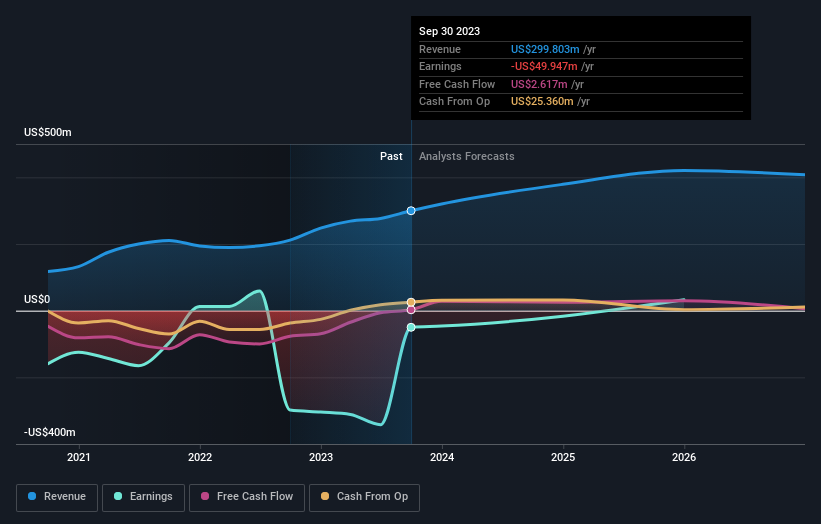

Given that TerrAscend didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, TerrAscend grew revenue at 25% per year. That is faster than most pre-profit companies. So why has the share priced crashed 23% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in TerrAscend had a tough year, with a total loss of 6.7%, against a market gain of about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

TerrAscend is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance