Time to Buy into the Blazing Price Performances of These Retail-Restaurant Stocks

Consumer spending on outdoor dining appears to be reaching new heights following the pandemic. Notably, several Zacks Retail-Restaurants stocks have hit 52-week highs this spring and could have more upside ahead.

To that point, the trend of upward earnings estimate revisions suggests the blazing price performances of these retail-restaurant stocks could continue going into the summer. This has contributed to their buy ratings and these restaurants are seeing expansive growth on their top and bottom lines.

With now looking like an ideal time to invest here are three of these top-rated retail-restaurant stocks to consider.

Brinker International EAT

Zacks Rank #1 (Strong Buy)

Outside of its steady growth, Brinker International’s stock is still attractive in terms of valuation despite soaring +48% year to date and currently trading at a 52-week high of $64 a share. Still, the operator of Chili’s Grill & Bar and Maggiano’s Little Italy trades at a 15.9X forward earnings multiple which is a pleasant discount to the industry average of 24.1X and the S&P 500’s 22.2X.

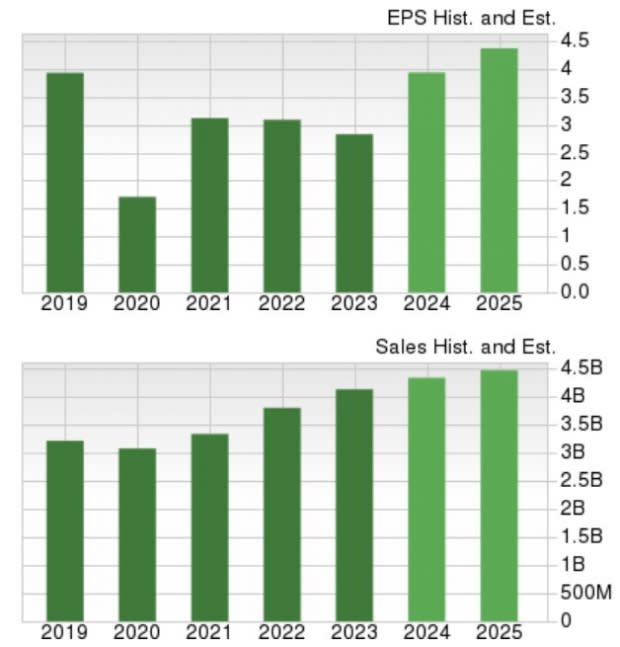

Image Source: Zacks Investment Research

Amid this year’s rally, rising earnings estimates have kept Brinker International’s P/E valuation reasonable. In this regard, fiscal 2024 and FY25 EPS estimates have spiked 6% in the last 30 days respectively. Brinker International's annual earnings are now expected to climb 39% this year to $3.94 per share compared to $2.83 a share in 2023. Another 11% EPS growth is in the forecast for FY25. Plus, total sales are projected to rise 5% in FY24 and are slated to increase another 3% next year to $4.47 billion.

Image Source: Zacks Investment Research

Wingstop WING

Zacks Rank #1 (Strong Buy)

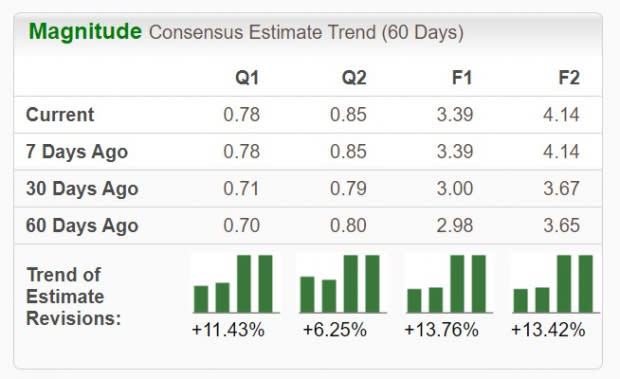

Also boasting a strong buy rating, earnings estimates are noticeably higher for Wingstop in the last month with FY24 and FY25 EPS estimates now up 13% over the last 60 days. It’s noteworthy that Wingstop has an “A” Zacks Style Scores grade for Growth as annual earnings are forecasted to climb 36% in FY24 and are projected to soar another 22% in FY25 to $4.14 per share.

Image Source: Zacks Investment Research

More impressive, Wingstop’s total sales are projected to soar 27% this year with the company’s top line expected to expand another 17% in FY25 to $685.82 million. Correlating with its growth trajectory, Wingstop’s stock is up +49% YTD with WING hitting highs of $389 earlier in the month.

Image Source: Zacks Investment Research

CAVA Group CAVA

Zacks Rank #2 (Buy)

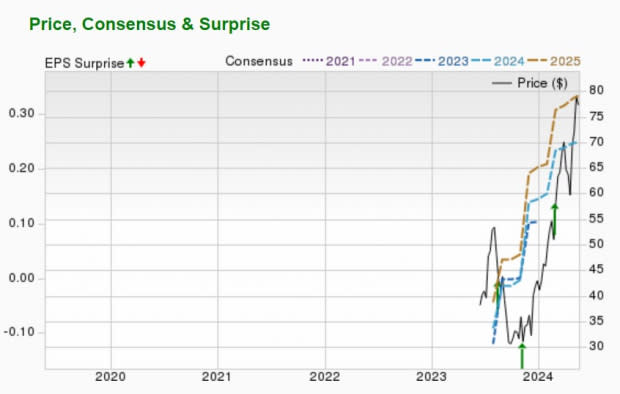

The healthy food choice options and growing popularity of the Mediterranean-style food chain Cava Group should be catching investors' attention as well. In addition to its buy rating, Cava Group’s stock has an “A” Zacks Style Scores grade for Momentum.

Cava Group’s sales are projected to increase 20% in FY24 and are forecasted to climb another 19% in FY25 to $1.04 billion. More importantly, earnings estimate revisions have remained higher over the last 60 days with EPS expected to jump 19% this year and projected to increase another 34% in FY25 to $0.33 a share.

Furthermore, since going public in June of last year, CAVA has now soared +84% and hit a high of $84 today.

Image Source: Zacks Investment Research

Bottom Line

Wingstop and Cava Group are two of the fastest-growing restaurant chains in the United States and Brinker International's expansion and valuation remain compelling. Buying these top-rated retail-restaurant stocks should continue to pay off as outdoor dining typically ticks up in the summer and they are shaping up to be viable investments for 2024 and beyond.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

CAVA Group, Inc. (CAVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance