Time to Buy These Highly Recommended Industrial Products Stocks

Several industrial products stocks are standing out among the Zacks Rank #1 (Strong Buy) list with 16 companies coveting spots from the sector.

Even better, here are three of these industrial products stocks that are highly recommended by brokers as well and have an average broker recommendation of 1.0 on a scale of 1 to 5 (Strong Buy to Strong Sell).

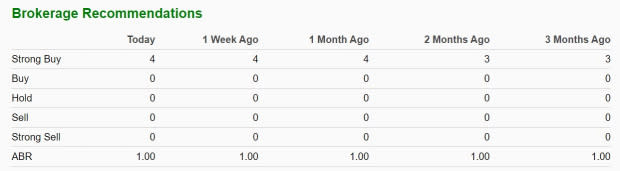

Applied Industrial Technologies AIT: Well known for its engineering, design and system integration services, all four of the brokers covering Applied Industrial Technologies stock and providing data to Zacks have a strong buy rating. Notably, AIT has started to push towards its 52-week high of $201 a share and has risen +7% so far this month.

Image Source: Zacks Investment Research

Plus, annual earnings are now expected to be up 9% in fiscal 2024 and are forecasted to rise another 2% in FY25 to $9.72 per share. Making the EPS outlook for AIT more attractive is a reasonable 20.4X forward earnings multiple and the Average Zacks Price Target of $211.25 still suggests 8% upside.

Image Source: Zacks Investment Research

Atmus Filtration Technologies ATMU: As a manufacturer of advanced filtration products, all six of the brokers covering Atmus Filtration Technologies' stock have a strong buy rating and the Average Zacks Price Target of $35.42 a share implies 16% upside. With ATMU trading at 13.5X forward earnings, EPS is expected to dip -2% this year but is projected to rebound and rise 5% in FY25 to $2.38 per share.

Image Source: Zacks Investment Research

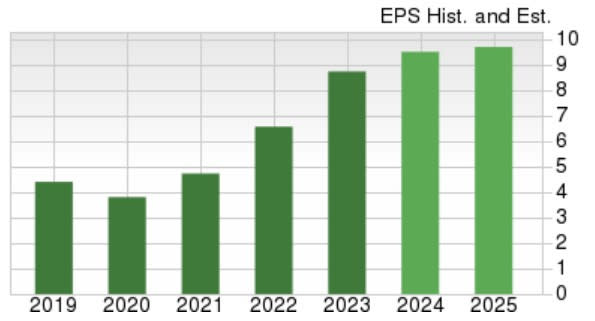

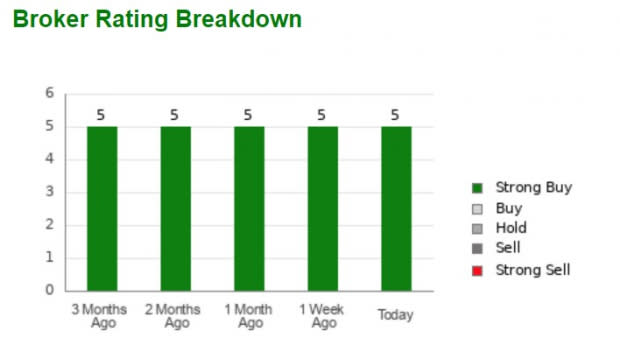

Belden BDC: Each of the five brokers rating Belden’s stock have a strong buy for the cable, connectivity, and networking products provider. Furthermore, BDC has popped +15% this month after Belden posted Q1 EPS of $1.24 which beat the Zacks Consensus of $1.05 a share by 18%. Annual earnings are now expected to dip -15% in FY24 but are forecasted to rebound and climb 29% next year to $7.47 per share. It’s also noteworthy that Belden’s Zacks Wire and Cable Products Industry is currently in the top 1% of over 250 Zacks industries and an average price target of $104.60 is still 13% above current levels.

Image Source: Zacks Investment Research

Bottom Line

Attributing to their spots on the Zacks Rank #1 (Strong Buy) list is that earnings estimate revisions have trended higher for these industrial products stocks. To that point, Applied Industrial Technologies, Atmus Filtration Technologies, and Belden have emerged as three winners of the Q1 earnings season and may keep moving higher during the current quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Belden Inc (BDC) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance